The Indian equity market benchmarks Sensex and Nifty fell in the negative in the last trading session on April 1 amid fears that the COVID-19 was rapidly deteriorating the country's macroeconomic health.

The 30-share Sensex ended 1,203 points, or 4.08 percent, down at 28,265.31 while Nifty settled 344 points, or 4 percent, lower at 8,253.80. The BSE Midcap and Smallcap indices remained better off than the benchmarks, down 2.18 percent and 1.06 percent, respectively.

All sectoral indices ended in the red on BSE, with the BSE Bankex, IT and Teck falling over 5 percent each.

Experts highlighted that the government's announcement regarding the cut in interest rates of several schemes such as PPF, Kisan Vikas Patra, NSC and small saving certificates indicates that the fiscal deficit will rise significantly and this has made the financial sector vulnerable. Rising coronavirus cases is already keeping markets on tenterhooks.

"Technically, Nifty has broken the level of 8,240 on an intraday basis, which is negative and may lead to further weakness in the market. Below the level of 8,250, Nifty would fall to 8,000 or 7,800 levels. The 7,800 level looks promising to invest in select stocks. On the higher side, Nifty is likely to face hurdles at 8,500 and 8,700 levels,” said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

We have collated 15 data points to help you spot profitable trades:

Note: The OI and volume data of stocks given in this story are the aggregates of the three-months data and not of the current month only.

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 8,105.4, followed by 7,957. If the index starts moving up, key resistance levels to watch out for are 8,495.15 and 8,736.5.

Nifty Bank

Nifty Bank closed 4.89 percent down at 18,208.35. The important pivot level, which will act as crucial support for the index, is placed at 17,782.07, followed by 17,355.83. On the upside, key resistance levels are placed at 18,894.67 and 19,581.04.

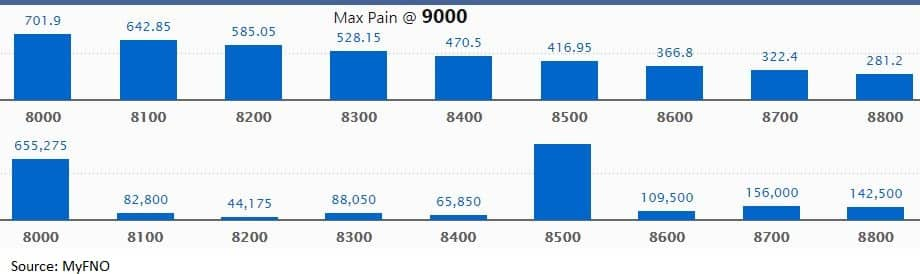

Call options data

Maximum call open interest (OI) of 8.14 lakh contracts was seen at the 8,500 strike price. It will act as a crucial resistance level in the April series.

This is followed by 8,000 strike price, which holds 6.55 lakh contracts in open interest, and 8,700, which has accumulated 1.56 lakh contracts in open interest.

Significant call writing was seen at the 8,800 strike price, which added 52,575 contracts, followed by 8,300 strike price that added 50,175 contracts.

A minor call unwinding was witnessed at 8,000 strike price, which shed 21,750 contracts.

Put options data

Maximum put open interest of 21.49 lakh contracts was seen at 8,000 strike price, which will act as crucial support in the April series.

This is followed by 8,500 strike price, which holds 12.43 lakh contracts in open interest, and 8,100 strike price, which has accumulated 8.06 lakh contracts in open interest.

Put writing was seen at the 8,000 strike price, which added 1.95 lakh contracts.

Put unwinding was seen at 8,700 strike price, which shed 20,700 contracts, followed by 8,400 strike price which shed 17,700 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

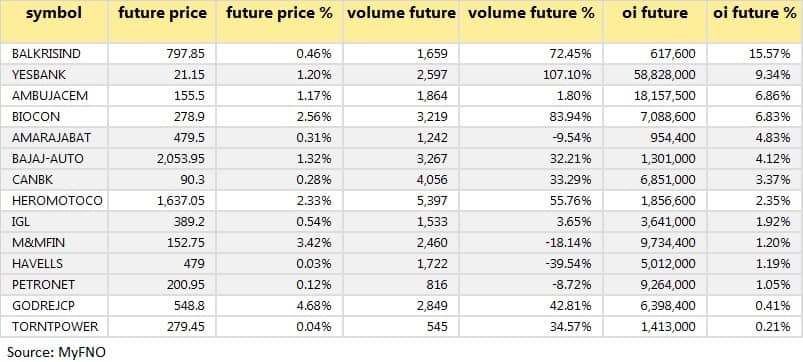

14 stocks saw long build-up

58 stocks saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

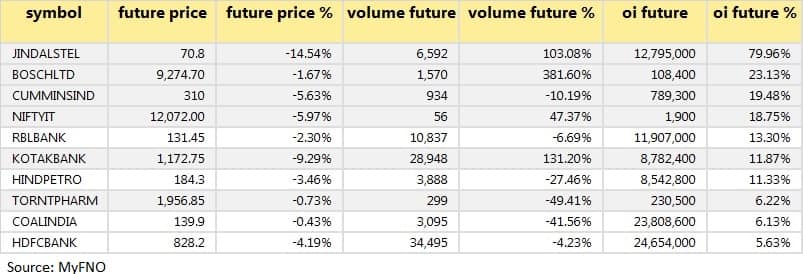

69 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

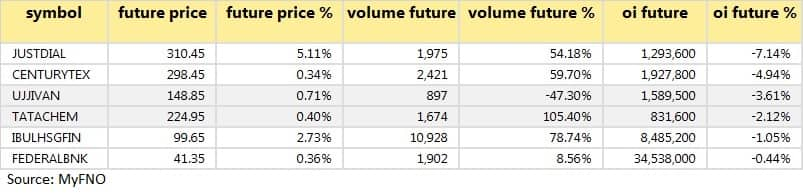

6 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

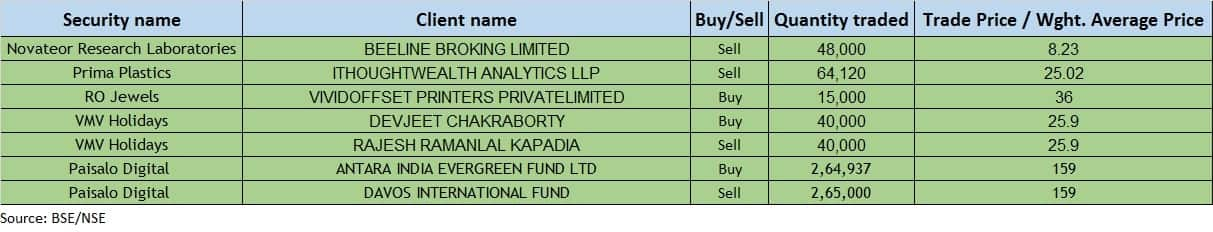

Bulk deals

(For more bulk deals, click here)

Board meetings

Dhanvarsha Finvest: The board will meet on April 3 for general purposes.

Franklin Industries: The board will meet on April 15 to consider the scheme of arrangement.

Kansal Fibres: The board will meet on April 15 to consider the reduction of capital.

Stocks in the news

RBL Bank: It saw a strong operating profit trajectory for Q4 with NIM at an all-time high and comfortable liquidity position.

PVR: ICRA retained rating at AA-/A1+, but placed the rating on watch with developing implications due to lockdown.

Gallantt Ispat: Company received a subsidy of Rs 33.06 crore from Uttar Pradesh Government.

IndiaNivesh: Arm IndiaNivesh Shares decided to disable all stockbroking (voluntary disablement) services.

Kanoria Chemicals: CARE revised rating for long-term bank loans as A from A+ earlier.

Future Enterprises: Haresh Chawla resigned as an Independent Director of the company.

Ashiana Housing: ICICI Prudential MF increase stake in the company to 7.27 percent from 6.98 percent earlier.

Godrej Consumer Products: Dharnesh Gordhon joined the company as Business Head -Africa, the Middle East and the USA.

Tata Power: Company completed the sale of an entire 50 percent stake in Cennergi (Pty), South Africa for ZAR 1,550 mn.

Atul Auto: March sales dropped 76.34 percent to 1,091 units versus 4,612 units YoY.

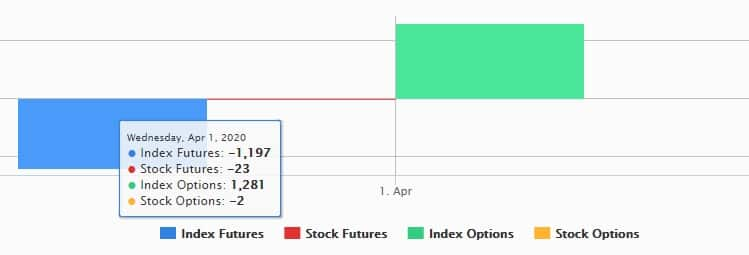

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,116.79 crore, while domestic institutional investors (DIIs), too, sold shares of worth Rs 450.36 crore in the Indian equity market on April 1, provisional data available on the NSE showed.

Stock under F&O ban on NSE

No security is under the F&O ban for April 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!