Indian equity benchmarks Sensex and Nifty snapped their losing streak of the last two consecutive sessions on February 11 as investors comforted from the decline in the rate of newly reported cases of Coronavirus in China.

Sensex ended the day with a gain of 237 points, or 0.58 percent, at 41,216.14 while Nifty finished at 12,107.90, up 76 points, or 0.63 percent.

Experts said while hope that the epidemic of coronavirus could come under control soon boosted sentiments, it remains a key monitorable for the markets over the next few days.

"Nifty showing upside bounce could be a cheering factor for bulls to make a come back from the lows. But lack of strength to sustain the highs could drag Nifty to the immediate support of 12,000 again, before showing any meaningful upside bounce," said Deepak Jasani, Head Retail Research, HDFC Securities.

"On the higher side, the area of 12,175-12,200 could be key overhead resistance. On falls, 12,000-11,950 is expected to be strong support," Jasani added.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 12,080.5, followed by 12,053.1. If the index continues moving up, key resistance levels to watch out for are 12,153.8 and 12,199.7.

Nifty Bank

Nifty Bank closed 0.78 percent up at 31,300.60. The important pivot level, which will act as crucial support for the index, is placed at 31,182.37, followed by 31,064.13. On the upside, key resistance levels are placed at 31,462.37 and 31,624.13.

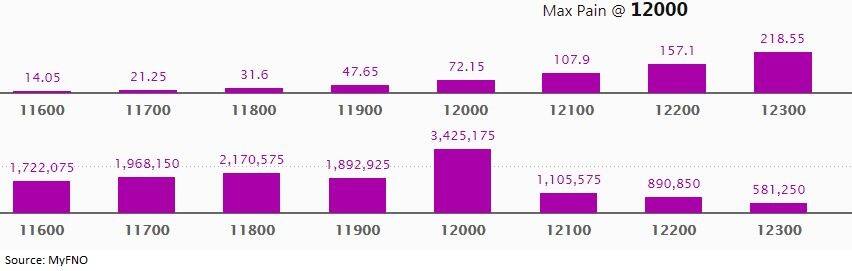

Call options data

Maximum call open interest (OI) of 27.54 lakh contracts was seen at the 12,500 strike price. It will act as a crucial resistance level in the February series.

This is followed by 12,400 strike price, which holds 18.98 lakh contracts in open interest, and 12,300, which has accumulated 15.81 lakh contracts in open interest.

Significant call writing was seen at the 12,400 strike price, which added 2.03 lakh contracts.

Call unwinding was witnessed at 12,000 strike price, which shed 2.56 lakh contracts, followed by 12,100 which shed 1.16 lakh contracts.

Put options data

Maximum put open interest of 34.25 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the February series.

This is followed by 11,800 strike price, which holds 21.71 lakh contracts in open interest, and 11,700 strike price, which has accumulated 19.68 lakh contracts in open interest.

Put writing was seen at the 12,100 strike price, which added 1.79 lakh contracts, followed by 11,800 strike, which added 1.54 lakh contracts.

Put unwinding was seen at 11,600 strike price, which shed 2.33 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

29 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

16 stocks saw long unwinding

39 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

58 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short-covering was seen.

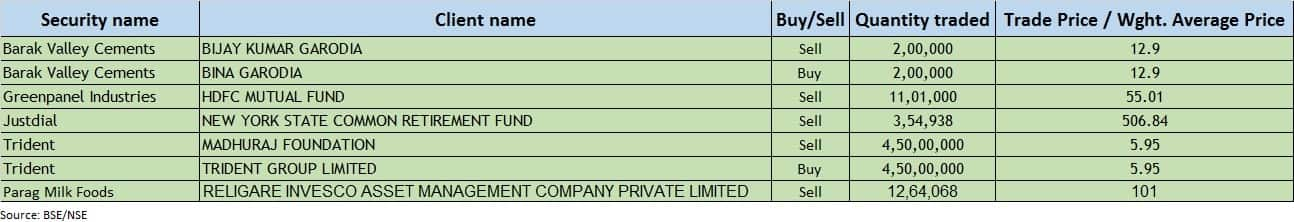

Bulk deals

(For more bulk deals, click here)

Quarterly earnings

Divi's Laboratories, Dish TV, NBCC, Info Edge India, Omaxe, PFC, Religare, Hindalco, IRCTC, Aar Shyam India Investment Company, Aarti Industries, Aayush Food and Herbs, ABB India, Alchemist, Anjani Finance, Bajaj Steel Industries, Bannari Amman Group, Centrum Capital, Dharani Sugars & Chemicals, Jamna Auto Industries, Jaiprakash Power Ventures and Mahamaya Steel Industries are among the companies that will release their quarterly earnings on February 12.

Stocks in the news

IndusInd Bank: Moody's revises outlook on the bank's rating to Negative versus Stable on the risk of worsening loan quality.

Aster DM Healthcare: Q3 profit jumps 33.7 percent to Rs 151.4 cr, revenue rises 8 percent to Rs 2,321.7 cr YoY.

Hexaware: Q4 profit dips 8.7 percent to Rs 167.7 cr, revenue rises 3.2 percent to Rs 1,528.8 cr QoQ.

BHEL: Q3 profit falls 17.3 percent to Rs 158.8 cr, revenue declines 22.6 percent to Rs 5,679.3 cr YoY.

IDBI Bank: Q3 loss at Rs 57.63 cr versus a loss of Rs 41.85 cr, NII rises 13 percent to Rs 15.3 cr YoY.

Neuland Labs: Q3 profit jumps to Rs 11.1 cr versus Rs 4.7 cr, revenue rises 18.9 percent to Rs 203.8 cr YoY.

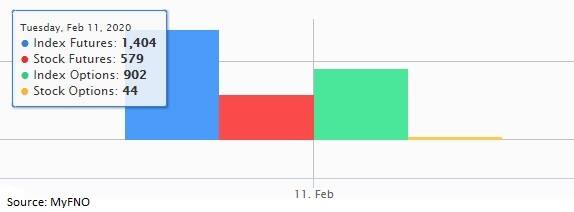

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 209.39 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 344.63 crore in the Indian equity market on February 11, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

Yes Bank is under the F&O ban for February 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!