Headline indices Sensex and Nifty closed with losses on July 27, mainly due to profit-booking in banking and financial stocks as worries over rising coronavirus cases and a surge in bad loans in 2020 weighed on investor sentiment.

Sensex closed with a loss of 194 points, or 0.51 percent, at 37,934.73 and Nifty settled 62 points, or 0.56 percent, lower at 11,131.80.

"After the recent rise in Nifty, the market is expected to consolidate for a couple of days, given flaring US-China relations and persistent rise in virus cases," said Siddhartha Khemka, Head - Retail Research, Motilal

Oswal Financial Services.

"Nifty formed a bearish candle today. Overall, while declines are being bought, follow-up is missing at higher levels. It requires a decisive range breakout for the next leg of the rally. Stock-specific action is likely to continue with a lot of heavyweights reporting their earnings over the next few days. Investors would also watch out for commentary from US Fed monetary policy meeting on Wednesday," Khemka added.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,071.4, followed by 11,011. If the index moves up, the key resistance levels to watch out for are 11,208.6 and 11,285.4.

Nifty Bank

The Nifty Bank index closed with a loss of 3.59 percent at 21,848.75. The important pivot level, which will act as crucial support for the index, is placed at 21,544.04, followed by 21,239.27. On the upside, key resistance levels are placed at 22,410.84 and 22,972.87.

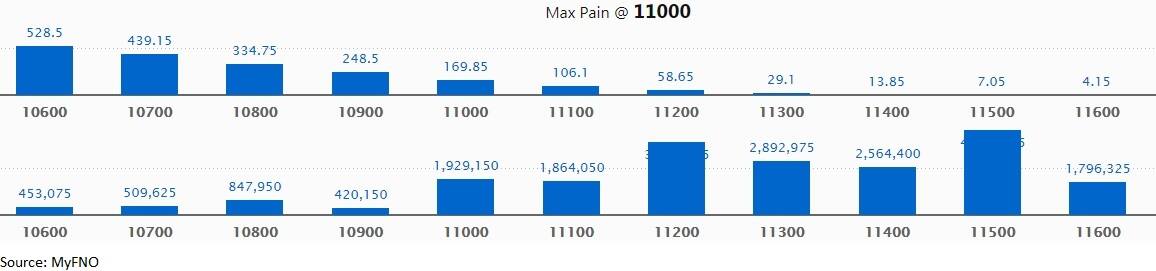

Call option data

Maximum call OI of 45.17 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the July series.

This is followed by 11,200, which holds 38.9 lakh contracts, and 11,300 strikes, which has accumulated 28.93 lakh contracts.

Significant call writing was seen at 11,200, which added 12.6 lakh contracts, followed by 11,500 strikes, which added 6.55 lakh contracts and 11,300, which added 5.65 lakh contracts.

Call unwinding was seen at 11,000, which shed 82,500 contracts, followed by 10,600 strikes, which shed 15,525 contracts.

Put option data

Maximum put OI of 41.2 lakh contracts was seen at 11,000 strike, which will act as crucial support in the July series.

This is followed by 10,800, which holds nearly 24.33 lakh contracts, and 11,100 strikes, which has accumulated 23.48 lakh contracts.

Significant put writing was seen at 10,900, which added 2.27 lakh contracts, followed by 10,600 strikes, which added 78,975 contracts.

Put unwinding was witnessed at 11,000, which shed 2.49 lakh contracts, followed by 11,200, which shed 2.06 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

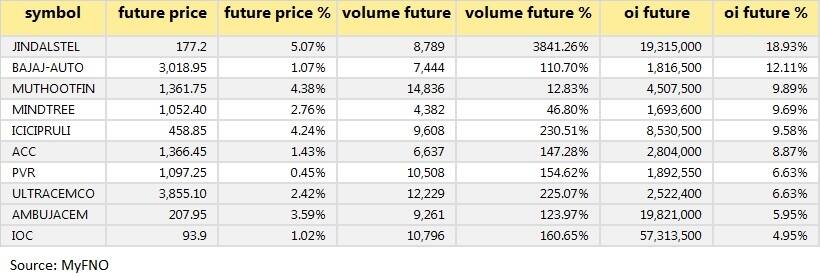

24 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

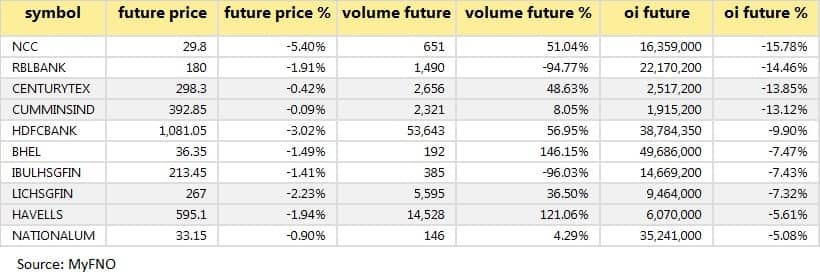

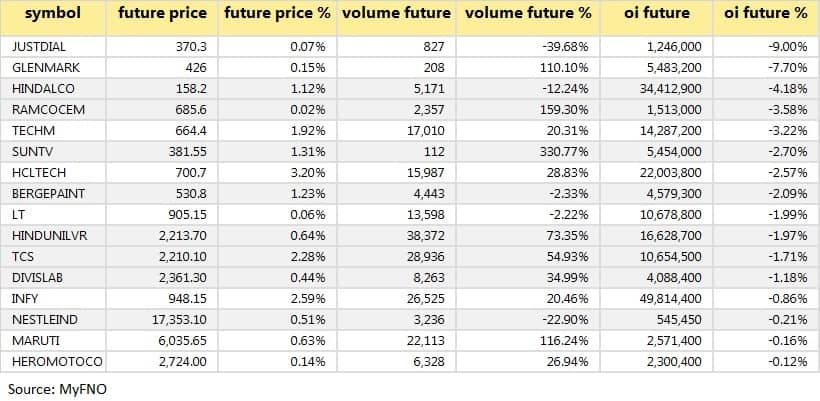

47 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

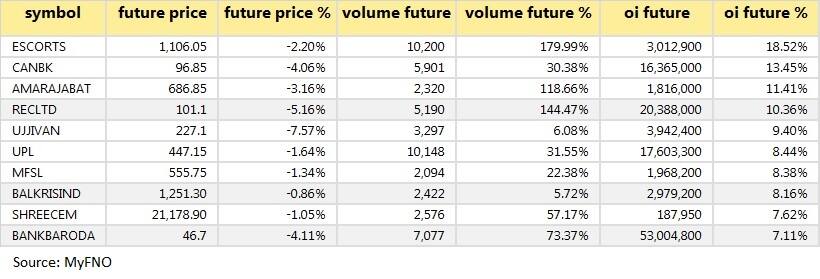

55 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

16 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering.

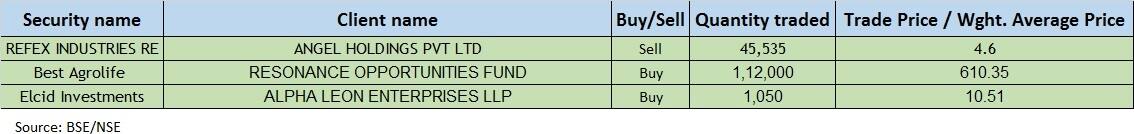

Bulk deals

(For more bulk deals, click here)

Results on July 28

UltraTech Cement, Nestle India, IDBI Bank, IDFC First Bank, RBL Bank, Castrol India, Hexaware Technologies, 3i Infotech, Adhunik Metaliks, Greenlam Industries, HT Media, Max Ventures, Mirza International, NIIT Technologies, Quess Corp, Sanofi India, Sunteck Realty, Tata Coffee, Welspun Corp, etc.

Stocks in the news

Tech Mahindra Q1: Profit at Rs 972.3 crore versus Rs 803.9 crore, revenue at Rs 9,106.3 crore versus Rs 9,490 crore QoQ.

NBCC India: The company received orders worth Rs 204 crore.

Mahindra & Mahindra Financial Services: Rights issue of Rs 3,088.8 crore will open on July 28, with a price at Rs 50 per share.

United Spirits Q1: Loss at Rs 241.5 crore versus profit at Rs 202.1 crore, revenue at Rs 3,820.7 crore versus Rs 7,292.5 crore YoY.

Kirloskar Electric Company: The company's units at Hirehalli (unit-7) and Budihyal (unit-15) have extended partial lay off its workmen for a further period of 30 days.

HSIL Q1: Loss at Rs 17.35 crore versus profit at Rs 14.34 crore, revenue at Rs 251.55 crore versus Rs 439 crore YoY.

Hindustan Media Ventures Q1: Profit at Rs 11.39 crore versus Rs 38.81 crore, revenue at Rs 89.88 crore versus Rs 217.95 crore YoY.

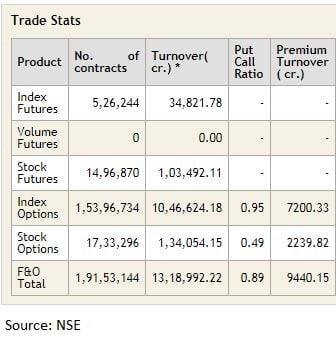

Fund flow

FII and DII data

Foreign institutional investors (FIIs) and domestic institutional investors (DIIs) sold shares worth Rs 453.31 crore and Rs 977.88 crore, respectively, in the Indian equity market on July 27, provisional data available on the NSE showed.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!