Foreign portfolio investors (FPIs) stayed positive on the Indian market as the FPI ownership in the BSE-200 Index showed a sequential increase during the December quarter of FY20.

A February 11 report from the brokerage Kotak Institutional Equities said that FPIs bought Indian equities worth Rs 44,900 crore and FPI ownership in the BSE-200 Index increased to 24.3 percent in December 2019 quarter from 23.8 percent in September 2019 quarter.

However, the trend of domestic investment showed a contrasting figure as domestic institutional investors' (DII) holding in the BSE-200 Index declined to 13.9 percent in the December 2019 quarter from 14 percent in September 2019 quarter, data from Kotak showed.

Banks, diversified financials and insurance sectors witnessed FPI buying while DIIs sold banks and oil & gas and consumable fuels sectors.

FPIs were overweight on HDFC, HDFC Bank and Kotak Mahindra Bank, while mutual funds (MFs) were overweight on SBI, ICICI Bank and NTPC. Banks, financial institutions (BFIs) were overweight on ITC, L&T and SBI.

On the flip side, FPIs were underweight on ITC, L&T and SBI while MFs were underweight on HDFC, Reliance Industries and TCS. BFIs were underweight on HDFC Bank, HDFC and Axis Bank.

Ownership pattern

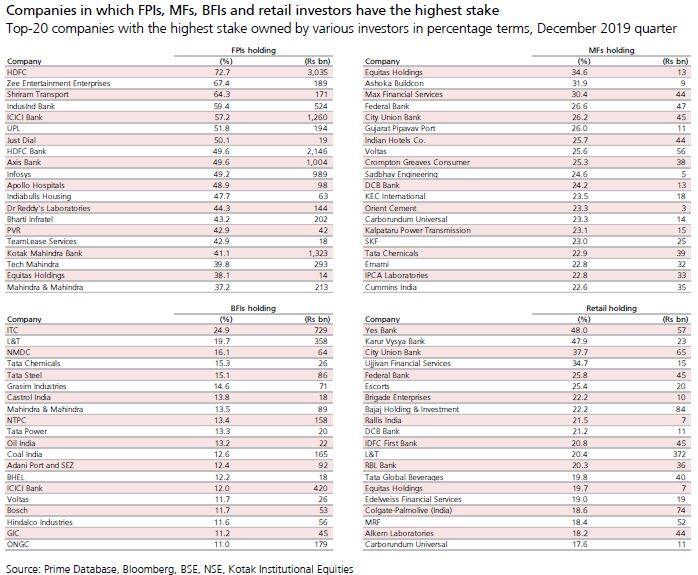

Among the companies with the highest stake owned by FPIs, HDFC stood at the top, followed by Zee Entertainment and Shriram Transport.

On the other hand, Equitas Holdings, Ashoka Buildcon and Max Financial Services were the companies that witnessed the highest stake by mutual funds.

Zee Entertainment, Bajaj Consumer Care, AU Small Finance, Bandhan Bank, RBL Bank, HDFC Life Insurance and Ujjivan Financial Services saw a substantial sequential increase in FPI holdings.

However, FPIs sold large stakes in Yes Bank, Indiabulls Housing, PVR, Narayana Hrudayalaya, Cipla, Federal Bank and Tata Power.

Data from Kotak also showed that Union Bank, Canara Bank, Punjab National Bank, Tata Motors, Indian Bank and Bank of Baroda were the top stocks that witnessed a significant increase in the holdings of promoters or promoter-groups.

On the contrary, Bajaj Consumer Care, Bandhan Bank, Zee Entertainment Enterprises, Quess Corp, Crompton Greaves Consumer, HDFC Life Insurance, Yes Bank, Jyothy Labs, CEAT and Nippon Life Asset Management were the top stocks that witnessed a decrease in the holdings of promoters or promoter-groups during the December quarter of FY20.

Bandhan Bank (Gruh Finance merger), PSU banks (capital infusion) and Bajaj Finance (QIP) saw fresh equity issuances, Kotak said.

MFs increased stake in Bajaj Consumer Care, Quess Corp, Crompton Greaves Consumer, PVR and Jyothy Labs, but reduced stake in Yes Bank, Union Bank, Mahanagar Gas, ICICI Bank and Indian Bank, data from Kotak showed.

BFIs increased stake in Narayana Hrudayalaya, Astral Poly Technik and Indian Hotels, but they reduced stake in Jagran Prakashan, Ujjivan Financial Services and Union Bank. Retail investors increased stake in Yes Bank, Quess Corp and Bandhan Bank and reduced stake in Union Bank, RBL Bank and Punjab National Bank.

LIC increased stake in Marico, Biocon and Bharti Infratel.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!