Public sector banks (PSBs) have played a pioneering role in developing India's industries, but recent evidence suggests they are being shortchanged. Large infrastructure projects have been bogged down by legacy issues, regulatory overreach, and negligence on the part of banks, which has only led to the pile of bad debt becoming bigger.

The rise in the level of non-performing assets (NPAs) has consequently led to more public money being injected into government banks to meet capital requirements. Provisioning for bad loans has impacted their profitability and growth. Private banks have been relatively more successful than their state-run counterparts in leveraging market forces to raise capital.

The gross NPA ratio of scheduled commercials banks rose from 10.2 percent at the end of September 2017, to 11.6 percent at the end of March 2018. Private banks fared much better during the period under review with an NPA ratio of only 4 percent; PSBs gross NPA ratio at the end of the period was 15.6 percent.

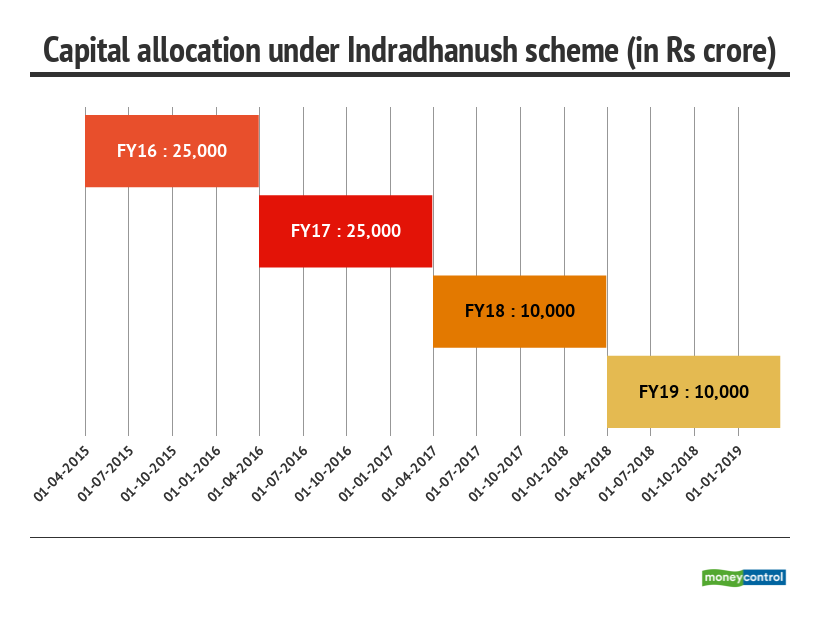

The government had formulated the 'Indradhanush' plan in August 2015 to resolve the issues faced by PSBs, and make them more competitive vis-à-vis private banks. The seven-pronged action plan to revamp PSBs identified both structural and policy issues that were holding back these institutions from living up to their mandate.

On the structural side, governance issues, NPAs, and a homogenous credit base have held back state-run banks. The Indradhanush plan estimated that recapitalisation to the tune of Rs 1.8 lakh crore was needed to nurse these banks back to health.

This amount was to be released in a staggered manner, spread over four years. Of the total, Rs 70,000 crore would be infused into banks by the government, while the remaining Rs 1,10,000 crore would have to be raised by banks. The government has already injected Rs 59,435 crore of the total in public banks, with the residual amount to be raised through budgetary provisions.

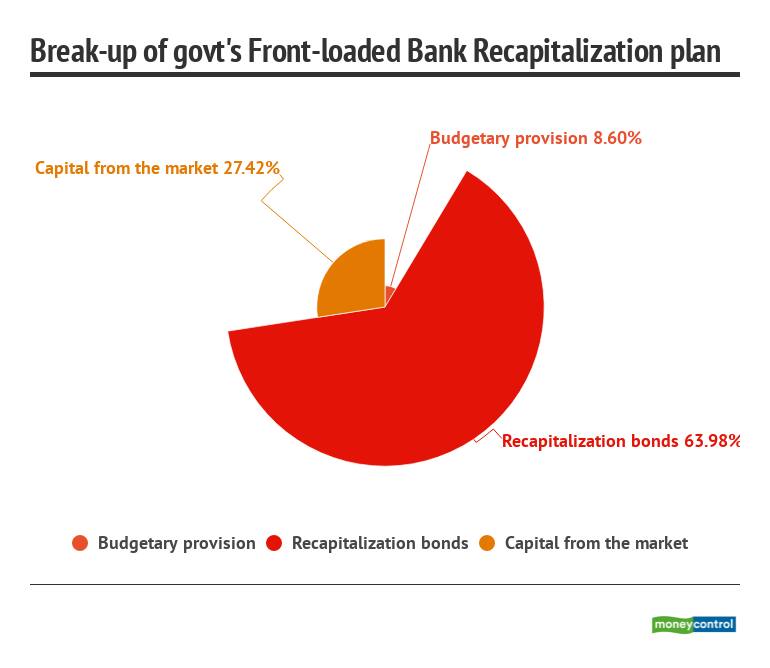

In January 2018, the government mooted a front-loaded bank capitalisation plan of Rs 2.11 lakh crore to augment the Indradhanush plan. Of the total, Rs 1.35 lakh crore was to be infused through sale of recapitalisation bonds, while the rest would come from budgetary provisioning and through funds raised from the market.

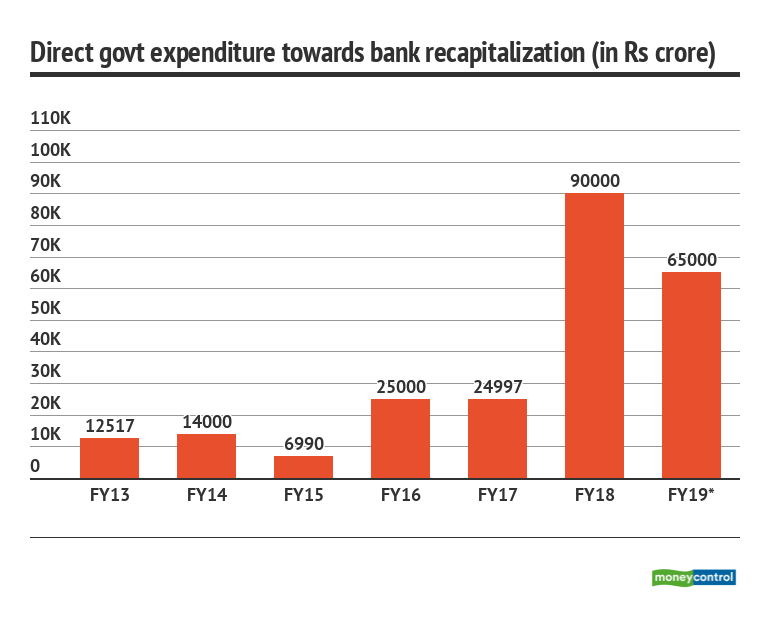

Public banks have been the beneficiaries of government aid, especially since the market liberalisation reforms of 1991. Union budgets presented in the last five years have earmarked money for bank capitalisation, of which Rs 83,504 crore has been spent. However, the budgetary provision for FY18 was Rs 90,000 crore, much more than the expense incurred over the last five years.

Source: Budget document, Ministry of Finance

Source: Budget document, Ministry of Finance

The diversion of public funds for keeping state-owned banks afloat is indicative of the systemic flaws that have culminated in mounting bad debt and over-leveraged balance sheets. Institutions like Life Insurance Corporation of India (LIC) have also been used as surrogates to stave off crisis in these banks.

The quantum of direct government support to the banking sector has increased by over 450 percent over the last four fiscal years, from Rs 15,504 crore in FY14 to Rs 86,510 crore in FY18. For the current financial year, Bank of India received the most government aid, having received at Rs 9,232 crore. It was followed by State Bank of India (SBI), which received Rs 8,800 crore.

The capital infusion by the government is broadly in line with the net losses reported by state-run banks. Of all the PSBs in the country, only Indian Bank and Vijaya Bank recorded profits in FY18. Cases of financial fraud, most notably, the one orchestrated by Nirav Modi and Mehul Choksi, pulled down the performance of Punjab National Bank, which recorded a loss of Rs 12,283 crore, the highest among PSBs. In FY18, SBI and its associates received Rs 8,800 crore in cash from the government, while recording a loss of Rs 5,339 crore for the year.

Of the 21 public banks in operation, 19 reported losses this year, resulting in numerous calls for their privatisation.

Source: CARE Ratings, Moneycontrol Data Bank

Source: CARE Ratings, Moneycontrol Data Bank

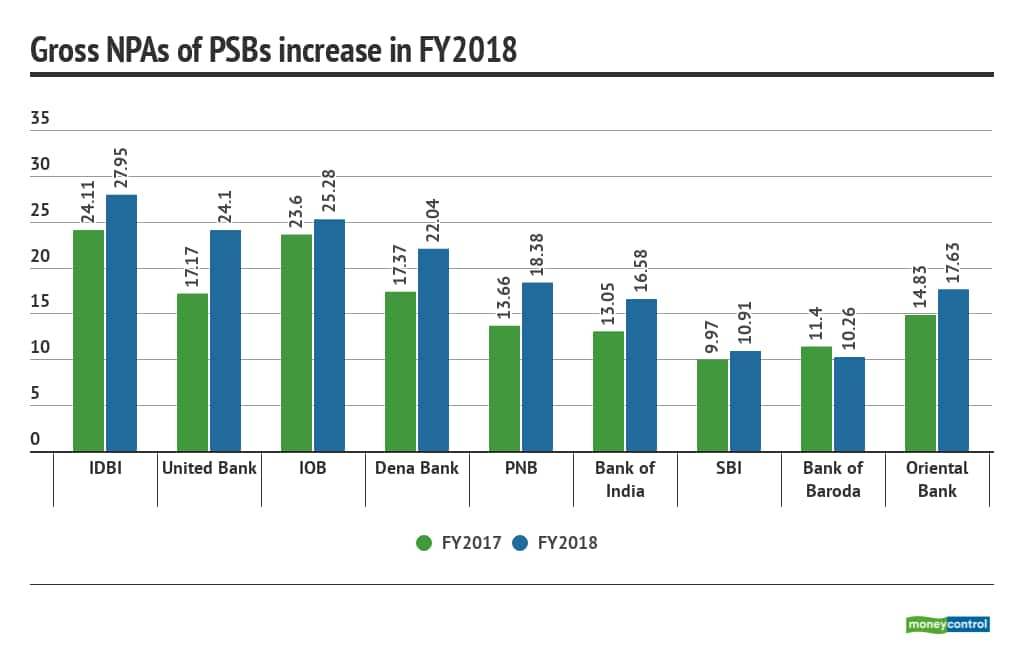

Despite the government having increased its allocation for recapitalisation of these banks by a not-so-modest amount, they are still being found wanting. Their gross NPA ratios have swelled in the recent past, with IDBI Bank reporting a GNPA ratio of 27.95 percent at the end of the June quarter, up from 24.11 percent as at the end of the same quarter last year.

The same is true in the case of United Bank of India, whose GNPA ratio rose by almost 7 percentage points over the past year. PNB's bad loans also spiked, with GNPA ratio increasing to 18.38 percent of its asset base.

Factoring in possible losses from restructured assets and additional provisioning, it would be safe to assume that more money will be need to be pumped in to ensure that public banks meet capital adequacy norms.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!