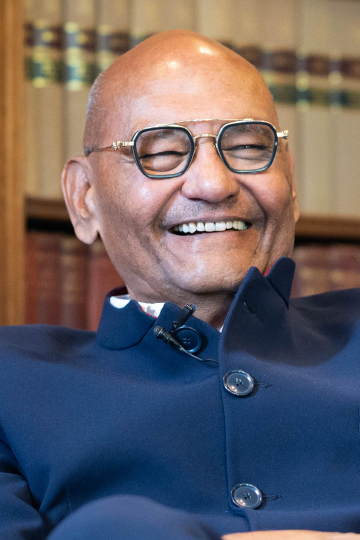

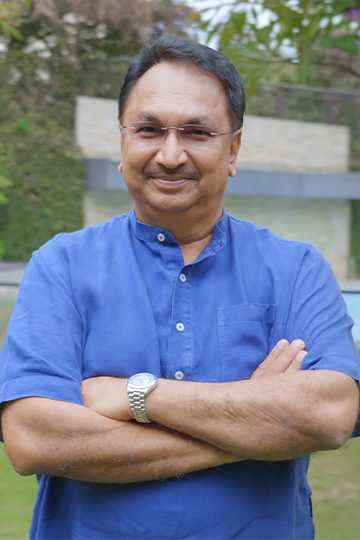

Getty Images

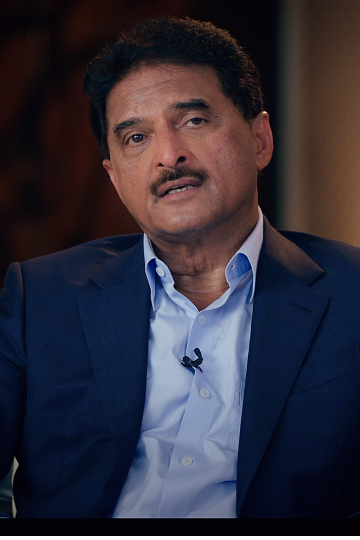

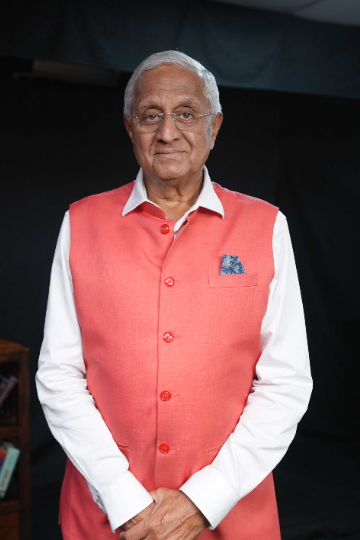

Getty ImagesBASIC FACTS

DATE OF LAUNCH

4 OCTOBER 1999

CATEGORY

EQUITY

TYPE

ELSS

AUM*

Rs.5,029 crore

BENCHMARK

NIFTY 500 TOTAL

RETURN INDEX

WHAT IT COSTS

NAV**

GROWTH OPTION

Rs.1,008.54

IDCW**

Rs.52.17

MINIMUM INVESTMENT

Rs.500

MINIMUM SIP AMOUNT

Rs.500

EXPENSE RATIO* (%)

1.83

*AS ON 30 JUNE 2023

**AS ON 25 JULY 2023

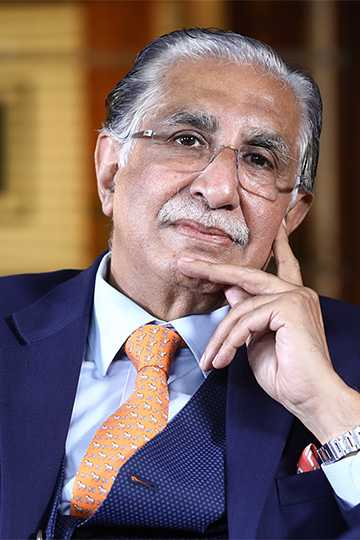

FUND MANAGER

ANAND RADHAKRISHNAN / R. JANAKIRAMAN (R)

1 YEAR, 8 MONTHS / 7 YEARS

Recent portfolio changes

New entrants

Crompton Greaves Consumer Electricals (April); Kalyan Jewellers India (June).

Complete exits

Delhivery, Maruti Suzuki India, One 97 Communications (April); LIC (May); Tata Power Company, Zydus Lifesciences (June).

Increasing allocation

ACC, City Union Bank, ICICI Prudential Life Insurance Company, United Breweries, Whirlpool of India (April); ACC, Multi Commodity Exchange of India (May); City Union Bank, GAIL, Voltas (June).

Should you buy?

This fund has amplified its large-cap bias, diluting exposure to mid and small caps in recent years. The portfolio is well diversified, running healthy positions in the top bets. The fund managers show no particuar style preference for this fund, adopting an index-agnostic approach to picking stocks and sectors. The fund went through a rocky patch between 2015 and 2020, underperforming the index as well as the category. However, it has seen an upturn in fortunes since 2021, suggesting a comeback. Even so, it needs to sustain this turnaround for longer to be considered a worthy bet.

(Source: Value Research)

Read More News on

(Catch all the Personal Finance News, Breaking News, Budget 2025 Events and Latest News Updates on The Economic Times.)