1 / 5

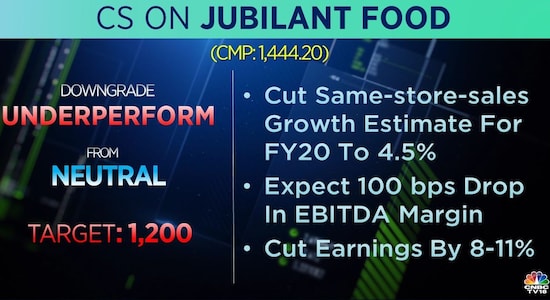

1 / 5Credit Suisse on Jubilant Foodworks: The brokerage downgraded the stock to 'underperform' from 'neutral' and cut target price to Rs 1,200 per share. It also cut the same-store sale growth estimate for FY20 to 4.5 percent.

2 / 5

2 / 5CLSA on Zee: The brokerage has a 'buy' rating on the stock but cut its target price to Rs 450 per share from Rs 515 earlier. The risk to share pledging crisis remains despite extension for loan repayment, it said, adding that it is positive on the stock due to growing business and compelling valuation.

3 / 5

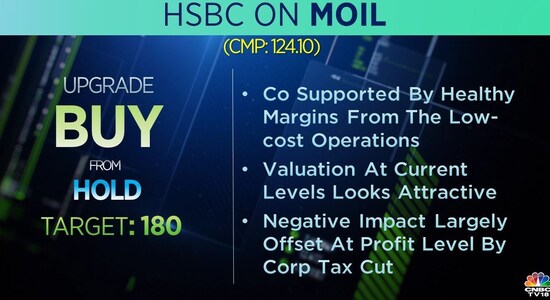

3 / 5HSBC on MOIL: The brokerage upgraded the stock to 'buy' from 'hold' with a target of Rs 180 per share. It said that the company is supported by healthy margins from the low-cost operations and that the valuation at current levels looks attractive.

4 / 5

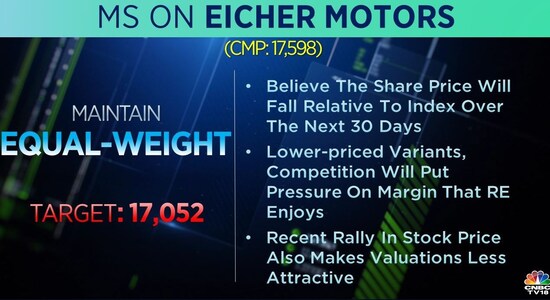

4 / 5Morgan Stanley on Eicher Motors: The brokerage is 'equal-weight' on the stock with a target of Rs 17,052 per share. The brokerage believes that the share price will fall relative to index over the next 30 days. It also added that the lower-priced variants, the competition will put pressure on a margin that Royal Enfield enjoys.

5 / 5

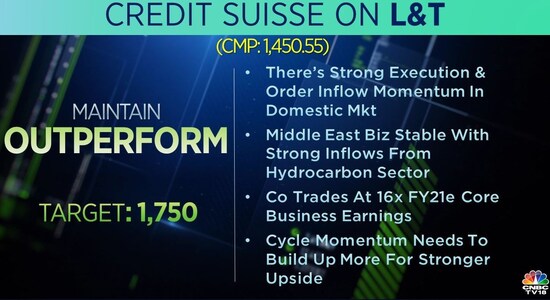

5 / 5Credit Suisse on L&T: The brokerage maintains 'outperform' rating on the stock with a target of Rs 1,750 per share. There are strong execution and order inflow momentum in the domestic market, it said, adding that the Middle East business is stable with strong inflows from the hydrocarbon sector.