The exuberance over the corporate tax rate cut seems to have fizzled out amid lingering concerns over the health of the economy as the bears took a grip over the Indian market on September 25.

News of impeachment inquiry against US President Donald Trump, tension in the Middle East and uncertainty over the US-China trade deal kept the market under pressure.

Other than the weak global sentiment, market experts believe the reports of the government's planning for strategic disinvestment in PSUs also contributed to the fall in the market.

"Political uncertainty in the US amidst impeachment talks pulled indices lower today. Afternoon trade witnessed heightened selling led by PSU banks amid reports of SUUTI stake sale," said S Ranganathan, Head of Research at LKP Securities.

Sensex broke the winning streak of the last three consecutive sessions, falling 504 points, or 1.29 percent, to 38,593.52. Only six stocks in the 30- share pack managed to settle in the green.

The Nifty index fell for the second consecutive day, ending the day at 11,440.20, down 148 points or 1.28 percent. This was the second biggest single-day fall this month for the index. Among the 50 stocks in the index, 37 suffered losses.

The overall market capitalisation of BSE-listed firms dropped to Rs 1.47 lakh crore from Rs 1.49 lakh crore in the previous session, making investors poorer by about Rs 2 lakh crore in a single day.

Nifty closed well below 11,500 level and formed bearish belt hold pattern on daily charts.

A bearish belt hold pattern is formed when the opening price is the highest point of the trading day (intraday high) and the index declines throughout the session making up for the large body. The candle will either have a small or no upper shadow and a small lower shadow.

Experts expect Nifty to be volatile amid F&O expiry but if the index breaks 11,382, the crucial support level, then selling could intensify in coming sessions.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 11,382.53, followed by 11,324.87. If the index starts moving up, key resistance levels to watch out for are 11,531.43 and 11,622.67.

Nifty Bank

Nifty Bank closed with a loss of 1.98 percent at 29,586.05. The important pivot level, which will act as crucial support for the index, is placed at 29,348.26, followed by 29,110.43. On the upside, key resistance levels are placed at 29,945.76 and 30,305.43.

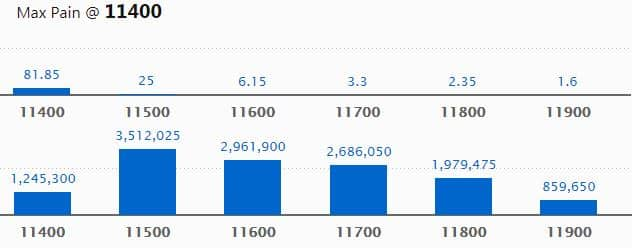

Call options data

Maximum call open interest (OI) of 35.12 lakh contracts was seen at the 11,500 strike price. It will act as a crucial resistance level in the September series.

This is followed by 11,600 strike price, which now holds 29.62 lakh contracts in open interest, and 11,700, which has accumulated 26.86 lakh contracts in open interest.

Significant call writing was seen at the 11,500 strike price, which added 16.7 lakh contracts, followed by 11,600 strike price that added 7.52 lakh contracts and 11,400 strike which added 2.34 lakh contracts.

Call unwinding was witnessed at 11,900 strike price, which shed 3.24 lakh contracts, followed by 11,800 which shed 3.22 lakh contracts.

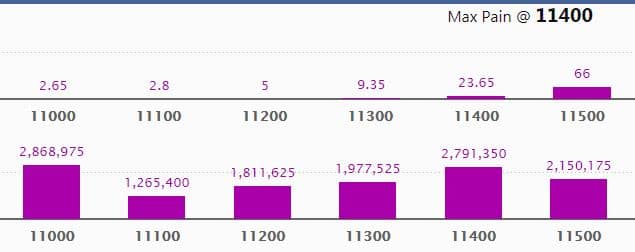

Put options data

Maximum put open interest of 28.69 lakh contracts was seen at 11,000 strike price, which will act as crucial support in September series.

This is followed by 11,400 strike price, which holds 27.91 lakh contracts in open interest, and 11,500 strike price, which has accumulated 21.50 lakh contracts in open interest.

Put writing was seen at the 11,400 strike price, which added 5.79 lakh contracts, followed by 11,300 strike, which added 2.45 lakh contracts.

Significant put unwinding was seen at 11,500 strike price, which shed 13.48 lakh contracts, followed by 11,600 strike which shed 11.63 lakh contracts and 11,700 strike which shed 1.55 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

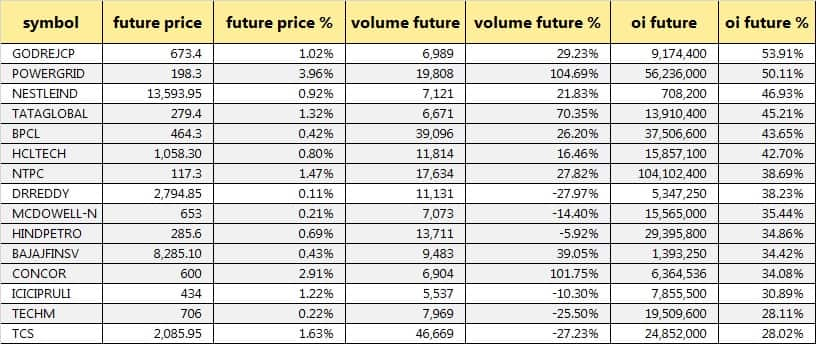

24 stocks saw long buildup

Overall, 24 stocks witnessed long buildup on September 25. Based on open interest (OI) future percentage, here are the top 15 stocks in which short buildup was seen.

7 stocks saw long unwinding

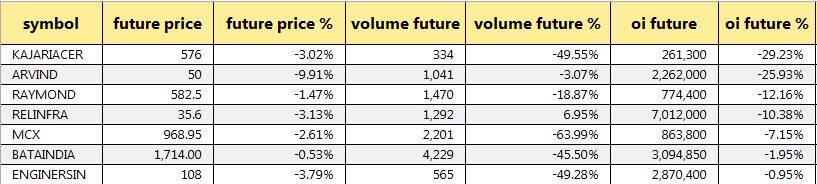

129 stocks saw short build-up

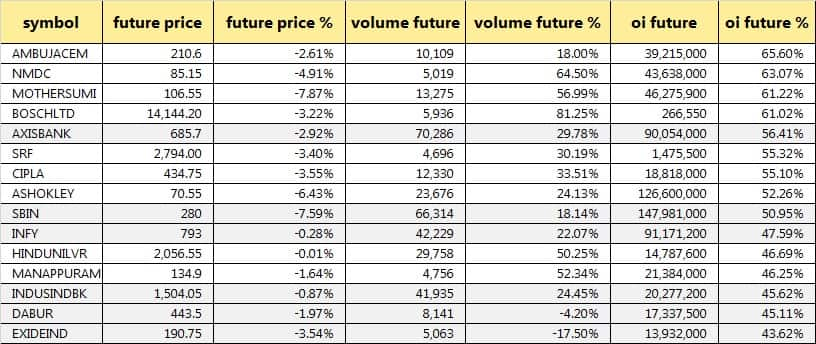

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 15 stocks in which short build-up was seen.

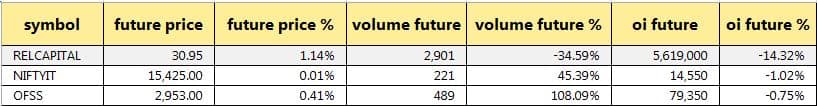

Only 3 stocks witnessed short-covering

As per available data, only three stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering.

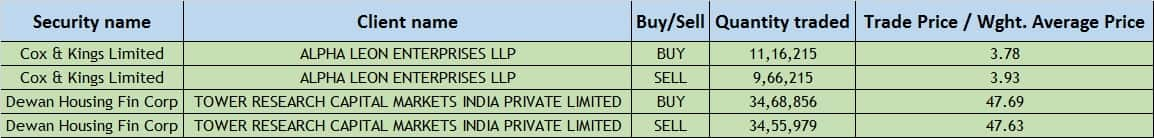

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings:

Omaxe: The board of the company will meet on September 26 for general purpose.

Punjab National Bank: The board of the company will meet on September 26 for general purpose.

GOCL Corporation: The board of the company will meet on September 27 to consider a special dividend.

Jump Networks: The board of the company will meet on September 27 to consider issuance of preferential shares.

Stocks in news:

DHFL: The company defaulted in interest and principal payment on NCDs due on September 20.

Cipla: The company has launched Daptomycin for Injection, AP-rated generic equivalent of Cubicin for Injection in the United States.

GlaxoSmithKline Pharmaceuticals: Regulatory authorities have detected genotoxic nitrosamine NOMA in ranitidine products.

Gravita India: Brickwork Ratings has revised the credit ratings of the company.

AstraZeneca Pharma: The company has received import and market permission in Form 45 (marketing authorization) from the Drugs Controller General of India.

Dredging Corporation of India: Brickwork Ratings has assigned "BWR AA+ (SO)" with "stable" outlook on the company's tax-free bonds.

Adani Enterprises: The company has incorporated Adani Mangalore International Airport.

Paisalo Digital: Bank of Baroda has enhanced the credit facility, under Consortium Financial Facility Arrangement, by Rs 50

crores to the company.

Future Enterprises: Credit rating agency Acuite Ratings & Research has reaffirmed credit rating "ACUITE A1+ " assigned to the company's commercial paper.

Sterlite Technologies: Sterlite Global Venture (Mauritius), a wholly-owned subsidiary of the company, has entered into definitive agreements to acquire a 100 percent stake in Europe's Impact Data Solutions Group.

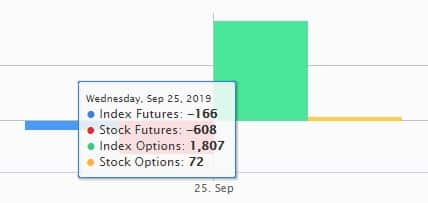

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 342.4 crore, while domestic institutional investors (DIIs) also sold shares of worth Rs 762.48 crore in the Indian equity market on September 25, as per provisional data available on the NSE.

Fund flow

No stock under ban period on NSE

There is no stock under F&O ban for September 26. Securities in ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!