The market has been highly volatile since last Diwali troubled by multiple issues like FPI surcharge, economic slowdown, weak earnings, the US-China trade war, fears of a global slowdown, and geopolitical tensions.

However, it has trimmed losses significantly over the last month, thanks to buying led by government measures to revive the economy. In fact, benchmark indices gained over 9 percent so far since last Diwali.

Excluding gains made over the last month, frontline indices have risen 1 percent and broader markets have logged losses of nearly 10 percent.

But things seem to be looking up. Key economic revival measures such as the 10 percent cut in the corporate tax rate, renewed buying interest from foreign investors and a 135 basis point cut in repo rate by the Reserve Bank of India are expected to lift the market to a new record high by next Diwali.

"I am very confident that the worst is either already behind us or will be very soon and markets would scale new highs by next Diwali," Dinesh D Thakkar, Chairman and Managing Director at Angel Broking said.

He said though MF inflows this year have slowed down, he was confident they will pick up from here on as market sentiments improve.

With stability on the political front, a pro-business government, declining cost of capital, and newer opportunities created by shrinking competence of Chinese companies (either due to high cost of labour or tariffs), foreign investments be it FDI or FPI will increase in India driving growth, according to Axis Securities.

Most brokerages believe banking and consumption themes are the best bets and could gain the most by next Diwali considering a potential broadbased growth.

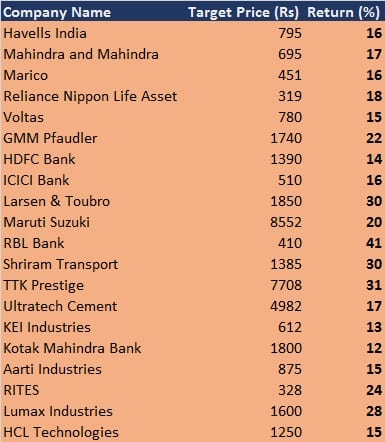

Here are top 20 stock ideas which could return 12-41 percent by Diwali 2020:

Brokerage: Religare Broking

Havells India: Buy | Target: Rs 795 | Return: 16 percent

Havells is strengthening its leadership by constantly expanding its product portfolio, increasing market reach and brand positioning. We believe Havells is best placed to leverage the opportunities in the FMEG space given the strong market share and distribution network. We expect its performance to improve (vs Q1FY20) in the next few quarters led by festive demand. Moreover, Havells has strong balance sheet (low debt, low working capital), robust return ratios and healthy cash flows. We recommend a Buy with a target price of Rs 795.

Mahindra and Mahindra: Buy | Target: Rs 695 | Return: 17 percent

M&M has witnessed sharp correction in the last one year owing to cyclical downturn in the auto industry. Going forward, we expect the tractor industry to recover as normal monsoon, easing liquidity conditions and lower interest would aid domestic sentiments. M&M’s automotive segment is likely to witness challenges due to increase in competitive intensity and BS-VI implementation. Nonetheless, we believe that these concerns are largely factored in and the core business is available at attractive valuations. Further, recently announced JV (not priced in our estimates) with Ford India would help M&M in strengthening its product portfolio, improve operational efficiencies, and increase exports from India. Therefore, we recommend a Buy on the stock, valuing the core business at 12x and arrive at a SOTP based target price of Rs 695.

Marico: Buy | Target: Rs 451 | Return: 16 percent

The Indian FMCG industry is the fourth largest sector in the economy, which is currently witnessing demand slowdown, thus we believe that in the near term sector would continue to face challenges. However, we expect the sector to revive going forward and grow steadily led by increasing demand from both rural and urban areas, changing consumer preference and emerging e-commerce space. With positive sector outlook, management remains confident on growing its revenue by ~13-15 percent YoY and volumes by ~8-10 percent YoY. Further, we believe the company would drive sustained profitable volume-led growth over the medium to long term, which would be driven by product mix, innovating new products, maintaining leadership position in key brands and by increasing promotion and advertisement spends. In addition, declining copra prices would help in providing cushions to margins. Hence, we recommend a Buy on the stock with a target price of Rs 451.

Reliance Nippon Life Asset Management: Buy | Target: Rs 319 | Return: 18 percent

We continue to remain constructive on the Indian mutual fund industry given its low penetration level as compared to major economies (11 percent AUM to GDP ratio v/s world average of 62 percent), increase in financialization of savings and continuous strengthening of SIP flows. Further, the regulatory changes in terms of reduction in total expense ratio (TER) is not only beneficial for investors due to low cost but would also benefit larger players like RNAM due to their ability to absorb cost which would lead to faster consolidation of industry. RNAM’s consistent increase in equity assets, industry leading retail assets and strong presence in B-30 cities augurs well for the growth prospects of the company. The consistent increase in monthly SIP book (Rs 860 crore) would ensure longevity and regular inflows providing stable growth. Further, the recent buyout by Nippon Life Insurance (75 percent ownership currently) from Reliance Capital removes the overhang on RNAM and would narrow the substantial valuation gap with HDFC AMC. Therefore, we recommend a Buy on the stock with a target price of Rs 319.

Voltas: Buy | Target: Rs 780 | Return: 15 percent

Led by revival in consumption and capex cycle coupled with the company’s efforts towards brand building, enhanced product offerings and widening distribution reach, Voltas’ sales and PAT are estimated to grow by ~13 percent & 24 percent CAGR respectively over FY19-21E. We expect relatively better demand scenario for room AC and air coolers in the coming quarters, which will result in improved volume off-take in UCP. Despite intense competition, Voltas is well poised to sustain its leadership position in room ACs. Further, sales and profit growth in EMPS is expected to be healthy given better quality order book and efficient execution particularly on the domestic front. We recommend a Buy on the stock with a target price of Rs 780.

Brokerage: Angel Broking

GMM Pfaudler: Buy | Target: Rs 1,740 | Return: 22 percent

GMM Pfaudler Limited (GMM) is the Indian market leader in glass-lined (GL) steel equipment used in corrosive chemical processes of agrochemicals, specialty chemical and pharma sector. The company is seeing strong order inflow from the user industries which is likely to provide 20 percent+ growth outlook for next couple of years.

GMM has also increased focus on the non-GL business, which includes mixing equipment, filtration and drying equipment for the chemical processing industry. It is expecting to increase its share of non-GL business gradually over the medium term.

GMM is likely to maintain the 20 percent+ growth trajectory over FY19-21 backed by capacity expansion and cross selling of non-GL products to its clients.

HDFC Bank: Buy | Target: Rs 1,390 | Return: 14 percent

HDFC Bank has planned to improve business with digital platforms and is engaging with mid market clients. Its next leg of growth road map includes (1) increasing branch opening number from 300 current to 600 annually in non urban area, (2) increase point of sale (POS) 4x to 4mn by FY2021 and double the virtual relationship manager clients in 3 years.

The bank registered NIM of 4.4 percent on the back of lower cost of funds, while healthy asset quality kept the provision cost lower. Consistency in both the parameters helped the bank to report healthy return ratio. Despite strong advance growth, the bank has maintained stable asset quality (GNPA/NPA – 1.3 percent/0.4 percent).

HDFC Bank's subsidiary, HDB Financial Services (HDBFS) continue to contribute well to the banks overall growth. Strong loan book, well-planned product line and clear customer segmentation aided this growth. We expect the bank's loan growth to remain 20 percent over next two years and earnings growth is likely to be more than 20 percent.

ICICI Bank: Buy | Target: Rs 510 | Return: 16 percent

ICICI Bank has taken a slew of steps to strengthen its balance sheet viz. measures like incremental lending to higher rated corporate, reducing concentration in few stressed sectors and building up the retail loan book. The share of retail loans in overall loans increased to 61.4 percent (Q1FY2020) from 38 percent in FY2012.

ICICI Bank's slippages remained high during FY2018, and hence, GNPA went up to 8.8 percent vs. 5.8 percent in FY2016. We expect addition to stress assets to reduce and credit costs to further decline owing to incremental lending to higher rated corporate and faster resolution in accounts referred to NCLT under IBC.

The gradual improvement in recovery of bad loans would reduce credit costs which would help to improve return ratio. At the current market price, the bank's core banking business (after adjusting the value of subsidiaries) is trading at 1.7x FY2021E ABV, which is inexpensive considering retail Mix and strong capitalization (tier I of 14.6 percent).

Larsen & Toubro: Buy | Target: 1,850 | Return: 30 percent

L&T is India's largest EPC company with strong presence across various verticals including Infra, Hydrocarbon and services segment. The company also has a very strong presence in the IT services and NBFC space through it's various subsidiary companies which are also growth drivers for the company.

L&T continued to report strong order flows during Q1FY20 despite the quarter being hampered by the general elections. Company reported order flow of Rs 38,700 crore and retained it's guidance of a 10-12 percent order inflow for the year and 12-15 percent revenue growth guidance.

Management had indicated a very strong pipeline for FY20 of Rs 9 lakh crore. which includes both domestic as well international orders. The company has a strong order backlog of ~ Rs 3 lakh crore. and the pipeline provides strong visibility for new order flows for the rest of the year.

We are positive on the prospects of the Company given the Government's thrust on Infrastructure with over Rs 100 lakh crore. of investments lined up over the next 5 years. Reduction in tax rate for domestic companies to 22 percent from 30 percent will improve profitability by ~15 percent for the company.

Maruti Suzuki: Buy | Target: Rs 8,552 | Return: 20 percent

Maruti Suzuki continues to maintain around 52 percent market share in the passenger vehicles space. The launch of exciting new models has helped the company to ride on the premiumization wave that is happening in the country. In the last two years, company has seen improvement in the business mix with increasing share from utility vehicles.

Company is well placed to capture any revival in industry due to overall refreshment of portfolio (Already more than 50 percent of portfolio launched based on BS6 compliance like Alto, Wagon, Baleno, Dzire, Swift. Recent new launches in August 2019 also has the potential to contribute significantly to the topline (MPV - XL6 and S-Presso).

RBL Bank: Buy | Target: Rs 410 | Return: 41 percent

RBL Bank (RBK) has grown its loan book at healthy CAGR of 53 percent over FY2010-19. We expect it to grow at 27 percent over FY2019-21E. With an adequately diversified, well capitalised balance sheet, RBK is set to grab market share from corporate lenders (mainly PSUs).

During Q1FY20 the retail loan portfolio grew 62 percent yoy to `18,391cr and now constitutes 32 percent of the loan book (from 18 percent share in 4QFY2017). NIM has expanded to 4.23 percent, up 19bps yoy despite a challenging interest rate scenario on the back of a changing portfolio mix. However, the management disclosed stressed asset worth Rs 1,000 crore, which will increase GNPA to 2.25 percent. Management is confident that it would normalize by Q1FY2021.

RBL Bank currently trading at 1.4x its FY2021E book value per share, which we believe is reasonable for a bank in a high growth phase with stable asset quality.

Shriram Transport: Buy | Target: Rs 1,385 | Return: 30 percent

SHTF's primary focus is on financing pre-owned commercial vehicles. We expect AUM growth to improve going ahead led by (1) good monsoon which will improve rural economic activity, (2) pick-up in infra/construction, which was subdued since 2019 elections, (3) ramping up in rural distribution.

SHTF gradually expanded its offering to existing borrower with good track record. New offering includes business loan and working capital which cover overall truck business owner requirement (payment at petrol pump/ tyre dealers, insurance premium).We expect asset quality to remain stable owing to lower LTVs since Q3FY2019 and stable collateral value as used CV prices to improve or remain stable in a BS6 regime.

We expect SHTF to report RoA/RoE of 3.1 percent/18.8 percent in FY2021E respectively. At CMP, the stock is trading at 1.3x FY2021E ABV and 6x FY2021E EPS, which we believe is reasonable for differentiated business model with return ratios.

TTK Prestige: Buy | Target: Rs 7,708 | Return: 31 percent

TTK Prestige (TTK) is the leading brands in kitchen appliances with 40 percent+ market share in organized market. It has successfully transformed from a single product company to a multi product company offering an entire gamut of kitchen and home appliances (600+ products).

It has also launched a economy range – 'Judge Cookware' to capture the untapped demand especially at the bottom end of the pyramid. It is expecting good growth in cleaning solutions.

Management expects to double its revenue in the next five years backed by revival in consumption demand, inorganic expansion and traction in exports.

Ultratech Cement: Buy | Target: Rs 4,982 | Return: 17 percent

Ultratech Cement is India's largest cement manufacturer with ~100mn TPA of capacity spread across the country with a strong presence in Central, North, and West India.

The company has added capacity by taking over stressed assets of over ~30mn TPA since 2017. Company would also be taking over Century textile's cement capacity of 13.4mn TPA from H2FY20 which will give it 40 percent plus market share in West and Central India which are amongst the best regions.

Increased costs due to high energy prices had adversely impacted margins in 1HFY19. However strong pricing discipline due to consolidation allowed cement companies to hike prices in Q4FY19. Energy prices (coal and pet coke) have come off significantly since the beginning of 2019 which along with benign freight costs would allow cement companies to protect margins despite any marginal dip in realizations.

We are positive on the long term prospects of the Company given ramp up from acquired capacities, pricing discipline in the industry and benign energy & freight costs. Reduction in tax rate for domestic companies to 22 percent from 30 percent will improve profitability by ~15 percent for the company.

KEI Industries: Buy | Target: Rs 612 | Return: 13 percent

KEI's current order book (OB) stands at Rs 4,414 crore (segmental break-up: EPC is around Rs 2,210 crore and balance from cables, substation & EHV). Its OB grew strongly in the last 3 years due to strong order inflows from State Electricity Boards, Power grid, etc.

KEI's focus is to increase its retail business from 30-32 percent of revenue in FY19 to 40-45 percent of revenue in the next 2-3 years on the back of strengthening distribution network (currently 926 which is expect to increase ~1,500 by FY20) and higher ad spend.

KEI's export (FY19 – 16 percent of revenue) is expected to reach a level 20 percent in next two years with higher order execution from current OB and participation in various international tenders. We expect KEI to report net revenue CAGR of around 15 percent to around Rs 5,632 crore and net profit CAGR of around 29 percent to Rs 300 crore over FY2019-21E

Brokerage: Axis Securities

Kotak Mahindra Bank: Buy | Target: Rs 1,800 | Return: 12 percent

KMB is well positioned due to higher capitalisation (Tier I - 17.3 percent), a strong liability franchise (CASA 51 percent) and benign asset quality, which would allow it to gain further market share. The performance of non-banking businesses (life insurance, AMC business) remains strong on growth & profitability. The bank has been trading at rich valuations consistently due to its superior return ratios with RoA of 1.7 percent. Promoter stake dilution could be an overhang. However, we reckon this will be a minor blip in an otherwise strong earnings trajectory. Based on SOTP valuations, we arrive at a target price of Rs 1,800.

Aarti Industries: Buy | Target: Rs 875 | 15 percent

Although the management has sharply lowered its growth guidance, we believe the same has been factored in the CMP. The multi-year contracts won by AIL shall being contributing from FY21E onwards which could offset the headwinds from auto and agrochem sectors in the near term. Pharma segment will take the drivers seat with sustainable margin profile of +20 percent over FY19-21E.

RITES: Buy | Target: Rs 328 | 24 percent

RITES has competitive edge in winning orders owing to its 4+ decade of experience in transport infrastructure consultancy and its association with MoR. Ample opportunities within railways (~50 percent revenue share) being captured by RITES via venturing into turnkey projects and railway station development is increasing its scale of operations.

RITES has paid dividends regularly to the equity shareholders and payout ratio has been +50 percent for FY17-FY19. The company’s stable financial position enables it to satisfy the minimum financial eligibility criteria for bidding in projects and asset light business model ensures healthy return ratios with RoE at 19 percent and RoCE at 27 percent for FY19. We estimate RITES to post revenue/PAT growth at a CAGR of 18.5 percent/21 percent respectively over FY19-21E.

Focus on Strengthening EPC business, diversification and continuous infrastructure push by government is expected to auger well for RITES.

Lumax Industries: Buy | Target: Rs 1,600 | Return: 28 percent

Lumax is not just the market leader but has relationships with 90 percent of all Original Equipment Manufacturers (OEM’s) in India. It’s top client is Maruti (market leader in PV segment) which contributed about 36 percent to its revenue in FY19. Other major revenue contributors include M&M, Hero Motocorp, Honda 2 wheeler and Honda Cars accounting for 40 percent of revenues. The company also supplies to some luxury car makers like Audi and JLR. It has tied up with other OEM like Daimler, Nissan, KIA motors, MG motors.

Lumax has consciously decided to cut costs and capital expenditure in the present situation of demand downturn.

Lumax has bagged new orders from MG motors (for the very well received MG Hector car) for both head and tail lights. In Q1FY20 alone, it contributed to 2 Cr of revenue and more collaboration is expected with them. They have also bagged orders for Maruti’s new launch this quarter and one in Q4FY20. In two wheeler segment it has bagged orders for TVS’s new launch. Its subsidiary SL Lumax (21 percent stake) has made inroads with KIA Motors and this should also drive revenue significantly going forward.

HCL Technologies: Buy | Target: Rs 1,250 | Return: 15 percent

Strong deal wins along with healthy outlook for BFSI and IMS is expected to drive growth going forward. Management’s guidance of 14-16 percent growth is in line with peers, while its organic growth at 7-9 percent is marginally higher than last year’s growth of 6.5 percent.

We expect improvement in margin trajectory from H2FY20 led by revenue contribution from IBM deal, which is a high-margin business, waning seasonality impact of Mode 3 business that has lower IP revenue in Q4 and stronger growth in Mode 2 driving operating leverage.

We expect strong growth in key segments viz, Mode 2 & Mode 3 business, ER&D outsourcing led by strong order book. We maintain a buy with a target price of Rs 1,250.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!