India’s largest port developer and operator comprising 12 ports and terminals and 538 MMT of operating capacity.

It also possesses the largest container handling facility in India.

Fundamental Aspects:

In 11 years

Reserves increased 11 times,

Sales increased almost 9 times,

Net profit increased 6 times,

Huge CAPEX for future expansion &

Promoters holding had increased marginally.

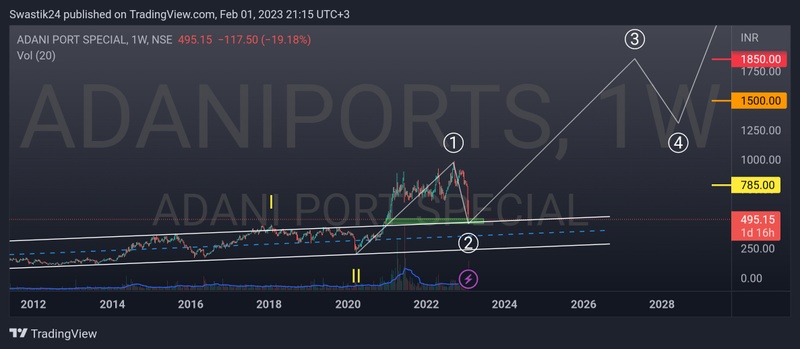

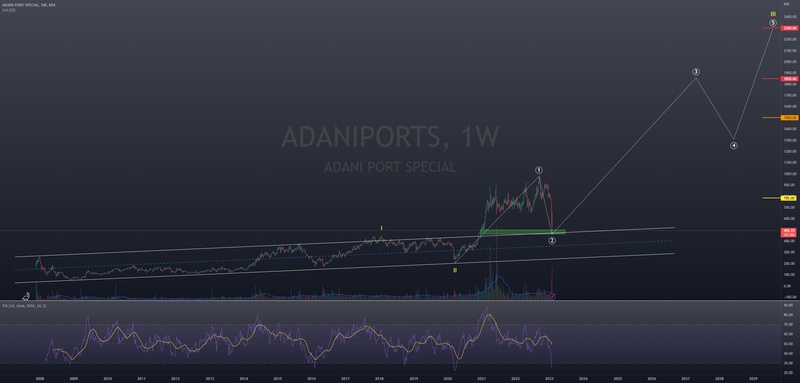

Technical Aspects:

Price had been moving inside an ascending channel for around 13 years.

Then it broke out of that channel and today it retested the top of the channel as support.

You can observe how the price bounced exactly at the top of the channel.

RSI & MACD are showing bullish divergence on both daily and weekly timeframes.

Alternatively price is in the 2nd primary wave (white markers) of the 3rd cyclical wave (yellow markers).

Expecting initiation of 3rd primary wave from green zone highlighted.

You can zoom out to see the bigger picture of the cyclical wave (just assumptions because of uncharted territory).

Will update in future as the chart unfolds.

Good to accumulate around 460 - 500 levels for the following targets:

Short term swing target @ 785 (58% ROI from CMP)

Long term swing target 1 @ 1500 (200% ROI from CMP)

Long term swing target 2 @ 1850 (273% ROI from CMP)

Long term positional target @ 2300 (364% ROI from CMP)

Do your own due diligence before taking any action.

Peace ✌🏻

❮

❯