Highlights:

- Disagreement between two largest shareholders has led to 9 percent fall in the stock price

- We expect this not to last long as it is in the best interest of all stakeholders

- Favourable industry dynamics making IndiGo an attractive opportunity

- Accumulate the stock as it weakens after the issue --------------------------------------------------

InterGlobe Aviation, which operates India’s largest low-cost carrier (LCC) IndiGo, has come under the radar on the back of the news of rift between the two largest shareholders, Rahul Bhatia (38.26 percent stake, including family) and Rakesh Gangwal (36.69 percent, including family).

The share price fell by as much as 9 percent on May 16 following the news. We believe that this won’t last long and the differences would be sorted out as it is in the best interest of all stakeholders.

Furthermore, IndiGo is expected to benefit from the attractive dynamics of Indian aviation industry. We advise investors to accumulate the stock during the time of weakness with an eye on the long term.

What could this tussle lead to?According to media reports, Bhatia and Gangwal are in disagreement over strategies and ambitions pertaining to IndiGo. And the tussle between promoters is expected to be negative for shareholders if it continues for long as that would impact decision making, especially, in a very dynamic environment the airline is operating in.

This would not only impact the growth for the company, but could also impact the industry as IndiGo is the market leader with close to 50 percent domestic passenger market share.

Would it actually last longer?Ronojoy Dutta, IndiGo CEO, however, has assuaged employees' concerns and indicated that growth strategy of the airline would remain unchanged and firmly in place, and the management is fully empowered by the board to implement it.

We are of the firm view that the disagreement may not last for too long and may not reach a point where it impacts the financial performance of the airline or significantly erodes value for the shareholders. At the end of the day, the two promoters of IndiGo have substantial skin in the game of the company and have created a very respectable business over the years.

For any overseas competitor airline eyeing the Indian market, Indigo appears to be the first port of call. So, the promoters of IndiGo can actually monetise their stake at a premium if they so wish.

Against this backdrop, it is highly improbable that the promoters will indulge in public spat that will have bearing on the image of the company and impact operational performance. We do not rule out the possibility of one of the promoters exiting the business by monetising his stake.

In a nutshell, we are of the opinion that the promoters are unlikely to indulge in a fight whereby they start losing the value of their investment in the airline. We have seen time and again that such boardroom battles do not go down well with the investors who turn cautious about the growth strategies and plans of the company. The recent case in point being Infosys that saw significant erosion in the market capitalisation as the boardroom battle unfolded.

Now, is the weakness an opportunity to buy stock?Indian aviation sector is tuning attractive after the grounding of Jet Airways which was hit due to liquidity constraints and a huge debt. The grounding has not only increased the market share for IndiGo, but also turned the industry dynamics favourable as the competitive intensity has waned and there has been significant improvement in yields.

The improvement in yields is due to the fact that Jet used to command 18 percent of the total industry seating capacity which has gone away, leading to capacity constraint, thereby imparting pricing power to the rest. Further, the impact of recent rally in crude prices would be minimal as yield would closely reflect the cost structure.

Additionally, IndiGo is getting new slots that have been left behind by Jet Airways (40-50 percent slots in Mumbai and 20-25 percent in Delhi). This is expected to be an important trigger for growth. In addition, this should result in cost savings because the airline was incurring additional costs for the delays on account of airport infrastructure bottlenecks earlier.

Apart from the domestic opportunities, IndiGo is aggressively focusing on international route and has been getting into code-share agreements with strong international carriers, including Turkish Airlines.

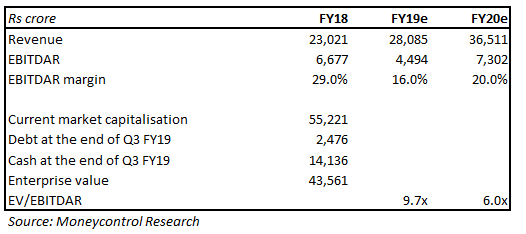

The stock price has fallen 13 percent from its recent high level, partly due to the rift, making the valuation attractive for the company (6 times FY20 projected EV/ EBITDAR). We advise investors to accumulate this during the ongoing weak phase.

For more research articles, visit our Moneycontrol Research page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!