Sensex and Nifty close higher, financials and metal stocks shine

Listen 02:48Sensex Today | Stock Market LIVE Updates

GIFT Nifty signals a negative start; Asian shares trade lower

After a stellar runup, where to invest in defence sector? Harshit Kapadia answers

Markets & Mandate: Where to invest in E-M-I basket going forward

F&O Ban List: SAIL, Hindustan Copper and 1 more stock under trade ban on Thursday

Meta shares sink on higher AI spending, light revenue forecast

At multi-year highs: These 3 stocks witness 5-year swing high breakout

Positive Breakout: Ashok Leyland and 3 other stocks cross above their 200 DMA

Big movers on D-Street: What should investors do with SAIL, MCX and Tata Elxsi?

Gold trades in tight range as market focuses on US economic data

Oil eases as US demand concerns outweigh fears over Middle East conflicts

S&P 500 ends higher as markets weigh rising yields, upbeat corporate results

Stock Radar I Why LTIMindTree could top 5000 levels in short term?

GIFT Nifty down 50 points; here's the trading setup for today's session

Stocks in news: Bajaj Finance, Nestle, Tech Mahindra, IndusInd Bank, Axis Bank, HUL, Kotak Bank

Fall in call market volume raises concerns over pricing of MIBOR, other instruments

Stock Radar: Down over 20% from highs! This IT stock is showing signs of bottoming out; time to buy?

Tesla jumps 10% as Musk's promise of 'more affordable' cars eases growth fears

ET Market Watch: Sensex and Nifty close higher, financials and metal stocks shine

Nifty Next 50 Index derivates debut on NSE. Over 1,200 futures contracts traded on first day

Syngene Q4 Results: Net profit rises 6% to Rs 189 crore, revenue drops 8%

Ahead of Market: 10 things that will decide D-Street action on Thursday

Hilton Q1 Results: Revenue rose 12% to $2.57 billion; co lifts profit forcast

Bunge Q1 Results: Profit falls on weaker agribusiness results, shares drop

Market Trading Guide: BHEL, Petronet LNG among 5 stock recommendations for Thursday

Nestlé India Earnings Preview: PAT growth seen at 17% YoY, revenue likely to jump 7%

Q4 Results: How AU SFB, DCB Bank and Equitas SFB performed in March quarter

These 5 PSU stocks hit 52-week highs, rally up to 40% in a month

NSE launches derivatives on Nifty Next 50 Index; here are key things to know

Indian Hotels Q4 Results: Cons PAT jumps 27% YoY to Rs 418 crore

Motilal Oswal effects leadership changes for AMC biz, elevates Prateek Agrawal as MD and CEO

Exide Industries, Vodafone Idea among 4 stocks with top long unwinding

Equitas Small Finance Bank Q4 Results: PAT jumps 9% YoY to Rs 208 crore

Making losses in options trading? Zerodha co-founder Nithin Kamath shares a pro tip

US stocks slip as higher yields offset upbeat corporate earnings

Canadian pension fund looks to trim stake in Delhivery via $110 million block deal: Report

AU Small Finance Bank Q4 Results: Profit falls 13% YoY to Rs 371 crore

Tech View: Nifty forms Doji candle ahead of monthly expiry. What traders should do on Thursday

ITC Hotels Demerger: ITC to hold meeting of ordinary shareholders on June 6 to approve scheme

Nifty Bank closes above 48K; immediate resistance seen around 48,500: Analysts

Tesla jumps 10% in premarket as Musk's promise of 'more affordable' cars eases growth fears

Boeing Q1 Results: Revenue declines 8%, first in 7 qtrs as deliveries decline

Invesco India, CEO, others pay Rs 5 cr to settle regulatory violation case with Sebi

Four-day market rally makes investors richer by Rs 8.48 lakh cr

Gainers & losers: Tata stocks, Hindalco among other counters inspotlight on Wednesday

Axis Bank board approves Rs 55,000 crore fundraise via mix of debt and equity

LTIMindtree Q4 Results: Net profit falls marginally to Rs 1,100 crore, misses St estimates

Axis Bank Q4 Results: Lender back in black with profit of Rs 7,130 cr; NII jumps 22% YoY

Rohit Srivastava on why VIX collapsed and why he will avoid telecom sector

HUL Q4 Results: Net profit drops 6% YoY to Rs 2,406 crore, misses estimates

Sensex, Nifty rise for 4th day; focus on key earnings this week

Nippon India Life Q4 results: PAT grows by 73% YoY, dividend of Rs 11 per share declared

Equitas Small Finance Bank Q4 Results: Firm reports PAT at Rs 208 crore

Voda Idea gets Nuvama upgrade, but Bharti Airtel remains in numero uno spot. Here’s why

Chennai Petroleum Corp shares soar 16% on Rs 55 dividend, 72% QoQ PAT growth

Tata Sons preparing for Tata Capital IPO with potential lookout for bankers: Report

JNK India IPO sails through on Day 2. Check subscription, GMP and other details

Maruti Suzuki, Bharti Airtel among 5 Nifty50 stocks that hit new 52-week highs on Wednesday

Tech Mahindra Q4 Results Preview: Weakness to persist as profit, revenue seen falling

6 smallcaps where MFs & FIIs raise bets for 4 quarters turn multibaggers

F&O stocks: ICICI Prudential, Indus Towers among 5 stocks with short buildup

F&O stocks: Tata Steel, National Aluminium among 5 stocks with long buildup

Markets & Mandate: How would you prepare your portfolio for Modi 3.0?

Retail investors get full allotment in Vodafone Idea FPO. What to expect from listing?

Indus Towers share declines 3% after Airtel dismisses talks of acquiring stake

Our focus is to be well-positioned and respond quickly to market changes: Rakesh Sharma, Bajaj Auto

Cyient DLM shares zoom 13% on solid Q4 results led by defence & aerospace deals

Expecting FY25 to be better than FY24 for exports: Rakesh Sharma, Bajaj Auto

Ex-Jane Street trader pillories claims he stole trade secrets

Bajaj Finance Q4 Preview: Healthy profit, NII growth seen, but margins may contract

ICICI Prudential Life shares decline 7% on Q4 earnings miss. What should investors do?

Tata Consumer Products, ICICI Prudential Life Insurance among 5 stocks with short buildup

Pre-market action: Here's the trade setup for today's session

- With bulls dancing, many more join Street party

- 3 stocks that may give returns between 16- 24%

- Stocks in news: Bajaj Finance, Nestle, Tech M, IndusInd, Axis Bank & HUL

- Rising share of new biz to drive growth at Persistent

- RBI urges banks for caution on forex transactions

- Big movers: What should investors do with SAIL, MCX & Tata Elxsi?

- Fall in call mkt volume raises MIBOR pricing concerns

- Invesco AMC, its CEO, others settle case with Sebi

- Japan finds another rising sun, steps up India bets

- T Rabi Sankar re-appointed as RBI DG for one year

- RBI bars Kotak Bank from adding customers digitally

- KRAs issue guidelines for simpler KYC process

- FSIB Recommends Rana Ashutosh for SBI’s MD Post

- 10 things that will decide D-Street action on Thursday

- Nestlé India Q5 PAT may soar 17% YoY; rev to jump 7%

- Bajaj Finance Q4 profit may rise, margins under watch

- Podcast

- Slideshow

- Price722.500.16%

- Target₹840

- BrokerageMotilal Oswal Financial Services

- Price578.000.41%

- Target₹700

- BrokerageMotilal Oswal Financial Services

- Price2,460.00-0.05%

- Target₹2,900

- BrokerageMotilal Oswal Financial Services

- Price1,490.000.29%

- Target₹1,870

- BrokerageMotilal Oswal Financial Services

- Price810.00-0.13%

- Target₹950

- BrokerageAnand Rathi

- Price1,113.45-0.06%

- Target₹1,190

- BrokerageICICI Securities

My Watchlist

Sign In | Sign UpMarkets Dashboard

- Most Active - Value

- Most Active - Volume

- Top Gainers

- Top Losers

- 52 Week High

- 52 Week Low

- Price Action

- Volume Action

- Most Searched

Name Price Chg %Chg Value (Cr.) 5 Day Performance HDFC Bank 1,511.70 4.11 0.28% 1,699.38 RIL 2,900.35 -18.31 -0.63% 1,526.46 Tata Steel 165.55 4.41 2.74% 987.55 Bharti Airtel 1,336.40 -5.95 -0.45% 842.83 Hindalco 636.10 24.31 3.98% 738.07 Tata Consumer 1,110.15 -63.20 -5.39% 721.22 Sun Pharma 1,485.75 1.10 0.08% 693.49

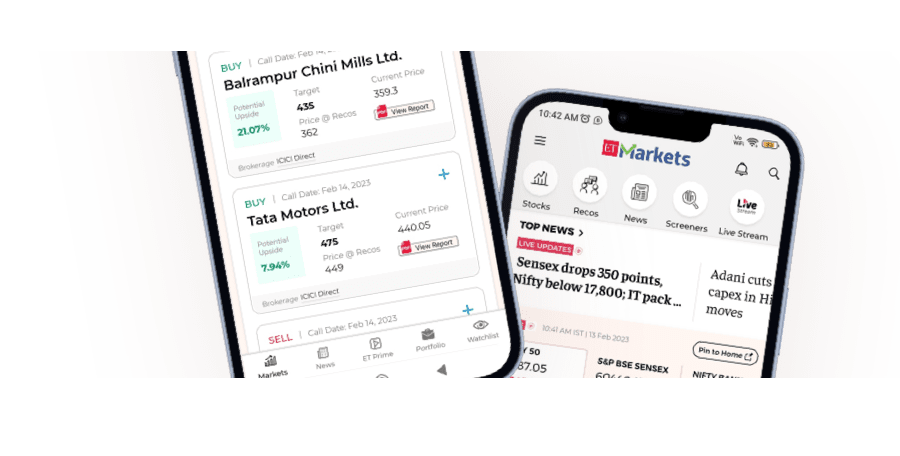

End your Buy or Sell dilemma with 100+ Daily Stock Recos

Scan QR to get App

- High Upside

- Top Score Companies

- Analyst Favs

Buy

Mean Recos by 6 Analysts

View ReportExpected Returns

48.1 %

1Y Target

Current Price

Strong Buy

Mean Recos by 10 Analysts

View ReportExpected Returns

47.6 %

1Y Target

Current Price

Strong Buy

Mean Recos by 6 Analysts

View ReportExpected Returns

43.0 %

1Y Target

Current Price

Strong Buy

Mean Recos by 7 Analysts

View ReportExpected Returns

42.6 %

1Y Target

Current Price

10/10

Stock Score

View ReportNo Rating (NR)NegativeNeutralPositiveEarnings 8Fundamentals 10Relative Valuation 10Risk 9Price Momentum 510/10

Stock Score

View ReportNo Rating (NR)NegativeNeutralPositiveEarnings 5Fundamentals 8Relative Valuation 8Risk 10Price Momentum 1010/10

Stock Score

View ReportNo Rating (NR)NegativeNeutralPositiveEarnings NRFundamentals 10Relative Valuation 3Risk 9Price Momentum 1010/10

Stock Score

View ReportNo Rating (NR)NegativeNeutralPositiveEarnings 9Fundamentals 9Relative Valuation 9Risk 9Price Momentum 7Buy

Mean Recos by 39 Analysts

View ReportExpected Returns

19.0 %

1Y Target

Current Price

Strong Buy

Mean Recos by 39 Analysts

View ReportExpected Returns

12.1 %

1Y Target

Current Price

Hold

Mean Recos by 43 Analysts

View ReportExpected Returns

9.4 %

1Y Target

Current Price

Buy

Mean Recos by 41 Analysts

View ReportExpected Returns

26.1 %

1Y Target

Current Price

CompaniesNews That's Moving Your Stocks

| Indices | Price | Chg | %Chg |

|---|---|---|---|

| Nifty Midcap 100 | 49,991.90 | 377.06 | 0.76 |

| S&P BSE SmallCap | 46,858.60 | 366.39 | 0.78 |

| Nifty IT | 33,442.55 | -272.00 | -0.81 |

| Nifty Bank | 48,189.00 | 218.56 | 0.46 |

| Nifty Auto | 21,896.90 | -17.40 | -0.08 |

| Nifty Pharma | 18,586.20 | 122.46 | 0.66 |

| Nifty FMCG | 53,932.50 | 27.20 | 0.05 |

| Nifty Financial Services | 21,442.60 | 108.40 | 0.51 |

Advertisement

Buy/Sell Signals

- Bullish MovingAverage Crossover

- Bearish MovingAverage Crossover

- Bullish MACDCrossover

- Bearish MACDCrossover

- Bullish StochasticCrossover

- Bearish StochasticCrossover

Name Price Chg %Chg Gain* Volume MRPL 248.70 24.15 10.76% 5.62% 3,98,49,649 Vaibhav Global 407.20 28.20 7.45% 5.16% 16,75,172 Max Healthcare 811.00 50.40 6.63% 4.04% 31,18,514 Ratnamani Metal 3,011.75 131.95 4.59% 3.67% 37,238 ACC 2,556.40 103.81 4.24% 3.57% 8,85,613 Jai Balaji Inds 1,037.50 41.86 4.21% 8.40% 98,904 *Note: Gain% is the average price movement within 7 days of signal in last 5 years

- Kajaria Ceramic25 Apr,2024, 08:38AM ISTDisclosures under Reg. 29(2) of SEBI (SAST) Regulations, 2011

- Sampre Nutrition25 Apr,2024, 08:36AM ISTDisclosures under Reg. 29(1) of SEBI (SAST) Regulations, 2011

- The Anup Engg25 Apr,2024, 08:35AM ISTDisclosures under Reg. 29(1) of SEBI (SAST) Regulations, 2011

- Hindalco Industries. Share PriceCipla. Share PriceJSW Steel. Share PriceTata Steel. Share PricePower Grid Corporation of India. Share PriceKotak Mahindra Bank. Share PriceApollo Hospitals Enterprise. Share PriceShriram Finance. Share PriceUltraTech Cement. Share PriceNTPC. Share Price

- Divi's Laboratories. Share PriceHero MotoCorp. Share PriceBajaj Finance. Share PriceOil And Natural Gas Corporation. Share PriceAxis Bank. Share PriceLarsen & Toubro. Share PriceCoal India. Share PriceBritannia Industries. Share PriceICICI Bank. Share PriceBajaj Finserv. Share Price

- Tata Motors. Share PriceHDFC Bank. Share PriceEicher Motors. Share PriceSun Pharmaceutical Industries. Share PriceLTIMindtree. Share PriceBharat Petroleum Corporation. Share PriceIndusInd Bank. Share PriceState Bank of India Share PriceDr. Reddy's Laboratories. Share PriceNestle India. Share Price

- ITC. Share PriceHindustan Unilever. Share PriceAdani Ports & Special Economic Zone. Share PriceMahindra & Mahindra. Share PriceAsian Paints. Share PriceMaruti Suzuki India. Share PriceBharti Airtel. Share PriceWipro. Share PriceHCL Technologies. Share PriceReliance Industries. Share Price

- Titan Company. Share PriceSBI Life Insurance Company. Share PriceAdani Enterprises. Share PriceInfosys. Share PriceTata Consultancy Services. Share PriceBajaj Auto. Share PriceHDFC Life Insurance Company. Share PriceTech Mahindra. Share PriceGrasim Industries. Share PriceTata Consumer Products. Share Price

CryptocurrencyBitcoin, Blockchain and All ElsePowered by

Top Cryptocurrencies

| Name | Symbol | Price (INR) | M.Cap (Cr.) | Vol (24h, Cr.) |

|---|---|---|---|---|

| Bitcoin Price | BTC | 53,68,707 | 1,05,48,025 | 2,67,250 |

| Ethereum Price | ETH | 2,62,847 | 32,05,220 | 1,28,951 |

| Tether Price | USDT | 83.30 | 9,20,201 | 4,43,312 |

| BNB Price | BNB | 50,695 | 7,78,986 | 16,060 |

| Solana Price | SOL | 12,214 | 5,45,931 | 37,274 |

| USDC Price | USDC | 83.39 | 2,78,584 | 63,990 |

| Lido Staked Ether Price | STETH | 2,62,775 | 2,45,487 | 881 |

| XRP Price | XRP | 43.98 | 2,42,486 | 11,829 |

CurrenciesForex & Futures

Trending in markets:

IPOStartups, Grey Market, DRHP, Listings

- Open

- Upcoming

- Listing soon

- Listed

IPO Name Issue Price Issue Size Issue Open Issue Close JNK India Ltd. 395-415 649.47 Cr 23-04-2024 25-04-2024 Emmforce Autotech Ltd. 93-98 53.90 Cr 23-04-2024 25-04-2024 Varyaa Creations Ltd. 150 20.10 Cr 22-04-2024 25-04-2024 Shivam Chemicals Ltd. 44 20.18 Cr 23-04-2024 25-04-2024 IPO Name Issue Price Issue Size Issue Open Issue Close Storage Technologies & Automation Ltd. 73-78 29.95 Cr 30-04-2024 03-05-2024 Amkay Products Ltd. 52-55 12.61 Cr 30-04-2024 03-05-2024 IPO Name Issue Price Issue Size Issue Open Issue Close Faalcon Concepts Ltd. 62 12.09 Cr 19-04-2024 23-04-2024 IPO Name Issue Price Issue Size Issue Open Issue Close Vodafone Idea Ltd. 10-11 18,000.00 Cr 18-04-2024 22-04-2024 Ramdevbaba Solvent Ltd. 80-85 50.27 Cr 15-04-2024 18-04-2024 Grill Splendour Services Ltd. 120 16.47 Cr 15-04-2024 18-04-2024 Greenhitech Ventures Ltd. 50 6.30 Cr 12-04-2024 16-04-2024 DCG Cables & Wires Ltd. 100 49.99 Cr 08-04-2024 10-04-2024 Teerth Gopicon Ltd. 111 44.40 Cr 08-04-2024 10-04-2024 Bharti Hexacom Ltd. 542-570 6,198.75 Cr 03-04-2024 05-04-2024

CommodityBullion, Base Metals & All Else

Calendar Spread

(Far - Near month contract)

| Commodity | Spread (Rs) | Unit |

|---|---|---|

| Natural Gas | 26 | 1 mmBtu |

| Cotton Candy | 1,780 | 1 CANDY |

| Silver Micro | 1,959 | 1 KGS |

| Silver M | 1,852 | 1 KGS |

| Silver | 1,755 | 1 KGS |

| Lead Mini | 4 | 1 KGS |

- Gainers

- Losers

Commodity Price(Rs) %Chg Expiry Mentha Oil 931.90 4.11 Apr 30, 2024 Aluminium Mini 246.90 2.66 Apr 30, 2024 Mentha Oil 930.00 2.55 May 31, 2024 Crude Oil Mini 6,938.00 2.30 Jul 19, 2024 Mentha Oil 931.10 1.87 Jun 28, 2024 Gold Guinea 57,948.00 1.01 Jul 31, 2024