ETtech

ETtechThe VC firm had announced the first close of the Chiratae Growth Fund (CGF-I) almost six months ago in November at Rs 759 crore.

It has raised the fund to back growth-stage companies at a time when global macro headwinds due to inflationary pressures have caused funding taps drying up, driving many startups to follow a course correction.

In fact, total inflows into Indian growth stage deals (Series B and C) totalled only $403 million during the January to March 2023 quarter, compared with $3.4 billion a year earlier.

A significant portion of the corpus raised by Chiratae for its growth fund was from domestic investors. Many of its existing limited partners have backed the latest fund.

Discover the stories of your interest

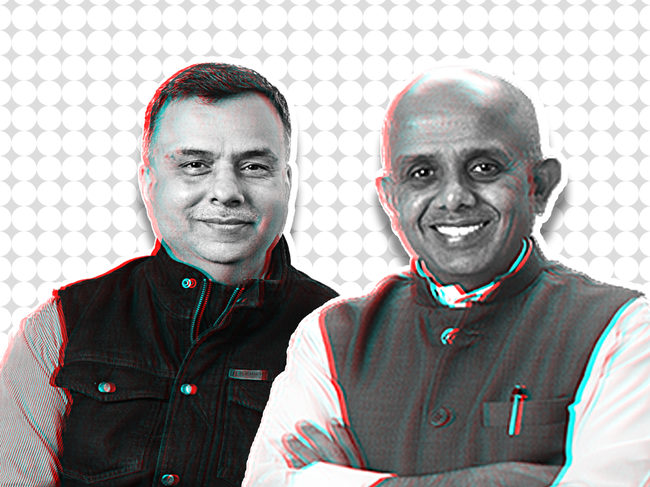

“The proportion of domestic investors is significantly higher because we wanted to close the fund faster. Since we saw there was an opportunity for us to invest in growth-stage startups, we accelerated the growth series,” Sudhir Sethi, founder and chairman of Chiratae Ventures told ET. “Valuations are down right now, and there is no reason for us to step back. But yes, we will invest with discipline.”

Existing investors including Infosys cofounder S Gopalakrishnan’s family office, Pratithi Investments, and US-based 57 Stars LLC have backed the fund. New domestic investors include IIFL and State Bank of India. Middle East-based NV Ventures LLP is also one of the new investors.

Chiratae has already invested in Lenskart, one of its existing portfolio companies, from the new growth fund.

According to Sethi, from the new fund, Chiratae will be making investments of $5.0-7.5 million on the lower side, going up to $15 million at the other end.

Chiratae looks to back startups based on “their merit” - which currently have a market leadership, are solving population scale problems, and are close to breakeven and cash-flow positive, he said. “Their exit profile will be five years and, by that nature, most of them will be pre-IPO, and will go public in the next three to four years. So, our strategy is not sector-focused but company-focused with this fund.”

While a bigger chunk of the capital will be directed towards the VC’s existing portfolio, it will also look to make new bets through the fund.

“We will be more conservative on outputs and will be extremely disciplined about exits overall. We will closely look at revenue projection (through this fund) … Companies that we are evaluating, they don’t need capital for the runway. Rather they are thinking about how to grow organically or inorganically (through acquisitions),” added Sethi.

Across its six funds, Chiratae manages assets of $1.1 billion, and has made more than 130 investments with eight unicorns in its portfolio, including Firstcry, Fibe (formerly EarlySalary), Curefit and Uniphore.

The VC firms claims to have made 48 exits with three IPOs in its portfolio.

“With the Growth Fund -I, we are well-positioned to continue to support promising startups through their growth journey and create value for all stakeholders by becoming market leaders,” said TC Meenakshi Sundaram, founder and vice-chairman of Chiratae Ventures.

Chiratae Ventures India Advisors, formerly IDG Ventures India, which was launched in 2006, has largely played on the themes of ecommerce, marketplaces, vertical commerce, software-as-a-service, agritech and fintech. It has been actively focusing on horizontal plays such as deeptech with its fourth fund and will also look to back opportunities in the climate-tech space.

It had closed its fourth fund at $337 million in August 2021.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times