Robust sales growth by National Thermal Power Corporation (NTPC) during the December quarter and a rock-solid project pipeline coupled with asset monetisation plan have got the D-Street excited.

The stock reacted with 3 percent gains intraday. At 11:57am on Monday, the scrip was trading at Rs 170.45, up 2.5 percent, on the BSE.

In the past two years, the stock has given 93 percent returns while in the past one year, it has rallied 22 percent largely because investors have lately been choosing fundamentally strong companies that shifting to the renewables space.

In Q3 FY23, the state-run power giant’s consolidated total income jumped to Rs 44,989.21 crore from Rs 33,783.62 crore a year ago. In the previous quarter, NTPC had clocked sales of Rs 44,681.50 crore.

Better demand along with higher tariffs supported the uptick in revenue, analysts said.

“Demand remained strong in Q3FY23, leading to a 7.7 percent YoY rise in sales to 72.9 billion units, while blended realisation also increased by 29 percent YoY to Rs 5.7 per unit due to a rise in fuel prices,” HDFC Securities said.

Nuvama Wealth Management said that realisation increased by Rs 0.60 in Q3, mainly due to 5–6 percent higher cost of imported coal blending, apart from commercialisation of capacities.

Catch up on all LIVE stock market updates here.

Net profit came in at Rs 4,854.36 crore for the December quarter as compared to the previous quarter’s Rs 3,417.67 crore and Rs 4,626.11 crore a year back. Its operating margin for the quarter declined to 32.5 percent in the reporting quarter from 33.1 percent a year ago.

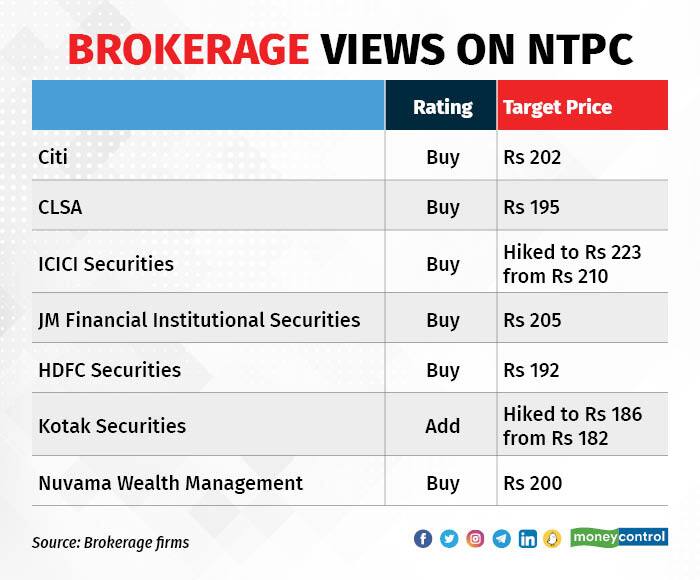

Citi is upbeat on NTPC as valuations look attractive and growth going ahead appears decent.

“Valuations at 1 time P/B (Price to Book) and 8 times P/E (Price to earnings) on FY2024 earnings remain attractive,” Kotak Institutional Equities said. The brokerage firm has also revised its earnings estimate for FY23 by 5 percent and by 1 percent for FY24, mainly taking into account NTPC’s strong earnings performance during the December quarter.

Asset Monetisation

Renewable asset monetisation is on track with the management reiterating its March 2023 guidance, analysts believe.

NTPC is consolidating all its solar and wind assets into its renewables’ subsidiary, NTPC Green Energy, and is targeting to offload 10-20 percent of its shareholding in the arm by end of FY23.

Also Read | MC Explains: Why oil companies are making big plans to invest in renewable energy

NTPC has an installed renewable capacity of 3,154 MW out of which 1,302 MW was commissioned in the first nine months of FY23, and another 4,718 MW under construction with expected commissioning over the next 24 months. Further, additional 340 MW renewable project bids have been won, which will be awarded soon, highlighted JM Financial Institutional Equities.

CLSA is of the view that the company is on track to achieve its target of more than 60 GW by FY32.

Project pipeline

Analysts are optimistic that the company’s expansion plan will fuel further growth. “NTPC’s ambitious targets on renewable assets (4.7GW under construction) and growth in coal assets (11.2GW under construction) should aid capacity addition and fuel incremental growth,” Kotak Institutional Equities said.

The country's largest power producer has around 11.3 GW of thermal and 2.3GW of hydro projects in under-construction stage, while another 6 GW of greenfield coal capacities is in the planning stage. NTPC has also entered into a joint venture for nuclear power generation and plans to add two projects of 4.2 GW by 2035.

CLSA is upbeat about the company’s prospects and believes that NTPC is a leader in energy transition. Even JM Financial Institutional Securities finds NTPC best-placed for success in India’s energy transition similar to its successful global peers.

Also Read | Top 10 ideas to trade in Feb series as bears get hold of Dalal Street

The domestic brokerage firm also believes that NTPC is poised for leadership in India’s solar market, given the visible pipeline of projects it has won, competitive advantage on debt cost at around 6 percent as against 8 percent for other industry players, and benefit of scale with 21 GW of renewable capacity and Ultra Mega Renewable Energy Power Parks under planning and development stage.

JM Financial Institutional Securities noted that NTPC is on course to develop a solar Park of 4.75 GW in Gujarat. Plans for development of Ultra-Mega Renewable Energy Power Parks with a capacity of 21 GW are in various stages and the company has received the in-principle approval from MNRE for a 4.75 GW solar park in Rann of Kutch. The state has already allocated land for the prject. Both solar and wind generation are envisaged for this park while part of the capacity will be used for producing green hydrogen.

Nuvama Wealth Management also sees NTPC as a play on thermal demand and transitioning towards renewable, aided by the advantages of the company’s size and profitability.

Further, NTPC continues to be one of the top picks for ICICI Securities because of the power company’s strong operational performances in the past few quarters, growth prospects and green energy initiatives.

Capex

NTPC aims to reach a capex of over Rs 96 billion over FY23-26.

Also Read | Budget 2023: Radhika Rao of DBS Bank expects a three-pronged focus in Budget, push to rural economy, social welfare

ICICI Securities highlighted that NTPC’s standalone capex target for FY23 is Rs 231 billion, of which 84 percent is spent during the first nine months of FY23. Additionally, the company has planned a capex of Rs 260 billion for FY24, Rs 225 billion for FY25 and Rs 250 billion for FY26.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!