A slowdown in India's consumption demand is taking a heavy toll on the country's consumer goods space.

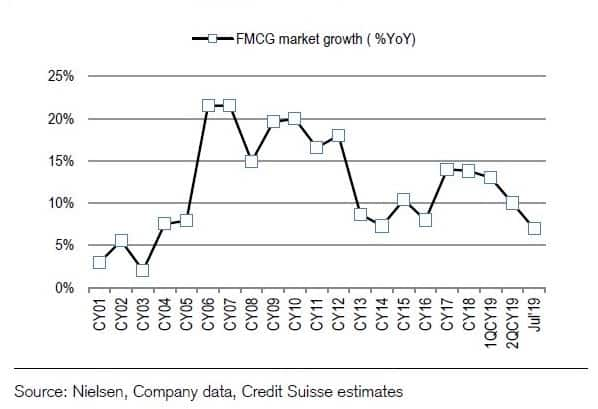

India's FMCG sector is likely to witness the worst revenue growth in 15 years on account of domestic as well as global factors, foreign brokerage Credit Suisse has said in a recent report.

"FY20 is likely to be the year of worst revenue growth for India's FMCG sector in 15 years, since 2000-03," Credit Suisse said.

The slowdown in agri sector, liquidity squeeze in India's financial system after the IL&FS fiasco and fall in employment in small businesses played out together to bring the worst, said the brokerage.

"Agri GDP growth has been at a 15-year low since 2018. Liquidity worsened after October 2018 as NBFCs faced pressures. Employment challenges for small businesses started with demonetisation and GST, and was aggravated due to liquidity. The simultaneous impact of these factors is playing out," said Credit Suisse.

As per the brokerage's estimates, the CAGR of FMCG revenue growth over FY16-19 was very low at about 7 percent.

However, fall in crude oil prices and GST savings helped FMCG firms expand their margins during the same period but the same factors are unlikely to play ball and the sector is staring at a challenge of shrinking margins, they added

"Despite the slowdown over FY16-19, FMCG companies grew their earnings faster by expanding margins from levers like fall in crude prices and GST Savings. This is now behind and the only lever for margins now will be cutting ad spends," Credit Suisse said.

The way ahead

The near-term outlook for the sector looks bleak and a lot will depend on how consumers spend during the coming festive season.

Sanjiv Bhasin, Executive VP - markets and corporate affairs at IIFL Securities is optimistic that the consumer demand will pick up the pace.

"The underperformance may be coming to the end, given that there should be an impetus to spend more money as the cost of money has fallen and the coming festive season should see the return of the consumer," he said.

Benign inflation and lower competitive intensity and government's measures are also expected to augur well for FMCG players.

Moreover, the consumption slowdown is likey to hit the local players more than the larger ones with sizeable market share and with diversified product presence.

"FMCG industry growth has slowed over the last 2 quarters and is likely to be modest even in Q2 FY20. However, given the fact that larger FMCG companies have gained market share from smaller players, the impact of the slowdown has hit larger players to a lesser extent," said Investec Securities in a recent report.

"We believe factors such as rising household incomes, higher propensity to spend and continued benefits of premiumisation and penetration remain intact, and that will result in sector growth moving back up to double digits from FY21E," Investec added.

Analysts opine there are stocks in the sector, such as Nestle and Dabur, that look bright despite the fears of a slowdown and have the potential to give healthy returns in the long term.

Shares of Nestle have gained 16 percent so far in CY2019, while Dabur has clocked a gain of 6 percent against the 8 percent fall in BSE FMCG index, data from Ace Equity showed.

"We prefer Nestle, Dabur, and Colgate as they are turnaround stories on market share gains," Credit Suisse said.

However, the foreign brokerage has downgraded Britannia Industries to 'neutral' from 'outperform', citing its core category of biscuits has slowed down sharper than the FMCG average.

Besides Britannia, Credit Suisse has downgraded Pidilite Industries as well to 'underperform' from 'neutral' due to stretched valuations and slowdown in real estate linked businesses.

Bhasin of IIFL Securities is positive on ITC, Godrej Consumer Products, Nestle, Titan and Dabur.

Investec Securities has a buy recommendation on Hindustan Unilever, Dabur, ITC and Jyothy Labs, while it has a 'hold' on Britannia, Emami, Godrej Consumer Products, Nestle and Marico.

Investec has given a sell recommendation on Colgate Palmolive (India), terming it as a single category play impacted by low category growth and high competitive intensity.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!