India's two largest IT companies announced their September quarter earnings, with TCS posting numbers below analyst expectations while Infosys' results matched street estimates.

Infosys reported 2.5 percent sequential growth in Q2 dollar revenue and TCS 0.6 percent, but the deal size was strong for the quarter at $2.8 billion and $6.4 billion respectively.

Analysts are concerned about the full-year double-digit growth for TCS amid headwinds in Europe BFSI segment whereas they turned optimistic about Infosys after it raised the full-year constant-currency revenue guidance again in Q2 to 9-10 percent.

Earnings were mixed, but that does not mean analysts also have mixed opinions on stock. In fact, they advised sticking more to laregcaps (TCS and Infosys) than midcaps in the IT space due to likely strong growth in coming years.

"I am positive on IT sector in the current scenario and expect both Infosys and TCS to give good annual returns in the next couple of years," Romesh Tiwari, Head of Research - CapitalAim, told Moneycontrol.

The recently-declared result of TCS was a bit subdued while the Infosys result met market expectations. However, investors should buy into both on dips for a better portfolio returns, Tiwari advised.

He feels IT majors like Infosys and TCS are robust and can provide comparatively-secured returns while returns on midcap IT will be more volatile. So, investors should choose according to their risk appetite.

The major reason behind the advice is the company's digital revenue contribution to topline, which has been increasing. Hence, these two majors are expected to gain lead share though the slowing global economic growth have been hurting the Indian IT companies’ earnings.

Factors like Brexit, Trade War and stringent VISA norms resulted in local hiring in the US and have been impacting the IT companies' growth and margins.

"The concept of rising digitalization has completely changed the dynamics of the IT industry thus, those companies with a large share of the revenue from the digital business are going to benefit most in the coming days. Thus, odds are in favour of large IT companies having a higher share from digital revenue," Paras Bothra, President of Equity Research - Ashika Group of Companies, said.

Ajit Mishra, Vice President - Research, Religare Broking, is also positive on Infosys and TCS from the long-term perspective. He recommends buy on the stock on dips.

"We remain constructive on long term growth prospects of the company due to its increased focus on digital business, a rising share of high margin business and strong management," he said.

TCS is India’s largest IT company and offers its services to a wide range of industries such as BFSI, manufacturing, Telecom, retail, transportation, and insurance.

It has over 4,20,000 consultants present in over 50 countries. In terms of revenue, 51 percent of its business comes from North America. Mishra believes that the company is well placed to benefit from the increasing demand for offshore IT services seen over the last decade.

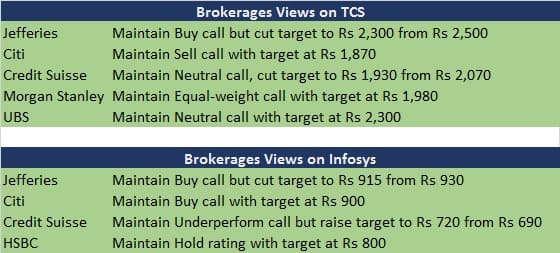

Meanwhile, global brokerages had mixed reactions to both companies earnings.

Jefferies has buy call on both stocks but cut target price for Infosys to Rs 915 from Rs 930 and for TCS to Rs 2,300 from Rs 2,500 per share.

"Infosys remains one of the best placed amongst top Tier IT companies and will benefit from the tailwind of large-scale digital transformation," the research firm said, adding that TCS will outperform Tier-I peers on growth and margin in the medium term. Weak results could provide a good entry opportunity into a strong long-term franchise.

Citi also maintained buy call on Infosys and sell rating on TCS with target price at Rs 900 and Rs 1,870 per share respectively.

"While the macro is tough, continued momentum/execution should provide comfort for Infosys. Company's positioning as a defensive in India context is good and the stock is one of our big overweights in the India model portfolio," the global brokerage said.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!