The government delivered just what the doctor ordered paving the way for higher growth in the economy and simultaneously giving investors the confidence that the bull cycle is still intact.

In a historic move, the FM announced bold corporate tax reforms. The reduction in the base rate of corporate tax to 22 percent (effective maximum tax rate 25.17 percent) for Financial Year 2019-20 subject to the condition that such companies will not avail any exemption/incentive is one of the boldest tax reforms.

The current base tax rate (excluding surcharge and cess) is 30 percent (effective maximum tax rate 34.944 percent) for companies having a turnover exceeding Rs 400 crores and 25 percent (effective maximum tax rate 29.12 percent) for companies having a turnover up to Rs 400 crores.

What does the tax rate cut mean for Nifty companies?

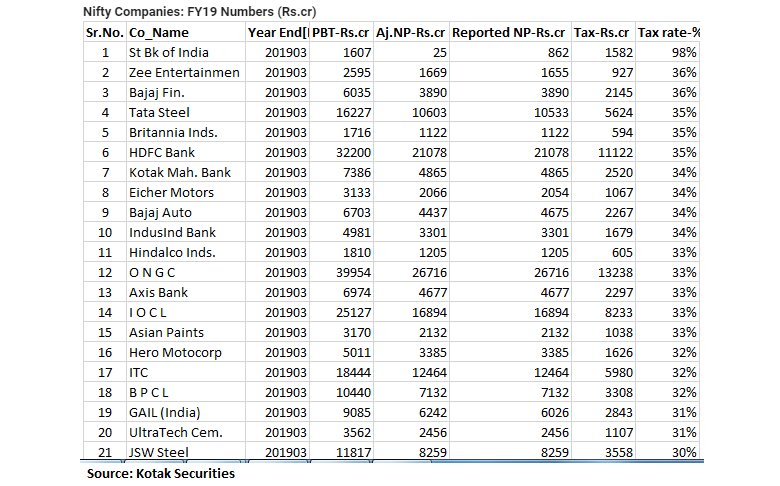

"There are only 20 Nifty companies which paid more than 30 percent effective tax rate and accounted for 43 percent of the overall net profit in FY19,” Kotak Securities said in a report.

Companies which are paying more than 30 percent tax include names like ZEE Entertainment, HDFC Bank, Tata Steel, Bajaj Finance, Britannia Industries, Kotak Mahindra Bank, Hindalco Industries, Axis Bank, ITC, GAIL India, and JSW Steel.

Fall in taxes will lead to a rise in EPS by double digits which is a positive sign especially at a time when earnings have been muted or largely in single digits for the last 12-18 months.

Nilesh Shah, MD & CEO, Envision Capital in an interview with CNBC-TV18 said that investors should look at buying companies with high tax rates. The other sectors which are likely to benefit are the ones in sectors like consumer, financials and technology services.

“Any company paying 33 percent tax rate will see its earnings go up by 12 percent. Overall, we can see Nifty earnings going up by ~5-6 percent in FY20 as the effective tax rate was already lower at 26 percent,” said Oza.

He further added that the sentiment booster angle and the way this will be taken positively by FIIs and local investors we can expect the Nifty to rally by 9-10 percent from today’s low of ~10,700. Hence, 11,500-11,600 is very much possible on the Nifty without considering any other factor.

The government has taken a hit on revenues of approximately Rs 1.45 lakh crore per annum by reducing corporate tax for existing companies to 22 percent (25.17 percent effective tax) from 30 percent.

There is a big boost for companies going for fresh capex and make in India as tax rates will be just 15 percent for companies making fresh investment and incorporated after 1st Oct 2019,” Rusmik Oza, Head of Fundamental Research, Kotak Securities told Moneycontrol.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!