Ambareesh Baliga

In a post-COVID environment, there is an expectation that many industries would shift out of China in a phased manner, as a number of countries, led by US, would look to de-risk their supply chain.

Speciality Chemicals is one such sector where India seems to have moved up a few notches in the last few years as China got serious on environmental compliance at the cost of growth. However, they still lead with a 38 percent market share in the global chemicals industry.

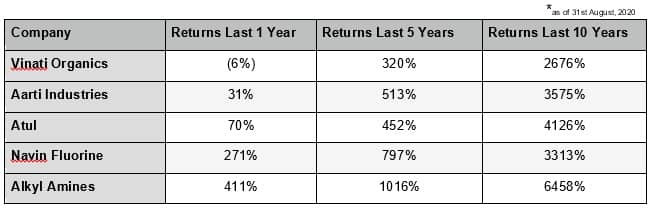

The nomenclature 'Speciality Chemicals' evokes an immediate interest from the investor fraternity and why not …… especially when some marquee home grown companies in Speciality Chemicals sector have given fantabulous returns to the shareholders in the last 10 years. In the same period the topline for most of them grew at a respectable 15 percent CAGR with operating cash flows growing at a CAGR of over 20 percent.

So what's the difference between 'Speciality Chemicals' and the so called 'Commodities' among Chemicals? Commodity chemicals are manufactured by a number of companies that tend to be of large volume with minimal product variation from producer to producer. So the pricing power is low unless there is huge supply disruption for any reason. Investors do not fancy such companies and tend to give a low discounting.

On the other hand, Speciality Chemicals are produced by combining different chemical substances that is designed to make it unique (or at least sound unique). These are generally additives for the final product and is meant for performance or for providing a specific function. Producers protect their closely guarded formulations through product patents or process patents.

The most abused term in Chemicals sector, especially from a stock market perspective, is 'Speciality Chemicals'. A Commodity Chemicals company get a single digit discounting irrespective of a consistent track record whereas Speciality Chemicals companies gets a decently high double digit discounting such as Vinati Organics 31x, Navin Fluorine 23x, Aarti Industries 34x, Atul 24x and Alkyl Amines 26x. The latest entrant in this space is Rossari Biotech which got an overwhelming response and the stock opened at a 58 percent premium to the issue price and since then remained strong, climbing to Rs. 800+ which is a return of 90 percent in about a month, and a PE of 65x.

It is expected that a speciality chemical manufacturer has a moat in the foreseeable future which gives them the edge, resulting in higher profit margins and sticky clients. The speciality chemicals manufacturers have an advantage for a limited period unless there are regulatory safe guards like product or process patents. In absence of these, the products where volume growth potential is large, attracts competitors, each of them vying for the largest pie, thus diluting the edge any single player could have, pushing the speciality chemicals to a notch above commodities.

A look at various players in speciality chemicals sector provides reasons for such premium valuation:

Vinati is the market leader in most of the products it manufacturers speciality organic intermediates and monomers with nearly 65 percent global market share and 70 percent domestic market share with a combined EBITDA margins of over 40 percent. The company has witness a revenue growth of 16 percent CAGR over the last 10 years. Vinati has process patents which gives them the edge.

Aarti Industries is one of the most competitive benzene-based speciality chemical companies in the world. Interestingly Aarti Industries had de-merged it’s Home & Personal care division with a turnover of Rs 325 crore into Aarti Surfactants since it was considered small and strategically unfit with other verticals where they were leaders and enjoyed an EBITDA margin of 23 percent. Aarti Surfactants on the other hand, has an EBITDA margin of 7.5 percent. Aarti has 9 patents for it’s products.

Navin Fluorine is a leader in Specialty Fluoro Intermediates and about 40 percent of the topline is contributed by the speciality chemicals division. The company enjoys a EBITDA margin of 25 percent.

Alkyl Amines is a global supplier of amines and amine-based chemicals to the pharmaceutical, agrochemical, rubber chemical and water treatment industries. One of the leading players in Diethyl hydroxyl amine (DEHA) and Acetonitrile and among of the largest producers of Dimethyamine HydroCholoride (DMA-HCL) which is used in Pharmaceuticals. Acetonitrile enjoys a gross margin of over 51 percent. Alkyl Amines has process patents.

Atul Limited a 73-year old company is into aromatics, colors, crop protection chemical, Pharma intermediates and polymers performance materials. The company enjoys a EBITDA margin of 24 percent and has sticky customers over decades.

Galaxy Surfactants is a leading manufacturer of surfactants and speciality chemicals for home & personal care sector, having more 37 patents across India, USA, Japan and Europe. The EBITDA margins at 14 percent are muted compared to other speciality chemicals since Surfactants which is a dominant part of it’s revenue, is a quasi-contract manufacturing activity, though Galaxy is involved in product development. But having 55 percent of it’s business coming from 10 major FMCG companies, mostly MNCs, ensures that margins are under check. However, the growth prospects are excellent which reflects in the 33x PE it enjoys.

Fine Organics is into Oleo Chemical Derivatives across various applications in sectors like food, cosmetics, pharma, paints, textiles, rubber etc. It has 9 product patents in India as well globally. They have global leadership in slip additives and a proprietary technology for green additives. The company has been growing at 15 percent in the recent past and with fresh capacity coming up, should grow at a faster pace. The reported EBITDA margin is 24 percent and enjoys a premium PE of 43x since the entry barriers in this segment is high.

Coming to the new listing, Rossari Biotech, Rossari Biotech has been the leader in textile chemicals, a sector which enjoys a EBITDA margin of 25 percent. If we look at the second largest player Fineotex, the EBITDA was 24 percent on a standalone basis which mostly caters to textile chemicals and the last few years it’s been in the range of 23 percent to 27 percent. However, comparing with unlisted players may be misleading as they report much lower profits for obvious reasons.

A closer look at Rossari Biotech EBITDA shows that it increased gradually in the last 3 years from 14 percent to nearly 18 percent as the company moved from largely a textile speciality chemicals player to one which would be focussed on Home & Personal Care segment. This was a smart move since the textile chemical universe was stagnant and as a leader of the segment, it was stunting their growth prospects. Secondly a company looking to raise funds from the market needed to have a bankable story. At the same time, the Home & Personal care segment has been growing rapidly, with rural India demand galloping faster. Now the Covid-19 pandemic and it’s after effects would provide a further fillip to this segment.

Fineotex Chemicals, which is the second largest in textile speciality chemicals & enzymes in India, having 400+ products with a market in 60+ countries. It has largely been an ignored stock with a market cap of around Rs 400 crore despite leadership position and a consistent performance track record of a CAGR of 24 percent in revenues and 20 percent in EBITDA over the last 10 years. The operating cash flows too have grown at the rate of 20 percent during the same period and it’s been a full tax paying entity. The debt free company has cash & cash equivalents of more than Rs. 59 crs which could be utilised for Capex or acquisition as this pandemic will throw up a number of such opportunities especially in the mid-range, possibly at distress valuation.

With India emerging as a formidable player in Speciality Chemicals, most of the frontline ones have long been identified. The markets are over-heated and expectations are high, thus disappointments could result in a sharp correction. However, smart investors would look for dark horses in this segment which will do the ‘catch-up’ over the next few quarters.

The author is Independent Market Analyst.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!