Moneycontrol Research

Highlights

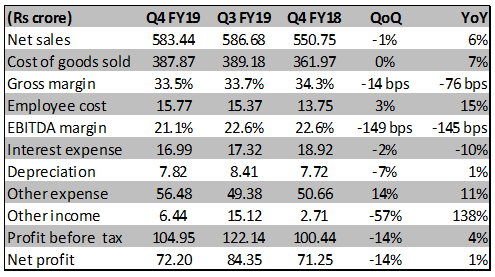

Chart: Q4 financials

Source: Company

Key positive

Sales grew by 6 percent YoY, lifted by better pricing and product mix, partially offset by de-growth in volume (- 9 percent YoY). Sequentially, sales growth was flat and there was an improvement in sales volume (6 percent QoQ) as the company has completed the debottlenecking of coal tar distillation (CTD) capacity, which led to plant shutdown in the previous quarter.

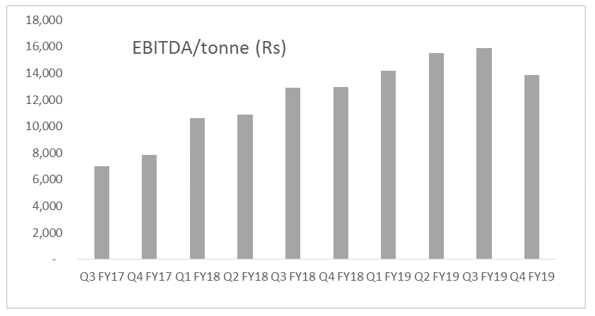

Chart: EBITDA per tonne trajectory

Source: Company

Key negative

EBITDA (earnings before interest, tax, depreciation and amortisation) margin (-145 bps YoY) for the quarter gone by was impacted by higher other expenses. In terms of EBITDA per tonne, the metric improved by 7 percent on a YoY basis, but declined sequentially by 13 percent due to lower realisations.

Observations

The company is on course to build 20,000-tonne (currently 600 tonnes) capacity for advanced carbon material (ACM) in West Bengal, to be used for lithium ion batteries. This capacity would be available for production in phases starting from H1 FY20 over the next 12 months.

The chemical maker completed the debottlenecking of CTD capacity in Q3 FY19. This provides an incremental capacity of 1 lakh tonne, leading to capacity addition of 25 percent in this segment. While the legacy capacity is optimally utilised, the company expects a gradual ramp-up in utilisation of new capacity -- peak utilisation in the next two years -- as and when aluminum industry prospects improve.

An additional capacity of 60,000 tonnes (currently 1.2 lakh tonnes) of specialty carbon black with a non-rubber application would be available by H1 FY20. Peak utilisation is expected in the next three years with a revenue potential of Rs 750 crore.

On the balance sheet front, there is a steady improvement. Compared to March 2018, net debt has reduced by Rs 199 crore, which takes net debt to equity ratio to 0.26x as against 0.43x earlier. Over the years, the company has worked towards strengthening its balance sheet. Net debt/EBITDA is now 0.8x compared to 5.3x in FY16. It’s noteworthy that ongoing capex programmes are funded through internal accruals.

Outlook

In the medium term, volume growth is expected to come from both the key streams of revenue – CTP and carbon black – because of new capacities. However, capacity utilisation ramp-up is expected to be gradual in light of softness in end markets – steel, aluminum and tyre industries.

Product price realisations for the carbon black will be a critical factor to watch, given the weakness in domestic auto/tyre industry. Here, investors should note that compared to its peer Phillips Carbon, Himadri’s exposure to carbon black category is relatively low and constitutes about 1/3rd of sales.

In the near term, barring increase in other expenses which is likely following commissioning/trial runs for new capacities, we expect EBITDA margins to remain stable. Over a longer period, higher contribution from advance carbon material and higher utilization of Sulfonated Naphthalene Formaldehyde (imposition of anti-dumping duty) are expected to be supportive of the margin profile.

Based on the quarterly update and end-market prospects, we have made a downward adjustment in our expectations for the near term. On account of this, stock is trading at a multiple of 13.9x FY20 estimated earnings, a slight premium to the sector multiple. However, in our view, the stock can be accumulated in a staggered manner for a long-term investment horizon as the company is well positioned to capture pick-up in demand trends in end markets later on.

Further, its focus on forward integration towards sunrise end markets – energy storage and non-tyre applications of carbon black – appears promising.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!