Sachin PalMoneycontrol Research

Highlights:

- Top line growth was aided by tiles and faucets

- Margins improved on the back of cost control measures

- Sanitaryware growth to remain subdued- Trading at 30 times FY20 estimated earnings

-------------------------------------------------

Cera sanitaryware continues to show robust quarterly performance in a subdued market. In Q4 FY19, the company reported a healthy double digit growth in topline along with an expansion in operating margins. Despite muted end-market conditions, the management remains upbeat about the company's prospects and is targeting double-digit topline growth in the current fiscal year.

Key result highlights

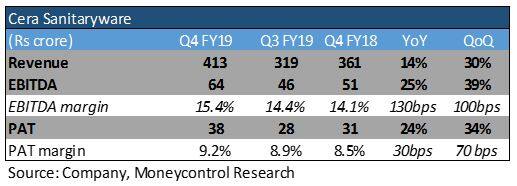

- Healthy growth across all its business segments drove the revenues higher by 14 percent year-on-year (YoY) to Rs 413 crore in Q4 FY19. EBITDA (earnings before interest, tax, depreciation and amortization) increased 25 percent as operating margins expanded 130 bps YoY on account of change in product mix and operating efficiencies. Bottomline also moved in-line with the operational performance and was 24 percent higher in comparison to last year.

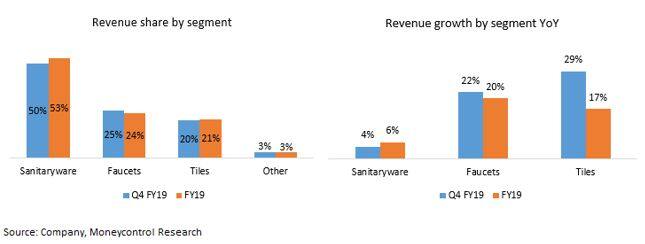

- On a segmental basis, Tiles led the overall business with a revenue growth of 29 percent. Other segments such as Wellness and Faucets grew at 28 percent and 22, respectively. Sanitaryware segment had another subdued quarter and clocked a topline growth of just 4 percent YoY.

- The capacity utilisation for Tiles as well as Sanitaryware was closer to 90 percent while for Faucets it was slightly lower at around 80 percent. Outsourced manufacturing across these three business segments lies in the range of 50-55 percent.

- Cera has a well-diversified dealer and distributor footprint across all regions. It has a strong foothold in southern market, which contributes 45 percent to its topline. Both North and West contribute a little over 20 percent while the balance comes from East India. The company is focusing on augmenting the distribution network and the customer touchpoints at the end of FY19 stood at 14,218. Going forward, the management plans to increase the touchpoints by 6-10 percent each year.

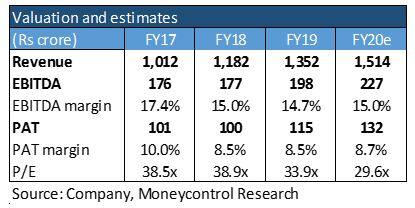

- The management anticipates the growth trend to continue at similar pace and has guided for mid-teen revenue growth in FY20 led by tiles and faucets segments. Gross margins for the business remain under pressure due to higher raw material prices. The company has taken a price hike of 4-6 percent in the month of April, which should alleviate some of the input costs pressures and help it sustain operating margins around 15 percent.

- The capex for FY20 is estimated at Rs 75-80 crores, which will be spent towards supply chain improvements, increasing distribution reach and automating its manufacturing plants.

Outlook and recommendation

- The overall demand for the building material products remains sluggish as the real estate activity is facing a subdued market environment due to policy changes and tight liquidity conditions. The management expects the sanitaryware market to grow in the range of 7-10 percent.

- Cera’s (CMP: 2,998, Market Cap: 3,900 crore) FY19 performance was noteworthy as the company has been able to grow its bottomline and topline despite a challenging demand and cost environment. From an operational standpoint, the company has an established distribution network and been able to develop a strong brand recall among its customers. Its superior operational execution capabilities gets reflected through its margins, return ratios and cash-rich balance sheet. The stock is now trading at a FY20 price-earnings multiple of 30x and should be kept on the radar for accumulation during market corrections.

Read: A shining star from the midcap cement pack

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!