Indian stock market is trading in the green tracking its Asian peers. Sensex is up 740.96 points or 2.61 percent at 29,181.28, and the Nifty jumped 224.80 points or 2.71 percent at 8.505.90.

Global crude oil prices have plunged to their lowest level since 2002, an 18-year low on heightened fears that the global coronavirus shutdown could last months and demand for fuel could decline further.

Data provider Genscape reported that US stockpiles at Cushing in Oklahoma rose more than 4 million barrels last week, which was the biggest one week increase in more than 10 years. With Saudi Arabia and Russia set to flood the market with oil next month, producers and shippers have been scrambling to lock oil up in storage as demand falls due to the coronavirus pandemic, a Reuters report said.

Brent futures fell USD 2.43, or 9.8 percent, to USD 22.50 a barrel by 10:40 a.m. EDT while US West Texas Intermediate (WTI) crude fell USD 1.22, or 5.7 percent, to USD 20.29.

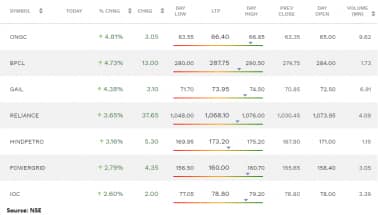

The fall in oil prices has a positive impact on oil & gas stocks. Nifty Energy jumped over 3 percent led by gains from Reliance Industries which jumped 4 percent followed by BPCL, GAIL India, HPCL, Indian Oil Corporation and ONGC which added 3-5 percent.

Morgan Stanley said both Hindustan Petroleum Corporation (HPCL) and Bharat Petroleum Corporation (BPCL) were its top picks. "We see significant tailwinds for refiners beyond the challenges of the shutdown. Hence we have overweight rating on IOC, BPCL and HPCL," said the global brokerage. However, the lockdown would result in a 6-9 percent impact to FY21 earnings, it added.

According to a report by ICICIdirect, lower demand of all kinds of fuels amid Coronavirus outbreak are expected to impact Q4FY20E, FY21E earnings of companies. A decline in stock prices presents investors with a buying opportunity. We prefer CGD companies and selective OMCs in our coverage. CGD companies are a structural play on increasing gas demand, favourable government policies and competitive price advantage against competing fuels.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!