The bulls were back in action in the truncated week that ended on April 18 as benchmark indices hit fresh all-time high and rallied nearly a percent, though mild profit booking took place in the last session.

A near-normal monsoon forecast by the India Meteorological Department (IMD), expectations of a US-China trade deal to be struck soon, a good start to March quarter earnings season and positive global cues boosted sentiment during the week.

A breakout on the upside after a long consolidation indicated that the trend is expected to remain positive in coming week, especially with the consistent flow of foreign money. But this could be amid volatility that is likely to be seen as April derivative contracts will expire on April 25, experts said, adding on April 22, the market will first react to the earnings of Reliance Industries and HDFC Bank .

"We may see further consolidation in Nifty but the bias would remain on the positive side. Traders should maintain caution especially on broader front as midcap and smallcap counters react sharply during such a scenario. Also we suggest keeping a close watch on earnings season for cues," Jayant Manglik, President - Retail Distribution, Religare Broking told Moneycontrol.

Deepak Jasani, Head of Retail Research, HDFC Securities also said Nifty could inch upwards on reacting to corporate results even as sectors and stocks see a rotational shift in buying preferences.

However, the broader markets underperformed frontliners, with the BSE Midcap and Smallcap indices ending flat.

Among sectors, Nifty Auto, Private Bank, Metal and IT indices closed in green with 1-2 percent gain while PSU Bank index lost most, falling 2.7 percent followed by Realty, which was down by two percent.

Here are 10 key things to watch out for in coming week:

Earnings

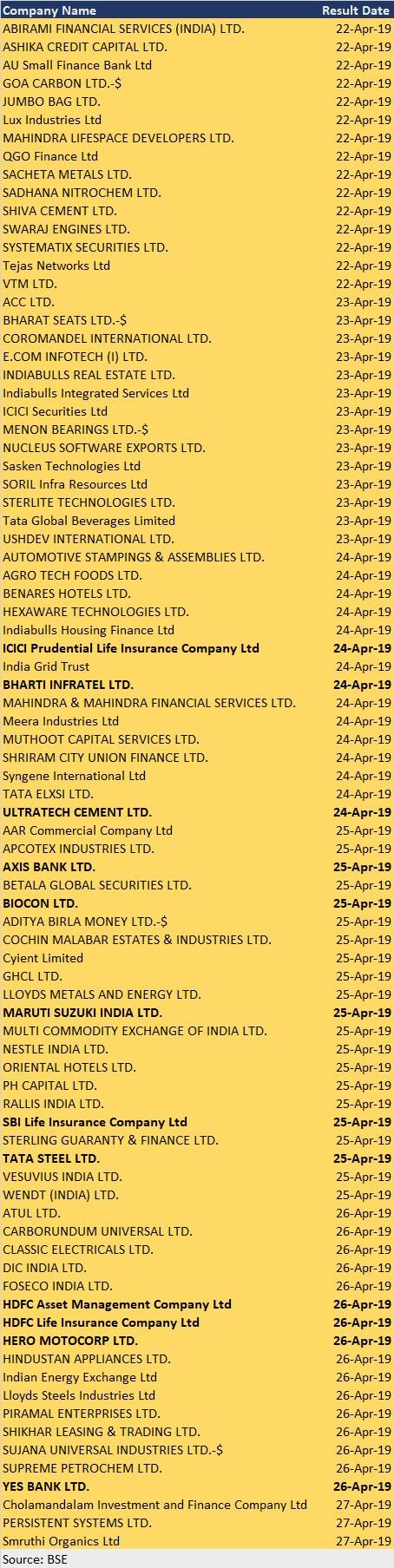

Earnings will continue to be a key factor in coming weeks and as it is a year-end, the season will continue till May-end.

As many as 84 companies will declare their March quarter numbers in coming week, including insurance, banking & financials and select auto majors.

Important results to watch out for would be Maruti Suzuki, Yes Bank, Hero Motocorp, Tata Steel, Axis Bank, Bharti Infratel, Indiabulls Housing Finance, ACC, SBI Life, HDFC Life, etc.

"Net profit of Nifty50 companies is expected to grow by 20 percent YoY for Q4FY19. The growth is mainly driven by banking sector due to low base in Q4FY18," Vinod Nair, Head Of Research at Geojit Financial Services said.

The country's third largest private sector lender is expected to register healthy growth in earnings driven by lower credit cost and lower slippages. Double digit loan growth may drive net interest income while pre-provision operating profit could be strong. It will declare results on April 25.

In March quarter ended 2018, the bank had reported a loss of Rs 2,188.7 crore.

"Axis Bank in a bid to achieve its long term target is poised to show incremental progress on operational matrix with improvement in credit growth as well as NII growth. Credit growth is expected at 17.2 percent YoY led by traction in retail as well as corporate portfolio," ICICI Securities said.

According the brokerage, credit cost may remain lower at 52 bps on the back of moderation in slippages. "However, asset quality may remain stable at 6 percent. On the back of healthy NII growth of 19.6 percent YoY, PAT is seen at Rs 1,036.4 crore in Q4."

While expecting profit at Rs 1,518.5 crore for the quarter, Motilal Oswal said deposit growth is likely to be around 20 percent, resulting in a CD ratio of around 94 percent. "Margins are likely to remain stable QoQ at around 3.5 percent."

Key issues to watch out for would be quantum of corporate slippages from BB and below list and any revision in the size of the stressed assets; outlook on the power assets, bank's strategy on retail, unsecured and business banking loans etc.

India's biggest passenger vehicle maker Maruti Suzuki, which will also announce its earnings on April 25, is expected to show subdued growth in quarter ended March 2019.

Revenues are likely to be flat due to decline in volume, which along with weak operating income is expected to impact profitability. Operating margin may see expansion sequentially on lower discounts but may contract on year-on-year basis, brokerages said.

"We expect revenues to remain flattish YoY in Q4FY19 on the back of 0.7 percent YoY volume decline, which will be offset by 1 percent YoY increase in ASPs due to a better product mix," Kotak said.

The brokerage expects EBITDA to decline by 9 percent YoY in Q4FY19 led by (1) rise in commodity costs and (2) increase in discounts due to a weak demand scenario. It further expects EBITDA margin to improve by 300 bps QoQ led by (1) 140 bps improvement in gross margin and (2) 150 bps improvement due to lower staff cost and discounts.

According to Motilal Oswal, net realisation is expected to decline 1.3 percent YoY (1.4 percent QoQ) to Rs 4,52,618 per unit. It expects adjusted PAT to decline by 21.8 percent YoY (up 8.2 percent QoQ).

Key issues to watch out for would be update on demand scenario, channel inventory, discounting trends and new launches; and demand trend in urban and rural areas.

Elections

The ongoing elections would continue to be on top of everyone's mind in the short term along with corporate earnings. The polling for 116 Lok Sabha constituencies across 15 states and Union Territories in phase 3 of general elections 2019 will be held in coming week, on April 23.

The voting of Assam, Bihar, Chhattisgarh, West Bengal, Jammu & Kashmir, Odisha, Uttar Pradesh, Karnataka, Tripura and Maharashtra will take place for some Lok Sabha seats while the polling in all parliamentary constituencies of Daman & Diu, Dadra Nagar Haveli, Gujarat, Kerala and Goa will be held in a single phase on the same day.

The last phase of general elections will be held on May 19 and counting of all votes will take place on May 23.

Macro Data

Foreign exchange reserves data for week that ended on April 19 will be released on April 26.

Deposit and bank loan growth for fortnight ended April 12 will be announced on same day.

FIIs & DIIs

FII inflow is one of major reasons for current rally as they bought nearly Rs 2,500 crore worth of shares in the week gone by, taking total April net buying to more than Rs 16,000 crore.

In fact, they have been net buyers from February and net purchased more than Rs 64,000 crore worth of shares in three months as a decline in US treasury yields resulted into shifting FII money to emerging markets.

During same period, however, domestic institutional investors turned net sellers to the tune of more than Rs 15,500 crore, the Moneycontrol data showed.

Technical Outlook

The Nifty50 after registering a fresh record high of 11,856.15 saw its highest weekly close at 11,752.80 levels, and formed small bullish candle on the weekly scale.

On the daily chart on April 19, the index formed a 'Bearish Belt Hold' or a 'Dark Cloud Cover' pattern that indicates trend reversal but that would be confirmed if market closes in negative on April 22, experts said, adding recovery in next one-two trading sessions would negate the bearish implication and higher high- higher low formation would continue.

"Nifty is trading above its two major simple moving averages 100 DMA and 200 DMA which are rising and placed around 11,000 levels, whereas the occurrence of crossover formation in them is adding the possibility of a strong uptrend in mid-term," Shabbir Kayyumi, Head - Technical & Derivative Research at Narnolia Financial Advisors told Moneycontrol.

Chandan Taparia of Motilal Oswal said that until the index holds above 11,700 zone it could extend its momentum towards 11,888, followed by the 12,000 zones.

"Nifty’s very short term support is at 11,626 where rising five-week SMA is placed. Major support for Nifty is around 11,540 where line of polarity is place. Moreover, indication from candlestick patterns suggests new trading range will be only above previous high 11,860 or below 11,626 levels," Shabbir said.

F&O Cues

Overall the market may remain volatile in coming week as April futures and options contracts will expire on April 25 and traders will roll over their positions to next month.

On the option front, the maximum Put open interest (OI) is at 11,500 followed by 11,000 strike while the maximum Call OI is at 12,000 followed by 11,800 strike.

Put writing is at 11,400 followed by 11,650 strike while Call writing is at 11,800 followed by 12,000 strike.

"Option band signifies a shift in higher trading range in between 11,600 to 11,900 zones," experts said.

"The open interest in Nifty futures is still quite low, which should limit downsides in the market. Short positions are still stuck at lower levels. Closure of these positions would limit downsides," Amit Gupta of ICICI Securities said.

"The highest Put base is placed at 11,500. The same is increasing at 11,700 strike, thus forming a good support at 11,650-11,700 for April expiry," he added.

India VIX moved up by 8.29 percent in the last week to 22.74 mark which is the highest zones in last six months since October 31, 2018 while VIX is up by 36.58 percent in April with its consecutive surge of last six weeks. In 2014 elections, it had moved towards 35 percent.

"Higher VIX is because of the election 2019 and may turn the street to volatile mode in coming weeks," Chandan Taparia of Motilal Oswal said.

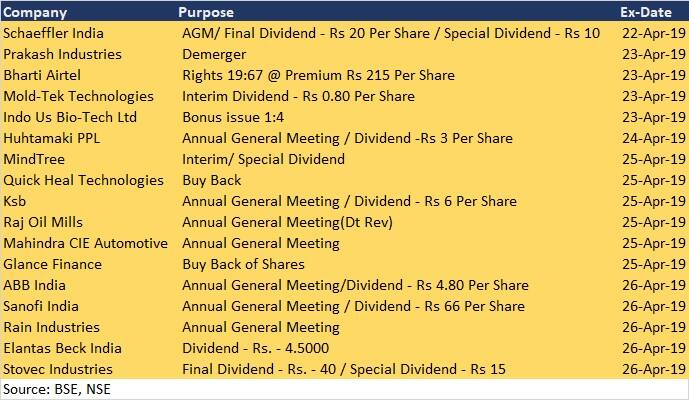

Corporate Action

Global Cues

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!