The Indian market managed to end in the green on August 10, despite profit-taking at higher levels, due to support coming in from select pockets.

Earnings of select pharma companies drove gains in the sector while government actions to boost domestic defence productions helped boost defence stocks.

The Sensex closed 142 points, or 0.37 percent, higher at 38,182.08 and the Nifty ended at 11,270.15, with a gain of 56 points, or 0.50 percent.

"Markets would react to the Supreme Court hearing on adjusted gross revenue (AGR) dues and stocks especially from telecom and banking pack will remain in the limelight. Since we are closely following global markets, US-China trade tensions, currency and crude oil movements would also be actively tracked," said Ajit Mishra, VP -Research, Religare Broking.

"We maintain our positive yet cautious stance and suggest traders prefer hedged bets as volatility is here to stay. A decisive breakout above 11,350 in Nifty would again turn the bias in favour of the bulls."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,226.37, followed by 11,182.53. If the index moves up, the key resistance levels to watch out for are 11,325.67 and 11,381.13.

Nifty Bank

The Nifty Bank index closed 0.67 percent higher at 21,900.25. The important pivot level, which will act as crucial support for the index, is placed at 21,772.9, followed by 21,645.6. On the upside, key resistance levels are placed at 22,049.7 and 22,199.2.

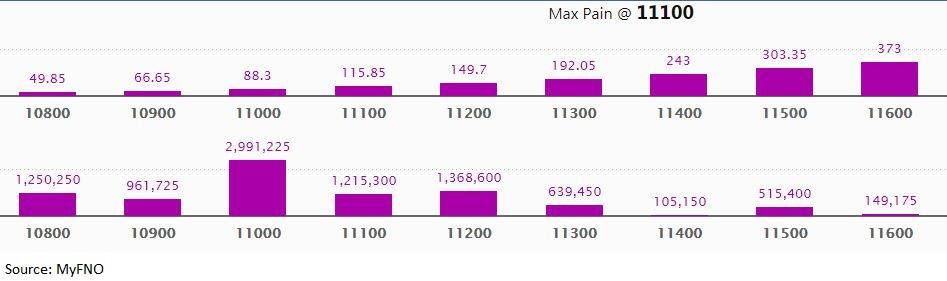

Call option data

Maximum call OI of nearly 21.03 lakh contracts was seen at 11,500 strikes, which will act as crucial resistance in the August series.

This is followed by 11,300, which holds 11.43 lakh contracts, and 11,200 strikes, which has accumulated 9.73 lakh contracts.

Call writing was seen at 11,600, which added 80,325 contracts, followed by 11,300 strikes, which added 46,275 contracts.

Call unwinding was seen at 11,000, which shed 1.22 lakh contracts, followed by 11,200, which shed 1.13 lakh contracts, 11,400, which shed 1.07 lakh contracts and 11,500 strikes, which shed 1.01 lakh contracts.

Put option data

Maximum put OI of 29.91 lakh contracts was seen at 11,000 strikes, which will act as crucial support in the August series.

This is followed by 11,200, which holds 13.69 lakh contracts, and 10,800 strikes, which has accumulated 12.50 lakh contracts.

Put writing was seen at 11,300, which added 1.92 lakh contracts, followed by 11,200 strikes, which added 1.06 lakh contracts.

Put unwinding was witnessed at 11,100, which shed 79,800 contracts, followed by 11,000 strikes, which shed 71,850 contracts.

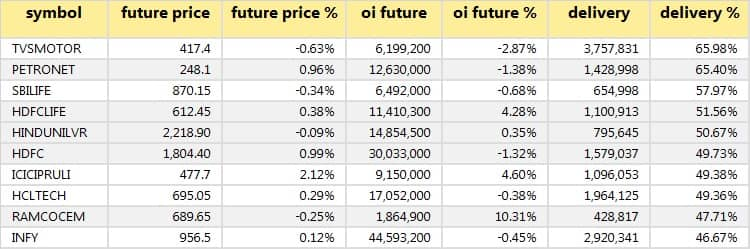

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

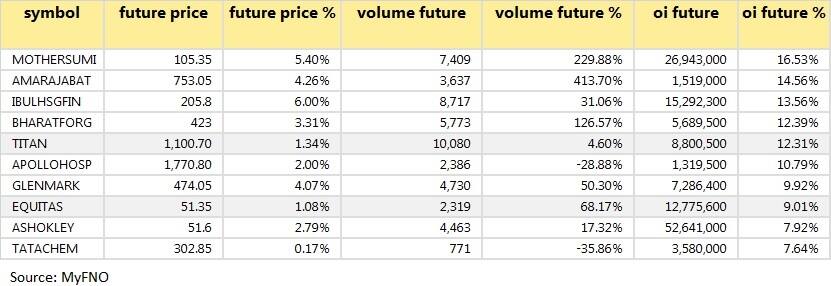

55 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

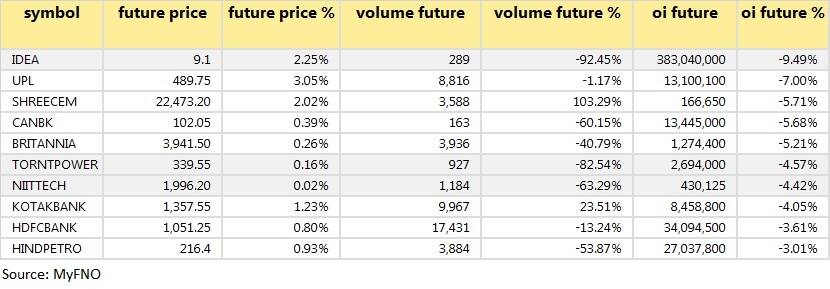

18 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

27 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

39 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

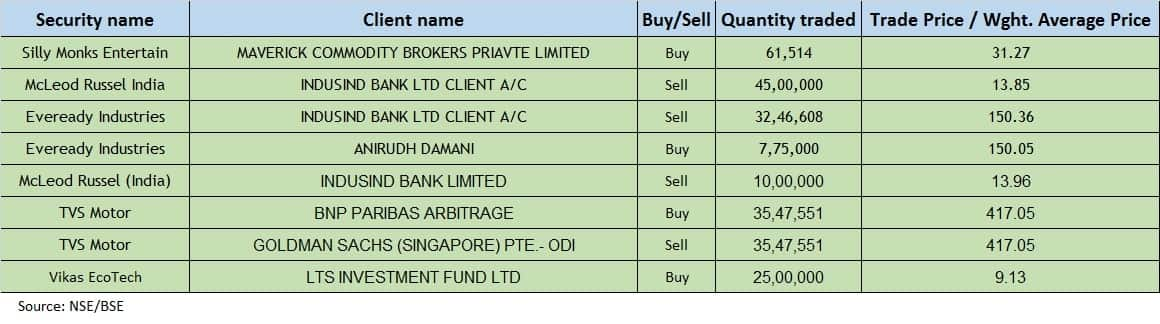

Bulk deals (For more bulk deals, click here)

(For more bulk deals, click here)

Results on August 11AIA Engineering, Ashoka Buildcon, Bajaj Electricals, Bosch, Capacite Infraprojects, Central Bank of India, Chalet Hotels, Elecon Engineering, Galaxy Surfactants, Godawari Power & Ispat, Indoco Remedies, JMC Projects, Kopran, Metropolis Healthcare, Motherson Sumi Systems, PTC India, RCF, RITES, Suven Life Sciences, Symphony, Usha Martin, VST Tillers Tractors, etc.

Stocks in the newsPower Grid Corporation: Q1 profit at Rs 1,978.9 crore versus Rs 2,427.9 crore, revenue at Rs 8,988.7 crore versus Rs 8,804.1 crore YoY.

Bank of Baroda: Q1 loss at Rs 864.3 crore versus a profit of Rs 709.6 crore, net interest income (NII) at Rs 6,816.1 crore versus Rs 6,496 crore YoY.

Shree Cement: Q1 profit at Rs 370.8 crore versus Rs 363 crore, revenue at Rs 2,325.8 crore versus Rs 3,036.41 crore YoY.

InterGlobe Aviation: Board approves raising funds up to Rs 4,000 crore via issue of equity shares by way of a qualified institutional placement (QIP).

ICICI Bank has set the floor price at Rs 351.36 per equity share for its QIP which opened on August 10.

Triveni Engineering will buy back up to 61.9 lakh shares at Rs 105 per share via the tender offer route.

Titan Company: Q1 loss at Rs 270 crore versus a profit of Rs 371 crore, revenue at Rs 1,862 crore versus Rs 4,939 crore YoY.

Sonata Software: Q1 profit at Rs 49.9 crore versus Rs 61.8 crore, revenue at Rs 952.4 crore versus Rs 928.7 crore QoQ.

KEC International: Q1 profit at Rs 70.8 crore versus Rs 88.6 crore, revenue at Rs 2,206.8 crore versus Rs 2,412.4 crore YoY.

Parag Milk: Stichting Depositary APG sold a 2.2 percent stake in the company on August 6.

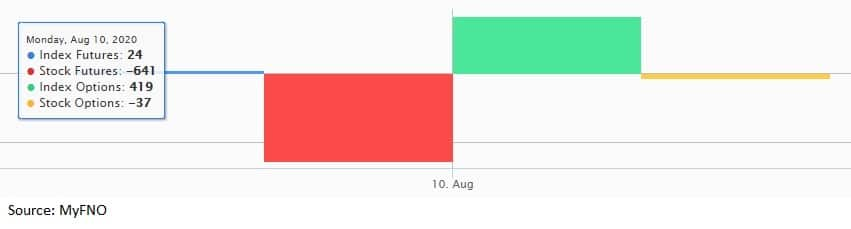

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 302.88 crore while domestic institutional investors (DIIs) sold shares worth Rs 504.92 crore in the Indian equity market on August 10, as per provisional data available on the NSE.

Stock under F&O ban on NSEFive stocks - Canara Bank, Century Textiles, Vodafone Idea, Muthoot Finance and Vedanta - are under the F&O ban for August 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!