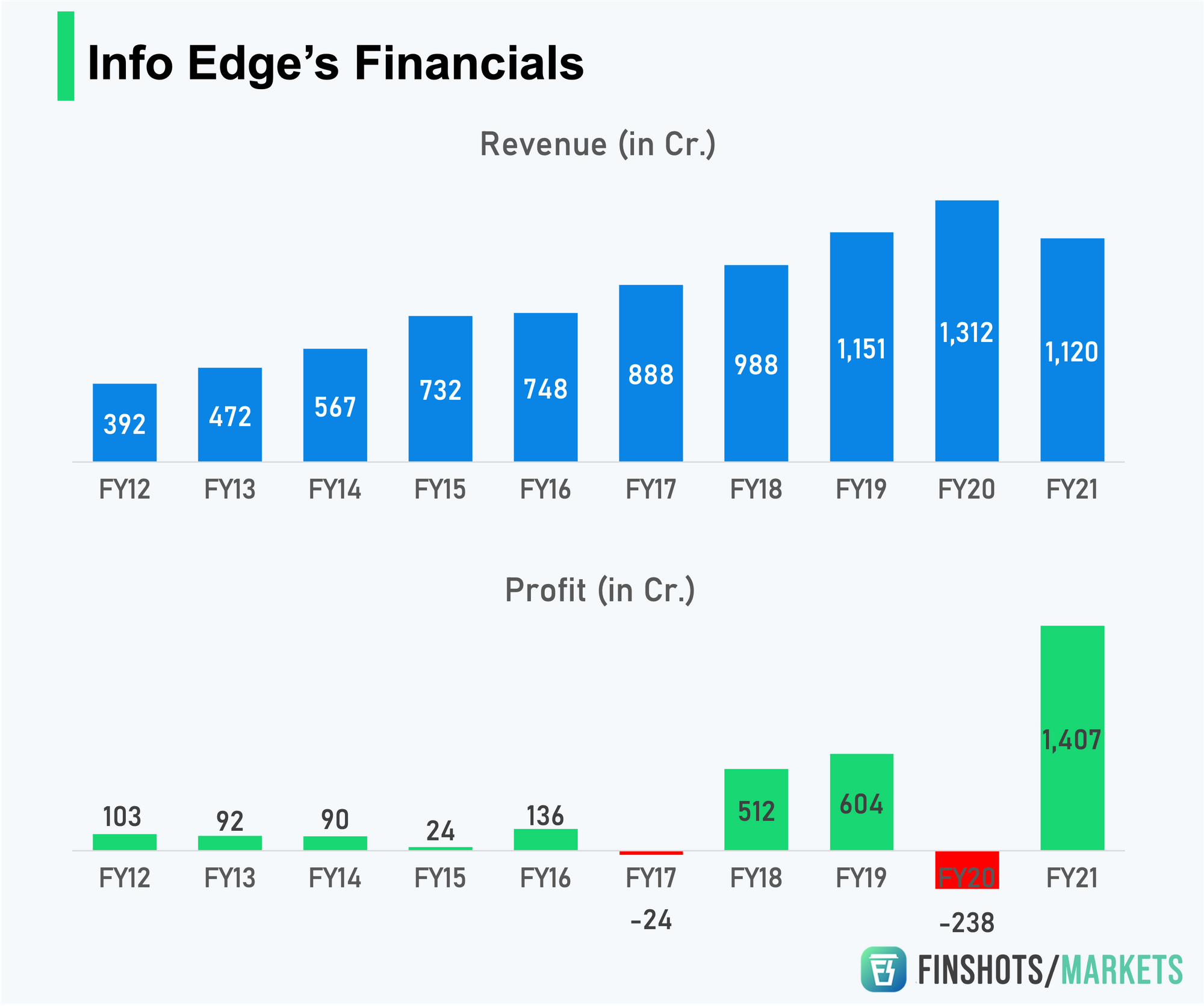

Info Edge has been one of the hottest stocks in the market of late. So we thought we could see why people seem to be betting so heavily on this old internet company.

The Story

Info Edge (IEL) is perhaps the first consumer internet company born in India. If you haven’t followed the stock or the company, we wouldn’t fault you for not knowing a lot about them. But Naukri.com, 99acres, and Jeevansathi — those names must surely ring a bell.

And guess who owns and manages these businesses? Info edge.

Take for instance Naukri.com — the company’s crown jewel. Back in 1995, IEL's founder Sanjeev Bikhchandani saw that his colleagues often turned to the job classifieds section in the newspaper, seemingly trying to find better career opportunities. So he decided to collate all job openings he could find on a single platform, hoping people wouldn’t have to stack up on newspapers anymore. To this end, he put together a website, added new jobs as they opened up and before you knew it, Naukri was up and running.

This might seem rudimentary in 2021. But back in those days, this was revolutionary.

Today Naukri.com controls over 75–80% of the online jobs market, making it the biggest in the country. With a total of 5 million job listings and close to 20,000 resumes uploaded every single day, they’re the undisputed leaders and the company’s cash cow. And the business model is remarkably simple — Businesses post job listings for a fee. Job seekers visit the website. As traffic increases, more companies adopt job listings on Naukri and even more job seekers visit the website. It’s an idea that has worked remarkably well for the company.

Next — there’s 99acres, the real estate classifieds business. People list their residential and commercial properties on the website and potential buyers can scout for their next home/office space right here. Most users have free access except developers, builders, and brokers who may be asked to pay a subscription fee, an advertising fee, or commission on sales. All in all, this segment contributes around 15% (FY21) to IEL’s revenue. But unfortunately, profits have been a rare sight here.

Then there’s Jeevansathi, the matrimony website, and Shiksha — an online platform where colleges and universities list their facilities. Both Jeevansathi and Shiksha bring about 14% of the total revenue. Unfortunately, both of them are yet to turn consistent profits.

But Info Edge has one other trump card. The company owns a sizeable stake in Info Edge Ventures and they’ve been investing in the startup ecosystem for a while now, racking up big winners like Zomato and PolicyBazaar on their portfolio. This has led some people to view the company a bit differently. Sure they’re an internet company focused on the classifieds business but they’re also a Venture Capital company with a seeming knack for investing early in winning businesses.

So does this last bit explain why Info Edge may be on a winning streak?

Unlikely. Granted Zomato’s bumper listing should give people a lot of confidence in the company’s other investments. But picking winners routinely in a cutthroat industry isn’t always easy. While Zomato and PolicyBazaar may still have room to grow, it’s still difficult to answer whether Info Edge will be able to replicate its success with its newer investments.

Having said that, however, there is something else brewing here. As one ICICI Securities report notes — “Info Edge is the best proxy on the grand job-wedding-housewarming party!”

The last couple of years haven’t been great for weddings, real estate, and the employment engine. But with the 2nd wave closing out, there’s been a resurgence in all three departments. Delayed weddings are now being scheduled. More people are looking to buy new homes. And businesses are looking to rehire talent once again in a big way. That’s the perfect storm for Jeevansathi, 99acres, and Naukri.com.

So there is an argument to be made that the next year or so could be very kind to Info Edge. Having said that, however, there’s always the big question — “Are you paying too much to buy the stock right now? And is Info Edge overvalued?”

That’s a question that you’ll have to answer for yourself. But for now, Info Edge seems to be riding the perfect wave and hopefully, now you know why.

Until next time…

Share this article on WhatsApp, and Twitter.

Understanding p2p Lending

Also, since there’s been a lot of talk surrounding p2p lending these days we wrote a simple explainer on the daily feed to demystify this new idea. You can read the full story on Finshots