Benchmark indices Sensex and Nifty extended their losses into the second consecutive session as they ended lower after a volatile session on January 28.

Major stock markets across the globe remained under pressure due to reports related to coronavirus emanating from China.

Back home, investors also turned cautious ahead of the Union Budget on February 1.

Sensex closed the day below 42,000-mark at 40,966.86, losing 188 points or 0.46 percent from the previous day's close. Nifty finished with a loss of 63 points, or 0.52 percent, at 12,055.80.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 11,999.03, followed by 11,942.27. If the index moves up, key resistance levels to watch out for are 12,138.03 and 12,220.27.

Nifty Bank

Nifty Bank closed 0.25 percent down at 30,761.40. The important pivot level, which will act as crucial support for the index, is placed at 30,595.67, followed by 30,429.93. On the upside, key resistance levels are placed at 30,987.77 and 31,214.13.

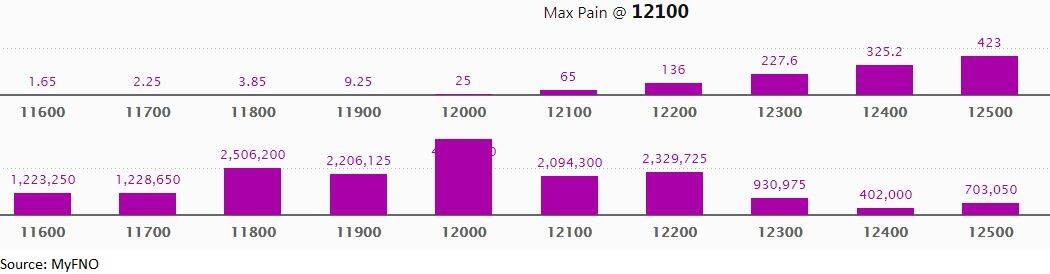

Call options data

Maximum call open interest (OI) of 61.48 lakh contracts was seen at the 12,200 strike price. It will act as a crucial resistance level in the January series.

This is followed by 12,300 strike price, which holds 45.6 lakh contracts in open interest, and 12,500, which has accumulated 40.6 lakh contracts in open interest.

Significant call writing was seen at the 12,100 strike price, which added 22.51 lakh contracts, followed by 12,200 strike price that added 6.33 lakh contracts and 12,300 strike that added 3.69 lakh contracts.

Call unwinding was witnessed at 12,600 strike price, which shed 1.93 lakh contracts, followed by 12,400 which shed 1.33 lakh contracts.

Put options data

Maximum put open interest of 40.4 lakh contracts was seen at 12,000 strike price, which will act as crucial support in the January series.

This is followed by 11,800 strike price, which holds 25.06 lakh contracts in open interest, and 12,200 strike price, which has accumulated 23.3 lakh contracts in open interest.

Put writing was seen at the 11,800 strike price, which added 1.87 lakh contracts, followed by 11,600 strike, which added 1.05 lakh contracts.

Put unwinding was seen at 12,200 strike price, which shed 4.75 lakh contracts, followed by 12,300 strike which shed 4.46 lakh contracts and 12,100 strike which shed 2.45 lakh contracts.

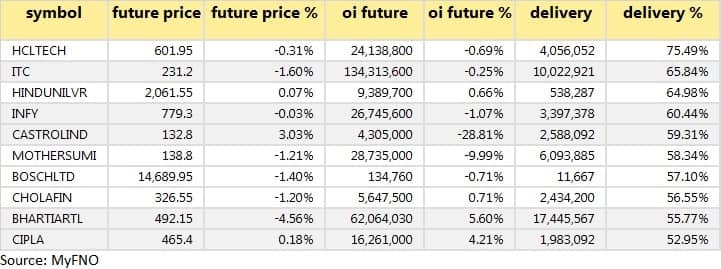

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

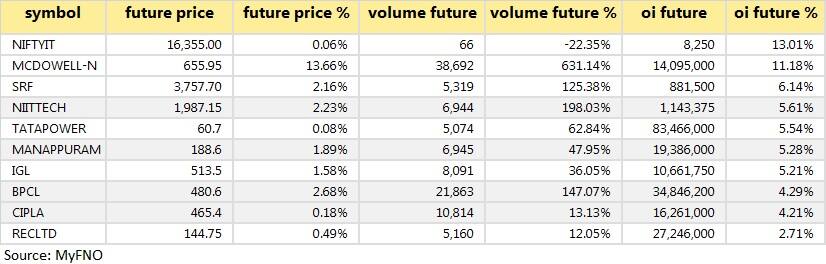

27 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

54 stock saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

46 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

20 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on open interest (OI) future percentage, here are the top 10 stocks in which short-covering was seen.

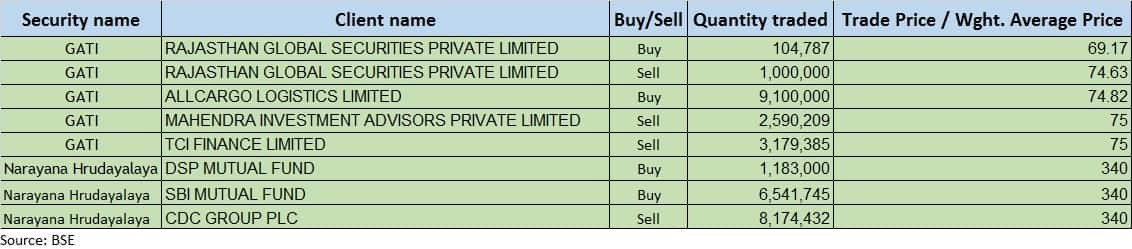

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Jonjua Overseas: The board of the company will meet on January 29 for general purposes.

Kabra Drugs: The board will meet on January 29 for general purposes.

KPIT Technologies: The board will meet on January 29 to consider and approve interim dividend and quarterly results.

NIIT Technologies: The board will meet on January 29 to consider and approve interim dividend and quarterly results.

PVV Infra: The board will meet on January 29 for general purposes.

Transport Corporation of India: The company's board will meet on January 29 to consider and approve interim dividend and quarterly results.

Stocks in news:

Earnings: Bajaj Finserv, Bajaj Finance, Bharat Gears, Birla Corporation, Cholamandalam Financial Holdings, Crompton Greaves Consumer Electricals, Escorts, Garware Polyester, Godrej Consumer Products, IDFC First Bank, Jubilant FoodWorks, Tata Power, NIIT Technologies, KPIT Technologies and West Leisure Resorts are among the companies that will release their December quarter earnings on January 29.

M&M Financial Services: Q3 profit rose 14.6 percent to Rs 365.3 cr, revenue jumped 15.7 percent to Rs 2,580.6 cr YoY.

JK Lakshmi Cement: Q3 standalone profit jumped 233 percent to Rs 49.2 cr, revenue rose 7.5 percent to Rs 1,004.9 cr YoY.

IFB Industries: Q3 profit dipped 18.2 percent to Rs 14.8 cr, revenue rose 2.7 percent to Rs 39.7 cr YoY.

HFCL: Company will buy a 47.9 percent stake in Bigcat Wireless for Rs 22.5 cr.

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,357.56 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 711.7 crore in the Indian equity market on January 28, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

No security is under the F&O ban for January 29. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!