1 / 7

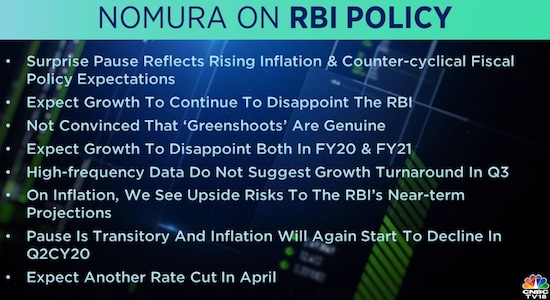

1 / 7Nomura on RBI Policy: As per the brokerage, the surprise pause reflects rising inflation and counter-cyclical fiscal policy expectations. It expects growth to disappoint in FY20 as well as FY21. The brokerage is not convinced that the 'green shoots' are genuine.

2 / 7

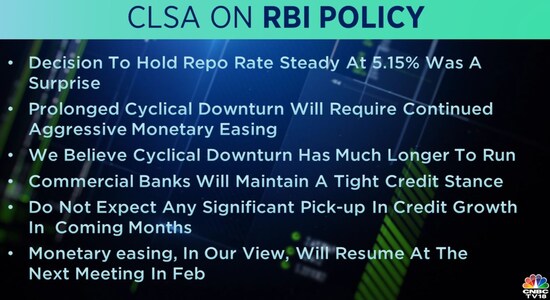

2 / 7CLSA on RBI: As per the brokerage, the decision to hold repo rate steady at 5.15 percent was a surprise. The prolonged cyclical downturn will require continued aggressive monetary easing, it added. The brokerage does not expect any significant pick-up in credit growth in the coming months and sees monetary easing resuming at the next meeting in February.

3 / 7

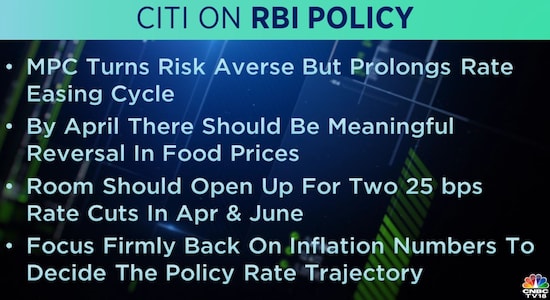

3 / 7Citi on RBI Policy: The monetary policy committee turned risk-averse but prolonged rate easing cycle, said the brokerage. It added that by April there should be a meaningful reversal in food prices. The room should open up for two 25 bps rate cuts in April and June.

4 / 7

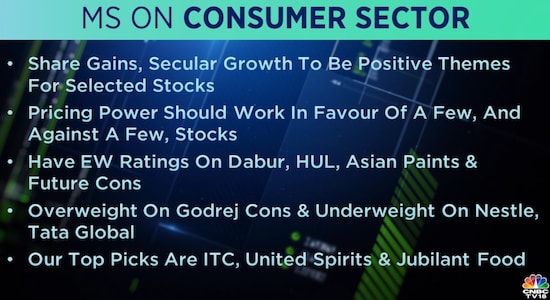

4 / 7Morgan Stanley on Consumer Sector: The brokerage is 'equal-weight' on Dabur, HUL, Asian Paints, and Future Consumer, 'overweight' on Godrej Consumer, and 'underweight' on Nestle and Tata Global. As per the brokerage, share gains, secular growth will be positive themes for selected stocks.

5 / 7

5 / 7CLSA on Bharti Airtel: The brokerage has a 'buy' rating on the stock with a target of Rs 560 per share. Fundraising should assuage concerns around funding of AGR risks, said the brokerage, adding that risk-reward favourable at current levels.

6 / 7

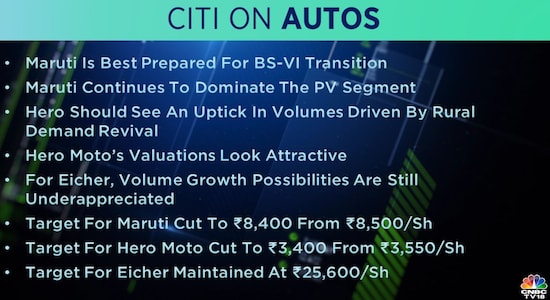

6 / 7Citi on Autos: As per the brokerage, Maruti is best prepared for BS-VI transition and continues to dominate the PV segment. It cut the target price for Maruti and Hero Moto but maintained the target price for Eicher Motors.

7 / 7

7 / 7Morgan Stanley on IndiGo: The brokerage is 'equal-weight' on the stock with a target of Rs 1,880 per share. Fares are holding up better but costs are also rising, said the brokerage. It added that Q3FY20 profit is likely to be flat YoY and below estimates.