Finance Minister Nirmala Sitharaman announced a bucket of reforms that will change the way public sector banks function in the country.

The Indian banking system is dominated by public sector banks and these reforms are bound to have an impact on the entire industry. It may also change the way private lenders look at their peers in terms of competition. The enhanced risk-taking capacity, power to finance bigger projects without relying on huge consortiums and longevity of the board can lift public sector banks to a new level, if they follow through with these reforms.

Here’s an overall wrap of announcements made for public sector banks on August 30:

Mega merger

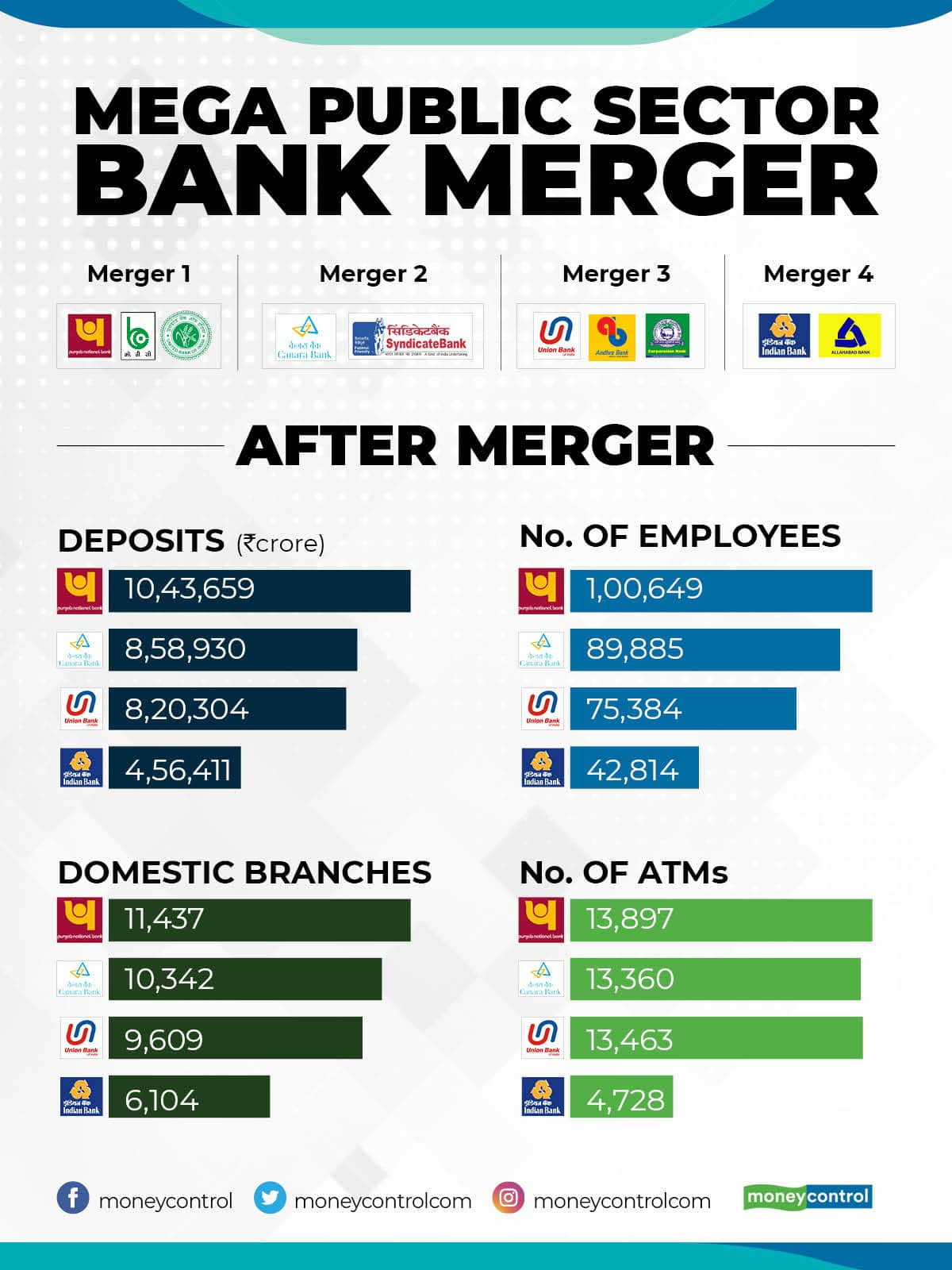

The government, after six months of deliberation, decided to merge 10 public sector banks into 4, thus bringing down the total number of state-owned entities to 12 (compared to 27 in 2017).

The aim is to create Indian banks that can compete globally.

Punjab National Bank, Canara Bank, Union Bank of India and Indian Bank will serve as anchor banks. Together these 10 banks represent 82 percent of state-owned bank business and 56 percent of commercial bank business.

Capital infusion

The government will be injecting Rs 55,250 crore into public sector banks. Emphasis has been given to the merging entities to enable the smooth transition. The finance minister assured there will be no layoffs and disruption to routine banking activities in the during the process of the mergers. The government had earmarked Rs 70,000 crore for recapitalisation of public sector banks in 2019-20.

Power to the boards

To bring in more accountability, board committees will appraise performance of General Managers and above, including the Managing Director. More positions of Chief General Managers to be introduced by boards in larger banks post the merger.

They can hire Chief Risk Officer from the market, which means it need not be an in-house candidate. This will increase competition and assure better pay for the post.

All senior officials will be given Individual Development Plans and boards will have the flexibility to prescribe residual service of two years for appointment of General Managers and above.

Focus on governance

Directors on management committee of board will get longer terms and their loan sanction thresholds will be doubled to process bigger loan proposals.

On the other hand, boards will be able to reduce or rationalise the number of board committees for better functioning. Boards can also increase the sitting fees of Non-official directors to encourage better participation. They will also be given training and will undergo performance evaluation.

Creating leaders

To address the issue of vacuum at the top levels, a pipeline of future chiefs will be created under the Banks Board Bureau’s Leadership Development programme. Also, the strength of Executive Directors in larger banks will be raised to four with special focus on technology.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!