Many quality large as well as mid-cap stocks have fallen in double digits in the past two months as a spike in COVID-19 related cases across the world triggered a risk-off sentiment that led to relentless selling by foreign investors of more than Rs 60,000 crore in the cash segment of the Indian equity market in March.

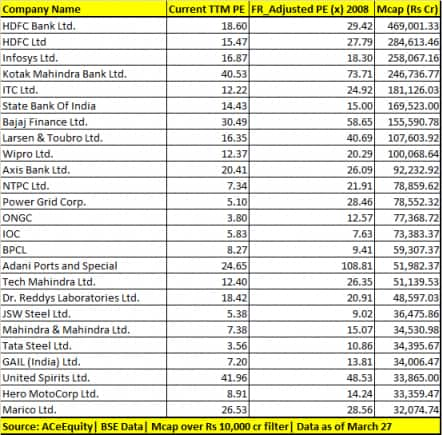

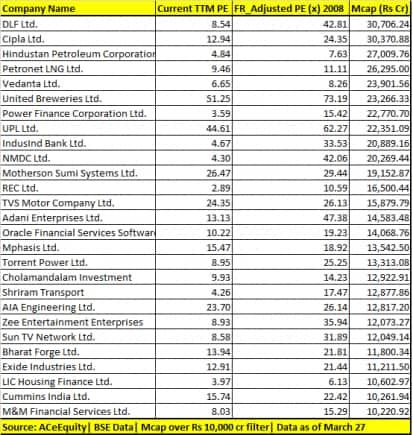

The recent wave of sell-off pushed many bluechip and midcaps stocks to their multi-year low which makes them an attractive buy at current levels, data showed. There are as many as 54 stocks that are trading at valuations lower than the global financial crisis of 2008.

The question now is – are all stocks that are trading below 2008 levels an attractive buy? Well, the answer is ‘NO’. And, investors should avoid making that mistake of picking anything because it is available cheap.Follow our LIVE coverage of PM Modi's address here

“Any decisions to invest in a particular stock cannot be solely on looking at P/E levels. As upcoming earnings growth or degrowth changes the entire scenario. The situation of COVID-19 is much different than the global financial crisis of 2008,” Pritam Deuskar, Fund Manager, Bonanza Portfolio Ltd told Moneycontrol.

“Out of all these stocks, one should see businesses that are least affected in terms of starting again after COVID-19 is over. If lockdown does get extended then companies that have major supply chain issues are going to take bit longer to smoothen earlier track,” he said.

Stocks that are trading at a P/E multiple which was lower than 2008 levels include ITC, HDFC Bank, Infosys. Kotak Mahindra Bank, Wipro, Axis Bank, ONGC, IOC, BOCL, Bajaj Finance, SBI, and L&T.

P/E ratio is the shortest & fastest way to get started when valuing a company. Yet it may not be correct to measure a business merely based on the P/E ratio, suggest experts.

“A lower P/E ratio does not always imply that the company is undervalued. The reason behind the lower P/E ratio can be the poor financial performance or decrease in earnings,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol.

“Similarly, a higher P/E ratio does not always indicate that the company is overvalued. The reason behind the higher P/E ratio can be an increase in earnings at a higher rate or overall improved financial performance,” he said.

This means that if the company increases its earnings then investor’s decision of investing in high P/E ratio stock is not always wrong because ultimately due to an increase in earnings, the P/E value will fall in near future.

Valuation is an important factor while picking stocks, and no doubt most of the companies are big-ticket names in their respective sector. But, basing your calculation on just one indicator might not be enough because situation in 2020 is completely different what we saw in 2008.

Why we say that is because if the lockdown does get extended we are looking at massive earnings downgrades in almost all the sectors leaving aside defensives. The crisis of 2020 is the existential crisis and not the financial crisis that we saw in 2008.

“If there is something that the global financial crises episode in the past has taught us is that picking stocks only because they are trading at cheaper valuations is an inappropriate strategy. What investors need to look for are good businesses,” Nirali Shah, Senior Research Analyst, Samco Securities told Moneycontrol.

“Quality businesses that have the ability to tide through tough times and emerge stronger by increasing their market share are the true winners. Undoubtedly, many stocks are now available at attractive levels. Investors can keep this as a starting point to pick the fundamentally strong hidden gems to invest in,” she said.

Other factors to track:

There are other factors that one should keep a tab on while making a buy or a sell decision. Price-earnings ratio is a good barometer; however, experts feel that more investors should also consider companies with low supply chain issues, have a strong balance sheet, as well as high RoCE companies.

“Rather than P/E, the PEG ratio is an important factor investors should check before buying stocks. Comparing P/E to the growth of companies is a strong measure to predict if indeed the valuations are cheap vis-à-vis the growth of a company’s business,” says Shah of Samco Securities.

She further added that return ratios such as ROE, ROCE, management and supply chain efficiencies, leverage, free cash flow are a few other factors to look out for before investing in stocks.

What to buy?

Well, there are over 50 stocks that are trading at a lower valuation when compared to the global financial crisis. But, analysts recommend only a handful of names for cherry-picking.

Garg of CapitalVia Global Research Limited- Investment Advisor recommends HDFC Bank, ITC, NTPC, as well as L&T.

Shah of Samco Securities recommends a number of names such as HDFC Bank, Infosys, Kotak Mahindra Bank, Marico, Bajaj Finance, Hero Motocorp, Tech Mahindra would be good picks for investment at this point in time. A staggered buy approach would be a sound way to play the current volatility.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!