Chennai-based Dolly and Rajiv Khanna, famous for picking quality mid and smallcap stocks, cut their stake in 11 companies in the June quarter, according to shareholding data as of July 22.

Most stocks in their portfolio (primarily mid and smallcaps) have given negative returns so far in 2019, which has led the duo to reduce holdings.

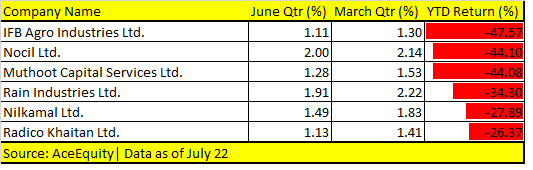

There are six companies in which the duo reduced stake in June quarter but kept it above 1 percent. They are IFB Agro Industries, Nocil, Muthoot Capital, Rain Industries, Nilkamal and Radico Khaitan.

For the last 18 months, the broader market has been under pressure. The small and midcap indices are still trading significantly lower than their life highs. No surprise that the stocks of all the six companies in which the duo cut stakes have given negative returns, falling 20-50 percent.

Table: Six stocks in which Dolly and Rajiv Khanna cut stakes in April-June period but kept it above 1 percent. Please note that this is not the exhaustive list of companies in which the duo hold stakes, but an indicative list of companies in which they have more than 1 percent stake. They have also cut stake in another five companies, bringing it to below 1 percent.

In five companies, the duo either exited or brought their stake below 1 percent. They are Butterfly Gandhimathi Appliances, JK Paper, RSWM, Ruchira Papers and Som Distilleries & Breweries.

Small and midcaps have been largely weighed down by corporate governance issues, absence of earnings growth, and persistent selling by institutional investors as fears of growth slowdown looms.

IFB Agro, Nocil, and Muthoot Capital in which the duo decreased their stake has fallen over 40 percent so far in 2019. Other stocks such as Rain Industries, Nilkamal, and Radico Khaitan fell 20-30 percent in the same period.

Rajiv Khanna started investing in equities in 1996 with an initial investment of Rs 1 crore. His portfolio is now worth over Rs 700 crore, according to some reports.

Disclaimer: The above article is for information only and not necessarily buy or sell ideas. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!