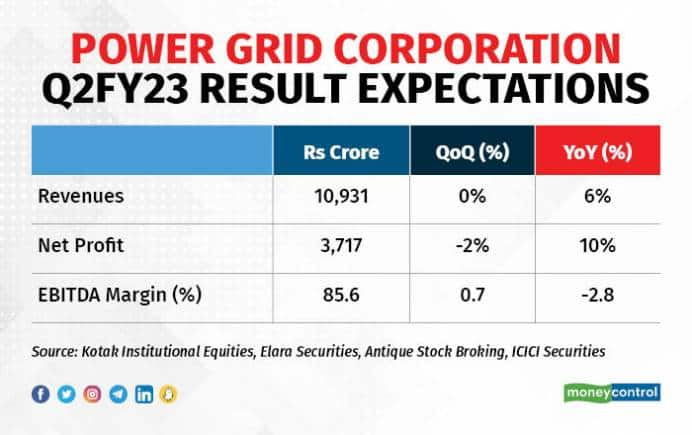

State-run power transmission company Power Grid Corporation is likely to report a 10 percent year-on-year (YoY) growth in its consolidated profit after tax (PAT) on the back of a 6 percent on-year growth in consolidated revenues. The company is set to declare its results on November 4 for the quarter ended September 2022.

According to a poll of brokerages conducted by Moneycontrol.com, PAT for the utility major is expected to be around Rs 3,720 crore, while consolidated revenues for the quarter are seen growing to Rs 10,930 crore.

On a sequential basis, both the consolidated PAT as well as revenues are likely to remain flat.

Brokerage views

ICICI Securities

The brokerage pegs the total income from operations for the quarter at Rs 10,965 crore with a YoY growth of 7 percent. The operating income is likely to remain flat compared to the previous quarter of the current fiscal.

The growth in income compared to last year is likely to be driven by a 7.5 percent on-year growth in Transmission income to Rs 10,805 crore and a 16 percent on-year growth in income from Consultancy activities to Rs 2,200 crore.

The operating expenses are seen increasing by 12.4 percent on-year to Rs 1,300 crore due to ~4 percent jump in employee costs and a 20 percent surge in other operating expenses. On a sequential basis however, the expenses are likely to decline by ~21 percent.

This will result in earnings before interest, taxes, depreciation and amortisation (EBITDA) of Rs 9,666 crore, a YoY growth of 6 percent, and a sequential growth of 4.5 percent.

The EBITDA margin at 88.1 percent is flat on-year, but likely to improve by 330 bps from the previous quarter.

“We expect Power Grid’s Q2FY23 consolidated recurring PAT to increase 10.1 percent YoY on the back of Rs 11,000 crore trailing twelve months (TTM) capitalisation, resulting in 6.1 percent YoY increase in EBITDA and 6.8 percent YoY rise in revenues,” said a report from the brokerage firm ICICI Securities.

According to the brokerage, the key factors to watch out for include capex and capitalisation during the quarter (Q2FY23), upcoming opportunities in the transmission space, especially in tariff-based competitive bidding (TBCB) projects, and update on diversification into smart metering, green businesses and data centre.

Kotak Institutional Equities

The brokerage estimates revenues of Rs 11,117 crore on account of asset capitalisation of Rs 16,400 crore in TTM.

The EBITDA margin at 85.5 is seen declining by 287 bps on-year and remaining flat on-quarter.

“We factor in asset capitalisation of Rs 2,200 crore in Q2FY23 compared to capitalisation of Rs 1,340 crore achieved in Q1FY23, while sequential decline in profits should be seen in the context of lower effective tax rate of 12 percent in Q1FY23,” said the brokerage in its note.

It forecasts a PAT of Rs 3,520 crore, a YoY growth of 5.3 percent, but a sequential decline of 6 percent.

Antique Stock Broking

The brokerage anticipates consolidated revenues for the quarter to grow 5 percent on-year and remain flat sequentially at Rs 10,426 crore, and EBITDA remaining flat at Rs 8,785 crore.

The PAT at Rs 3,759 crore is higher by 13 percent on-year. However, it is likely to remain flat on-quarter.

The company had indicated that it has plans to foray into the smart metering infra business, where it will invest in smart meter asset development business as floated by the respective state utilities. Power Grid aspires to be present across the value chain, wherein the company will set up the required infrastructure and manage the operations and maintenance business as well as those that will aid revenue growth in the coming quarter, the brokerage said in its report.

Power Grid was ended Rs 1.90 lower at Rs 226.15 on November 4 at the National Stock Exchange (NSE). The stock has generated returns of 22 percent over the past one year. Over the last one month, it has gained 8.5 percent.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!