The market has been one roller coaster ride for investors on June 16 as it opened strong on positive global cues after the US Federal Reserve expanded its bond buying programme, but shed all its gains in the afternoon amid India-China border tensions, followed by a strong recovery in the last couple of hours of trade.

The Sensex climbed 376.42 points, or 1.13 percent, to 33,605.22, led by banking and financials. The Nifty rose 100.30 points, or 1.02 percent, to 9,914 and formed a small bodied red candle on daily charts as the closing was lower than its opening.

"On Wednesday (June 17), 9,700 will be a crucial level and on dismissal of the same, the Nifty would quickly fall to 9,550 and 9,400 levels. Technically and based on the daily chart, the index should rise keeping the level of 9,700 intact," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities, told Moneycontrol.

He feels the level of 10,100 and 9,700 could act as a resistance and trend decider levels, respectively.

The market breadth was in favour of declines as about 1,032 shares declined against 835 advancing shares on the NSE.

"Markets may continue to mirror global markets. While the stand-off between India and China along the Line of Control will be on investors' radar, any further escalation could negatively impact the market," Ajit Mishra, VP - Research at Religare Broking, said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance level for the NiftyAccording to pivot charts, the key support level for the Nifty is placed at 9,746.27, followed by 9,578.53. If the index moves up, the key resistance levels to watch out for are 10,063.97 and 10,213.93.

Nifty BankThe Nifty Bank rallied 383.80 points, or 1.93 percent, to close at 20,296.70. The important pivot level, which will act as crucial support for the index, is placed at 19,656.27, followed by 19,015.83. On the upside, key resistance levels are placed at 20,787.97 and 21,279.23.

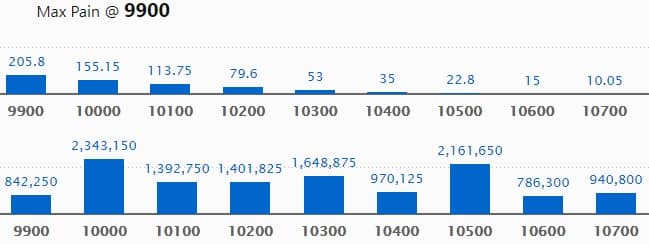

Call option dataMaximum call OI of 23.43 lakh contracts was seen at 10,000 strike, which will act as crucial resistance in the June series.

This is followed by 10,500, which holds 21.61 lakh contracts, and 10,300 strikes, which has accumulated 16.48 lakh contracts.

Significant call writing was seen at the 10,300, which added 5.98 lakh contracts, followed by 10,100 that added 5.63 lakh contracts and 10,000 strikes, which added 2.51 lakh contracts.

Call unwinding was witnessed at 9,700, which shed 0.94 lakh contracts, followed by 9,800 strikes, which shed 0.52 lakh contracts.

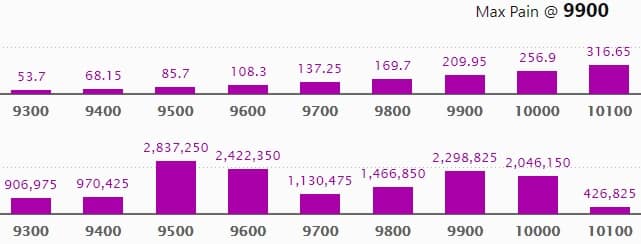

Put option dataMaximum put OI of 28.37 lakh contracts was seen at 9,500 strike, which will act as crucial support in the June series.

This is followed by 9,600, which holds 24.22 lakh contracts, and 9,900 strikes, which has accumulated 22.98 lakh contracts.

Significant put writing was seen at 9,300, which added 1.29 lakh contracts, followed by 9,700 strikes, which added 1.25 lakh contracts.

Put unwinding was seen at 9,500, which shed 1.41 lakh contracts, followed by 10,300 strikes, which shed 0.34 lakh contracts.

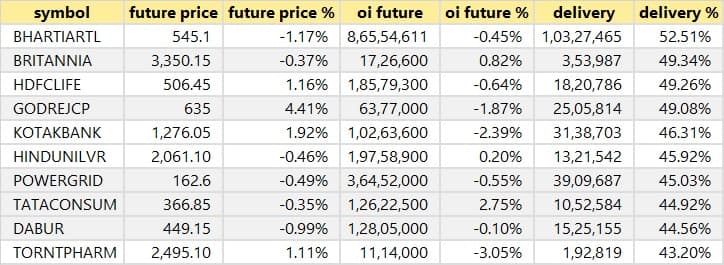

Stocks with a high delivery percentageA high delivery percentage suggests that investors are showing interest in these stocks.

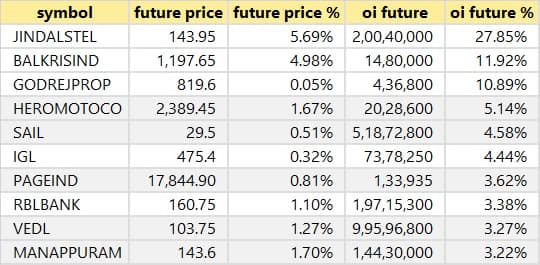

21 stocks saw long build-upBased on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

45 stocks saw long unwinding

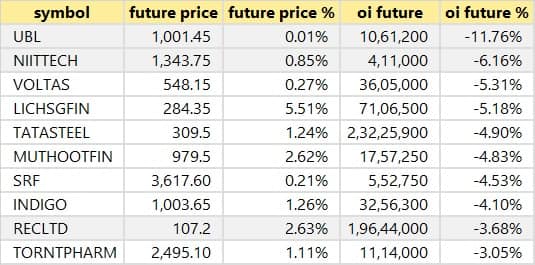

33 stocks saw short build-upAn increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

45 stocks witnessed short-coveringA decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are top 10 stocks in which short-covering was seen.

Bulk dealsHindustan Oil Exploration: Fidelity Funds - India Focus Fund sold 17,10,898 shares in company at Rs 64 per share.

Indian Terrain Fashions: Malabar India Fund sold 3,04,627 shares in company at Rs 32.72 per share.

Lycos Internet: Oak India Investments sold 35 lakh shares in company at Rs 11.95 per share.

(For more bulk deals, click here)

Results on June 17Pidilite Industries, Indraprastha Gas, Muthoot Finance, REC, Aban Offshore, Clariant Chemicals, Cummins India, Prataap Snacks, Emkay Global Financial Services, FDC, Fortis Healthcare, Gulf Oil Lubricants, HEG, Indostar Capital Finance, ITD Cementation, JK Cement, Lumax Auto Technologies, Mangalam Cement, Mold-Tek Technologies, Natco Pharma, Navneet Education, Rane Brake Lining, Rico Auto Industries, Texmaco Infrastructure, Texmaco Rail, Triveni Engineering and Welspun Corp will declare their March quarter earnings on June 17.

Stocks in the newsNavin Fluorine International: Q4 profit at Rs 272.7 crore versus Rs 35.18 crore, revenue at Rs 276.6 crore versus Rs 252.6 crore YoY.

HDFC AMC: Standard Life Investments to sell up to 60 lakh shares (with an option to sell an additional 60 lakh shares) via an offer for sale on June 17-18.

NMDC: Q4 profit at Rs 347 crore versus Rs 1,451.81 crore, revenue at Rs 3,187.34 crore versus Rs 3,643.32 crore YoY.

Ratnamani Metals: Q4 profit at Rs 67.34 crore versus Rs 63.19 crore, revenue at Rs 629 crore versus Rs 686.74 crore YoY.

Gokul Refoils approved share buyback of up to Rs 39.48 crore.

Schneider Electric Infrastructure: Q4 loss at Rs 25.75 crore versus a profit of Rs 1.46 crore, revenue at Rs 229.6 crore versus Rs 286.4 crore YoY.

Bank of Maharashtra: Q4 profit at Rs 57.57 crore versus Rs 72.38 crore, revenue at Rs 1,022.5 crore versus Rs 999.93 crore YoY.

Wipro: Wipro Gallagher Solutions partnered with DocMagic to enhance digital mortgage processes.

HCL Technologies commenced operations in Sri Lanka to leverage the country's IT workforce.

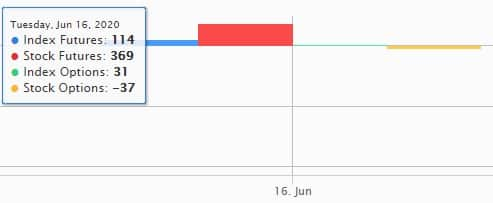

Fund flow

FII and DII dataForeign institutional investors (FIIs) sold shares worth Rs 1,478.52 crore, while domestic institutional investors (DIIs) bought shares worth Rs 1,161.51 crore in the Indian equity market on June 16, provisional data available on the NSE showed.

Stock under F&O ban on NSEFour stocks - Adani Enterprises, Vodafone Idea, Jindal Steel & Power and Just Dial - are under the F&O ban for June 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!