Agencies

AgenciesThe auto ancillary stock hit a 52-week high of Rs 1,260 on 29 December 2021 but it failed to hold on to the momentum. The stock closed at Rs 943 on 29 June 2022.

The stock bounced back after hitting a low of Rs 836 on 7 June to reclaim 50, and 200-DMA on the daily charts which is a positive sign for the bulls.

The auto and auto ancillary space extended its outperformance as the Nifty Auto index is poised for a breakout above its multi-year highs since CY17.

Within auto ancillary, Minda Industries offers a favourable risk-reward proposition at the current juncture, suggest experts.

From a fundamental perspective, the consensus recommendation from 17 analysts for Minda Industries is a buy, data from Trendlyne showed. Minda Industries weekly average delivery volume is 44.16 per cent which is also a positive sign.

Agencies

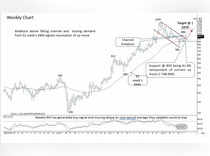

AgenciesOn the weekly charts, the stock managed to reclaim its short-term moving average of 50-weeks SMA which is a sign of momentum building up in the stock.

The momentum remains strong despite muted trend seen in D-Street. The stock rallied more than 8 per cent in a week, and over 5 per cent in a month – outperforming the benchmark index.

“The stock witnessed a falling channel breakout after a strong base formation at the major support area around Rs 860 as it is the rising 52 week’s EMA (currently placed at Rs 860 levels) signalling a resumption of up move and offering a fresh entry opportunity,” Dharmesh Shah, Head – Technical, ICICI direct said in a note.

“We expect the stock to extend the current up move and head towards Rs 1,070 levels in the coming months as it is the 61.8 per cent retracement of January-May 2022 decline (Rs 1,244-768),” he said.

The weekly RSI recently generated a buy signal moving above its 9-period average. Thus, it validates the positive bias, recommends Shah.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Read More News on

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times