Morgan Stanley slashed earnings forecast for a third time after the virus outbreak which led to a cut in the Sensex target from 36,000 earlier to 32,000 in the base case scenario for 2020.

Morgan Stanley’s FY21 Sensex EPS growth estimate says it could be in the range of 10 percent, down from 20 percent in mid-February. The revised Sensex target for December 2020 suggests an upside of 20 in the base case and a 6% downside in the bear case.

Despite the muted outlook, Morgan Stanley believes that investors with a 12-month view should put money to work in the equities.

It is time to buy quality businesses where share prices have undergone a massive correction and thus valuations have become attractive.

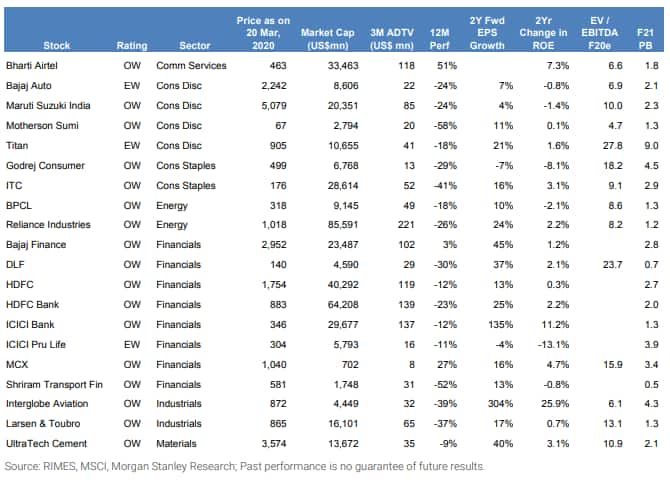

Morgan Stanley highlights 20 stocks in the focus list which include names like Bharti Airtel, Baja Auto, Maruti Suzuki, Motherson Sumi, Titan Company, Godrej Consumer and ITC, among others.

The Indian market, which has plunged by about 40 percent from the recent peak, might be still away from an absolute bottom with precision, but it's close on many metrics, Morgan Stanley said in a note.

“Our proprietary sentiment indicator is at its lowest level ever suggesting completely broken sentiment for stocks, historical VaR is at a new high, change in realized volatility is the highest for any bear market, and valuations are skirting with all-time lows and well below the levels hit during the global financial crisis,” it said.

This bear market is only two months whereas bear markets generally last at least 6 months. Given the pace of the decline, it may not be following the past average duration.

“The price decline of around 40% also leaves some more downside risk on the table when compared with past bear markets,” said the Morgan Stanley note. The global investment bank recommends investors buy stocks of quality businesses where prices have corrected sharply.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!