August was relatively better for the Indian stock market than the gloomy July. Domestic institutional investors provided the much need support, despite the exodus by foreign institutional investors that continued on their selling spree for the fourth consecutive month in August.

Benchmark indices Sensex and Nifty lost just fourth of a percent in August against a 5 percent and 5.7 percent correction, respectively, in July . The loss also narrowed considerably in broader markets as the BSE Midcap and Smallcap indices declined a percent each in August against 8 percent and 11 percent fall in July respectively.

The improvement in market sentiment was also because of government's focus towards the revival of economy that slowed down to six-year low at 5 percent in the first quarter of FY20. Finance Minister announced slew of measures for sectors including auto, NBFCs among others.

As a result, inflows into equity funds further improved during August to Rs 9,152 crore from Rs 8,113 crore in July 2019 while SIP inflows also remained robust, though were marginally lower, at Rs 8,231 crore against Rs 8,324 crore in July.

"Retail investor interest in equity mutual funds, for the 4th time in succession, continues to be steady, displaying maturity, despite uncertain economic and volatile market situation," N S Venkatesh, Chief Executive, AMFI said.

Net inflows, across all categories of equity funds, especially in small and mid-cap funds and ELSS segment, signified heightened confidence and interest in emerging businesses and disciplined tax planning, he added.

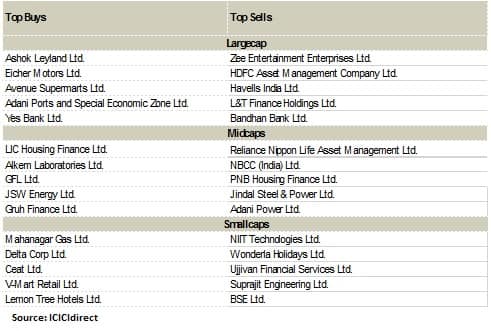

Among largecaps, mutual funds made highest buying in Ashok Leyland, Eicher Motors, Avenue Supermarts, Adani Ports and Yes Bank during August, ICICI direct said.

Largecap stocks which saw selling by AMCs on a consolidated level in August include Zee Entertainment, HDFC AMC, Havells, L&T Finance and Bandhan Bank, it added.

In the midcap space, mutual funds made highest buying in stocks like LIC Housing Finance, Alkem Laboratories, GFL, JSW Energy and Gruh Finance, while Reliance Nippon AMC, NBCC, PNB Housing Finance, Jindal Steel & Power and Adani Power saw highest selling, ICICI direct said.

Overall, the industry (debt + equity) witnessed better inflows at Rs 1,02,538 crore in August as against Rs 87,087.71 crore in July, with assets under management rising to Rs 25.47 lakh crore from Rs 24.53 lakh crore month-on-month.

Among smallcap stocks, AMCs made highest buying in Mahanagar Gas, Delta Corp, Ceat, V-Mart and Lemon Tree Hotels. Although, NIIT Technologies, Wonderla Holidays, Ujjivan Financial Services, Suprajit Engineering and BSE Ltd witnessed selling.

The sectoral trend was mixed in August as Nifty Auto, which hit badly in July, gained more than 2 percent. Consumption rose 4 percent, IT (2.5 percent) and Pharma gained 1 percent whereas Bank continued on its losing streak, falling 5 percent.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!