Government's 10-year bond yield fell before recovering on October 4, after the Reserve Bank of India (RBI) slashed key rates by 25 bps, lowest in 9 years.

The RBI Governor assured investors by maintaining its accommodative stance that more rate cuts could be in the offing. Most experts feel that the central bank has room to cut rates by 15-30 bps in FY20.

Anecdotal evidence suggests that dividend-paying stocks perform relatively better in a falling interest rate environment. Observation of rolling one-year returns indicates that the bulk of the outperformance of Nifty Dividend Opportunities 50 index was during the FY10-12 period when real yields remained persistently negative.

“We believe that interest rates globally are headed lower along with improving liquidity and hence, real bond yields could dip further as the RBI is expected to cut rates incrementally while inflation rises closer to the 4 percent mark,” ICICI Securities said in a note.

“Marginal tax rate cut from 34.94 percent to 25.15 percent will improve the dividend payout profile of India Inc. immediately as capital allocation decisions on new investment may happen with a lag as demand environment remains weak,” it said.

Falling bond yields are an indication that interest rates are heading lower in the economy implies that the cost of borrowing is expected to move down. Such a scenario is good for equity as an asset class as lower interest rates are beneficial to spur consumption in the economy, suggest experts.

“Further, capital intensive sectors like metals, oil & gas and power can avail new capital at a much lower interest rate. In total, we believe that not only dividend yield stocks but overall equity as an asset class tend to benefit from falling bond yields,” Ajit Mishra, Vice President Research, Religare Broking told Moneycontrol.

The yield on the benchmark India 10 Years Government Bond (6.614 percent yield on October 3, 2019) changed -9.6 bps during last week, +5.0 bps during September, and -140 bps during last year.

In the past, the India 10 Years Government Bond reached a maximum yield of 8.182 percent on September 11, 2018.

“The fall in real bond yield environment indicates that there are concerns over growth in the economy. The real bond yield actually takes into the effect of inflation and hence what is actually left for investors at the end of term,” Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

“A high dividend yield stock tends to perform in both environments. They are part of the portfolio to add value through dividends and create higher alpha in the long term if reinvested. During times like these where we have seen a shrink in GDP and economic activity we believe these dividend stocks will continue to perform,” he said.

Top dividend yield stocks to bet on handpicked by analysts:

ICICI Securities

ONGC, BPCL, Coal India, Hero MotoCorp, NMDC, and Power Grid. Infosys is a high dividend yield stock with low tax cut benefit.

Ajit Mishra, Vice President Research, Religare Broking

Among the high dividend yield stocks, we like ONGC, BPCL, and IOC. Further, the government's plan of carrying out the disinvestment of Rs 1 lakh crore by FY20 through stake sale of PSUs is likely to benefit these stocks. Investors may accumulate these stocks at CMP and also on dips.

Mustafa Nadeem, CEO, Epic Research

TCS, HUL, ITC, HPCL, and IOC are some stocks that can be kept on the radar for dividends. They have consistency and have a good track record.

Amit Gupta, Co-Founder and CEO, TradingBells

When selecting high dividend-paying stocks, investors must ensure they are paying attention to other fundamental factors as well such as the sales and profit growth of the company, EPS, debt vs equity and so on. We like Vedanta, IOC, and P&G Health.

Factors to consider before buying dividend yield stocks:

High dividend yield stocks are ones that pay a high dividend as a percentage to the market price of its share. When it comes to stocks, investors prefer capital appreciation to dividend yield, but that does not lessen the importance of dividends by the slightest, suggest experts.

Under a falling bond yield environment, which makes it difficult to generate regular income by holding government debt, high dividend-yielding stocks become more popular due to their stable income generation characteristic for investors.

“When selecting high dividend-paying stocks, investors must ensure they are paying attention to other fundamental factors as well such as the sales and profit growth of the company, EPS, debt vs. equity and so on,” Amit Gupta, Co-Founder and CEO, TradingBells told Moneycontrol.

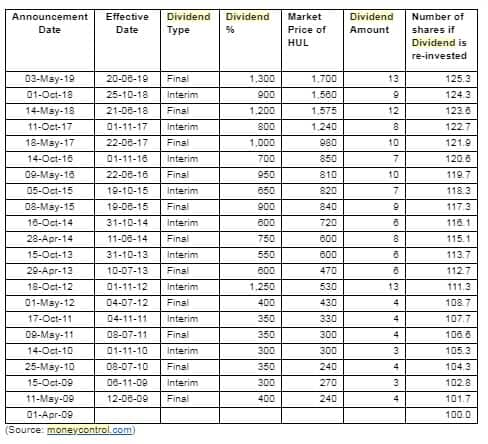

“If selected carefully, one can generate high alpha by re-investing the dividends back into the markets. For example, if one had re-invested all dividends received from HUL in the last 10 years at the then-prevailing prices, one would have had additional 25 shares of HUL today for every 100 shares held 10-years-ago. This means an alpha of 25 percent over and above other returns such as capital gains,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!