Benchmark stock indices Sensex and Nifty suffered strong losses on September 19 due to widespread selling across sectors as the concerns over rising geopolitical tension, crude oil prices and the deteriorating macroeconomic environment continued to keep the risk appetite of investors low.

Moreover, uncertainty over US Fed's future rates trajectory added to investors anxiety.

On the technical charts, the market breached crucial support at 10,800, seen as a reason for a steep fall.

"Nifty breached the 10,800 level which had been acting as crucial support for the last many sessions. The sharp fall in the market can be attributed to the fact that it is lurching towards new support on the downside," said Pankaj Pandey, Head of Research at ICICI Securities.

The Nifty index closed at 10,704.80, down 136 points, or 1.25 percent, with 7 stocks in the green and 43 in the red. The index managed to hold 10,700-mark but ended at its lowest level since February 19.

Closing at its lowest level since March 1, the BSE Sensex plunged for 470 points or 1.29 percent to settle at 36,093.47 with only four stocks - Tata Motors, HDFC Bank, Bharti Airtel and Asian Paints - in the green.

Nifty formed a bearish candle - which resembles a 'Bearish Belt Hold' kind of pattern on daily charts - for the second time this week.

The index still traded in a range of 10,650-11,150 levels, but as it went near to August lows intraday, the sentiments look to be weak. experts say if the index breaks August lows in the coming sessions, then a steep fall can't be ruled out.

"Going ahead, the August low of 10,637 can now provide some support to the index. However, it is likely to break eventually. Traders can continue to hold short positions and add more once the low breaks. The short term target on the downside is at 10,455 that is the 78.6 percent retracement of the October – June rally," said Gaurav Ratnaparkhi, Senior

Technical Analyst at Sharekhan by BNP Paribas.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 10,634.93, followed by 10,565.07. If the index starts moving up, key resistance levels to watch out for are 10,809.93 and 10,915.07.

Nifty Bank

The Nifty Bank closed with a loss of 1.53 percent at 26,757.65 on September 19. The important pivot level, which will act as crucial support for the index, is placed at 26,541.99, followed by 26,326.3. On the upside, key resistance levels are placed at 27,074.39 and 22,7391.1.

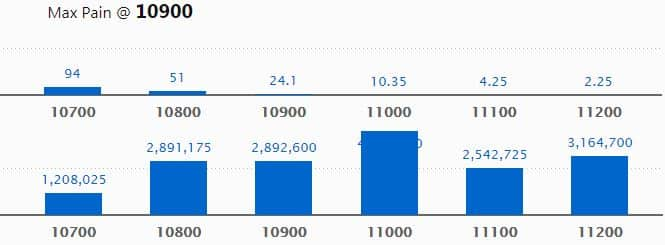

Call options data

Maximum call open interest (OI) of 44.8 lakh contracts was seen at the 11,000 strike price. It will act as a crucial resistance level in the September series.

This is followed by 11,200 strike price, which now holds 31.65 lakh contracts in open interest, and 10,900, which has accumulated 28.93 lakh contracts in open interest.

Significant call writing was seen at the 10,800 strike price, which added 19.51 lakh contracts, followed by 10,700 strike price that added 10.20 lakh contracts and 11,000 strike which added 9.87 lakh contracts.

There was a minor call unwinding at 10,300 strike price, which shed 1,050 contracts.

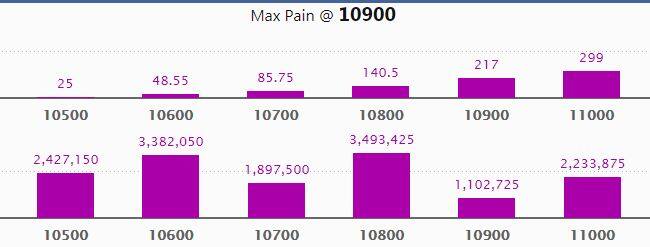

Put options data

Maximum put open interest of 34.93 lakh contracts was seen at 10,800 strike price, which will act as crucial support in September series.

This is followed by 10,600 strike price, which holds 33.82 lakh contracts in open interest, and 10,500 strike price, which has accumulated 24.27 lakh contracts in open interest.

Put writing was seen at the 10,700 strike price, which added 6.68 lakh contracts, followed by 10,500 strike, which added 4.09 lakh contracts and 10,400 strike which added 3.93 lakh contracts.

Put unwinding was seen at 10,900 strike price, which shed 3.31 lakh contracts, followed by 10,800 strike which shed 2.39 lakh contracts and 11,000 strike which shed 97,725 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

21 stocks saw long buildup

14 stocks saw long unwinding

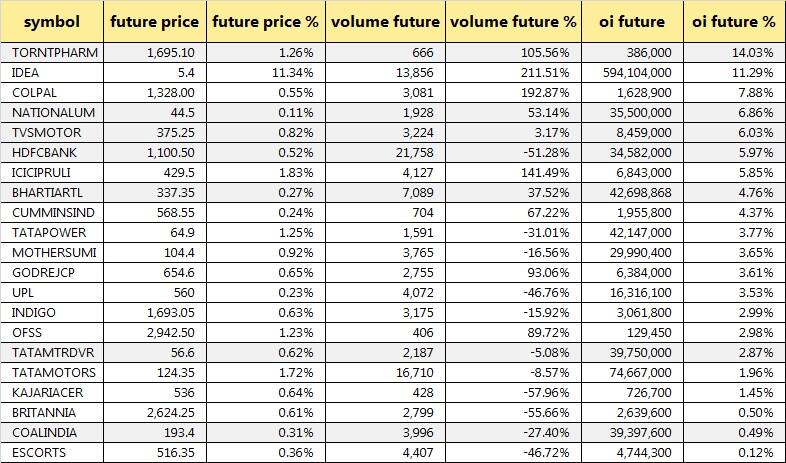

128 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 15 stocks in which short build-up was seen.

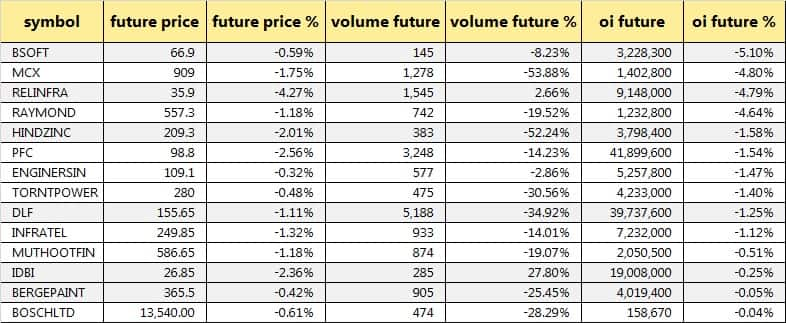

No stock witnessed short-covering

As per available data, there was not a single stock that witnessed short-covering on September 19. A decrease in open interest, along with an increase in price, mostly indicates a short covering.

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings:

The board of Thyrocare Technologies will meet on September 21 to consider the report of valuation of the wholly-owned subsidiary company, Nueclear Healthcare (NHL), obtained from a second valuer engaged for the purpose, in the context of deciding whether or not to retain the company's shareholding in NHL.

The board of directors of Speciality Papers, Wanbury, W S Industries India, Dharamsi Morarji Chemical and FCS Software Solutions will meet on September 20 for general purpose.

The board of directors of Future Supply Chain Solutions will meet on September 20 to consider and approve fund raising.

The board of directors of Goodluck India will meet on September 20 to consider the issue and allotment of warrants, convertible into equity shares on a preferential basis.

The board of directors of Kaveri Seed Company will meet on September 24 to consider and approve the proposal of buyback of shares.

Stocks in news:

Yes Bank: Morgan Credits, part of the promoter group of the company, sold 2.3 percent shareholding In the bank.

DHFL: The company has got proposal from a developer to act as development managers in certain projects including

projects taken under slum rehabilitation scheme.

Andhra Bank: Bank unions call for strike from September 25-27 to oppose proposed mergers and strike will affect the functions of the bank.

PNB: The lender is to consider raising up to Rs 3,000 crore via Tier-I bonds on September 26.

Bharat Forge: The company has acquired a 50 percent stake in German company Refu Electronik GmbH for 11.35 million euro.

Reliance Power: Lenders invoked 2.85 percent stake in the company from May 2-September 9.

Lincoln Pharmaceuticals: Board approved the scheme of amalgamation between the company and subsidiary Lincoln Parenteral Limited, subject to all requisite approval.

Morepen Laboratories: The company approved the issue and allotment up to 3.7 crore warrants for an aggregate amount of up to Rs 74 crore, convertible into 3.7 crore equity shares to promoter group entity(ies) on a preferential basis.

Adani Transmission: The company said it has acquired the entire stake in Bikaner-Khetri Transmission Ltd (BKTL).

Godrej Consumer Products: The company has raised stakes from 90 percent to 95 percent in Godrej West Africa Holdings (GWAHL) and Mauritius & Darling Trading Company (DTCL). The cost for acquisition of the additional stake in GWAHL and DTCL is $13.80 million and $7 million, respectively.

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 892.52 crore, while domestic institutional investors (DIIs) bought Rs 645.72 crore worth of shares in the Indian equity market on September 19, as per provisional data available on the NSE.

Fund flow

NSE

NSE

No stock under ban period on NSE

There is no stock under F&O ban for September 20. Securities in ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!