Headline indices -- Sensex and Nifty -- logged healthy gains on July 16 despite weak global cues and rising coronavirus infection in India and the world.

Gains in the market were led by IT heavyweight Infosys, which surged 9.56 percent on the BSE to close at Rs 910.90. In terms of index contribution, Infosys remained at the top among the stocks that lifted Sensex, followed by HDFC Bank and Kotak Mahindra Bank.

The Sensex ended the day with a gain of 420 points, or 1.16 percent, at 36,471.68 and Nifty settled 122 points, or 1.15 percent, higher at 10,739.95.

Ajit Mishra, VP - Research at Religare Broking, is of the view that the market will continue to take cues from the global peers in the absence of any major domestic trigger.

"While the mood in the global markets continues to remain buoyant, the rising number of cases in the US and India would remain a key cause of concern. Besides the earnings announcements will further induce stock-specific volatility," Mishra said.

He has a cautious view on the market and suggests preferring hedged trades.

We have collated 15 data points to help you spot profitable trades in the next session:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 10,638.37, followed by 10,536.73. If the index moves up, key resistance levels to watch out for are 10,798.47 and 10,856.93.

Nifty Bank

The Bank Nifty rose 1.20 percent to close at 21,597.15 on July 16. The important pivot level, which will act as crucial support, is placed at 21,192.93, followed by 20,788.67. On the upside, key resistance levels are placed at 21,836.33 and 22,075.46.

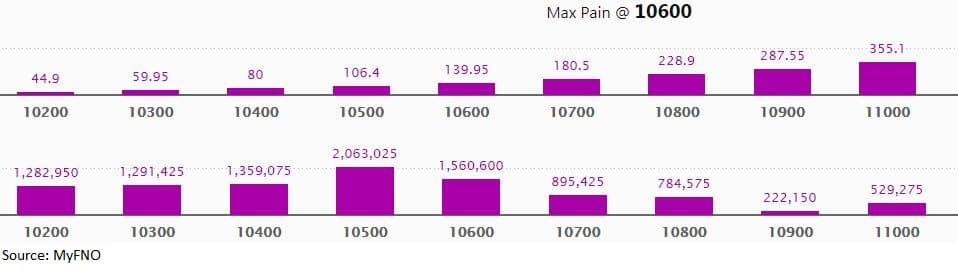

Call option data

Maximum call OI of 25.68 lakh contracts was seen at 11,000 strike, which will act as crucial resistance in the July series.

This is followed by 10,800, which holds 11.56 lakh contracts, and 11,200 strikes, which has accumulated 10.34 lakh contracts.

Significant call writing was seen at 10,900, which added 1.09 lakh contracts, followed by 10,700 strikes, which added 98,775 contracts.

Call unwinding was witnessed at 10,500, which shed 32,925 contracts, followed by 11,200, which shed 28,500 contracts, and 10,600 strikes, which shed 28,125 contracts.

Put option data

Maximum put OI of 20.63 lakh contracts was seen at 10,500 strike, which will act as crucial support in the July series.

This is followed by 10,600, which holds 15.61 lakh contracts, and 10,400 strikes, which has accumulated 13.59 lakh contracts.

Put writing was seen at 10,600, which added 4.35 lakh contracts, followed by 10,500 strikes, which added 2.03 lakh contracts.

Put unwinding was witnessed at 10,800, which shed 53,775 contracts, followed by 10,200 strikes, which shed 23,250 contracts.

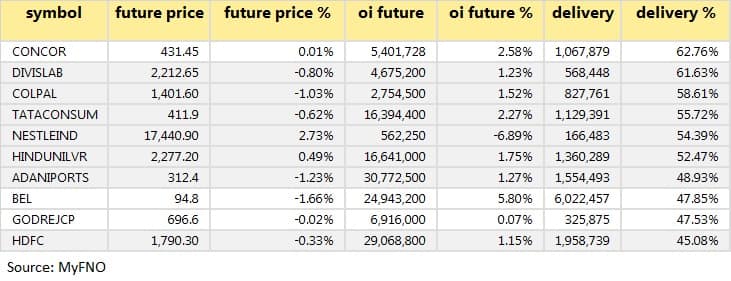

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

51 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

16 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

34 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

42 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

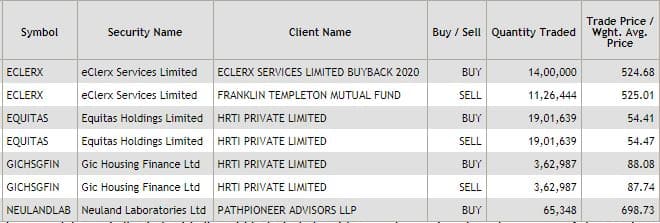

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on July 17

HCL Technologies, Britannia Industries, ICICI Lombard, Coffee Day Enterprises, Granules India, Hathway Cable, etc.

Stocks in the newsAgro Tech Foods: Rakesh and Rekha Jhunjhunwala cut their stake in the company to 5.14 percent in the June quarter from 5.75 percent in the March quarter.

Eveready Industries: IL&FS Financial Services invoked a pledge on 1.88 lakh shares in the company.

Metropolis Healthcare: Pledge released on 16.47 percent stake by Vistra ITCL India.

Endurance Technologies announced the consolidation of plant operations in Italy.

ICICI Prudential Life Insurance Company: FPIs raised stake in the company to 15.06 percent in the June quarter from 13.34 percent in March quarter. The government of Singapore acquired 1.39 percent stake.

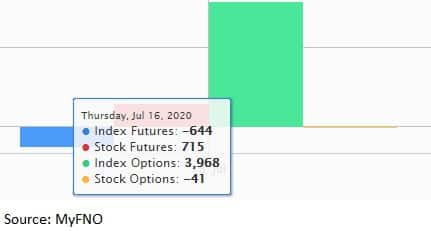

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,091.08 crore while domestic institutional investors (DIIs) bought shares worth Rs 1,659.91 crore in the Indian equity market on July 16, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Six stocks - Canara Bank, Century Textiles & Industries, Vodafone Idea, L&T Finance Holdings, Punjab National Bank and Sun TV - are under the F&O ban for July 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!