Madhuchanda Dey

Moneycontrol Research

Last week, we had hinted at probably more correction in the stock of Mindtree. But the recent fall post the exit of the founders has been fast and furious. Is it a falling knife that should be avoided or is it time to be greedy when a large section of the markets is fearful?

After months of speculation, the hostile bid of L&T to acquire Mindtree has ended rather peacefully, with L&T acquiring close to 60.06 percent of the company at a price of Rs 980 per share.

We were expecting the promoters of Mindtree (founders Krishnakumar Natarajan, N S Parthasarathy, Rostow Ravanan and Subroto Bagchi hold 3.72 percent, 1.43 percent, 0.71 percent and 3.1 percent respectively) with their insignificant stake to exit the company. The company recently informed the stock exchange concerned that Executive Chairman Natarajan, Executive Vice Chairman & Chief Operating Officer Parthasarathy and CEO & MD Ravanan have submitted their resignations as members of the Board of Mindtree and employees of the company. The stock reaction post this event was sharp.

Mindtree corrected by close to 14 percent post the exit of the founders and 23 percent from the open offer price and is whisker away (2.3 percent) from its 52-week low price.

Why the long-term investors should be greedy now

Mindtree will most likely witness a management rejig under the new promoter, L&T. There would be transition pangs and periods of probable business uncertainty in the interim.

However, investors got to remember that till sometime ago, Mindtree was a much sought-after asset that its founders wanted to retain badly and the acquirer wanted to take over. It had marquee investors sitting in the company as well.

Mindtree had carved out a niche for itself in the areas of new technology with its early adoption of digital that started to yield rich dividends. The world had been closely following the success story and many, including rivals, therefore wanted to be a part of this journey.

Albeit the temporary disruption, the core attractiveness of Mindtree’s capabilities has not changed.

For L&T, getting Mindtree is a good deal

In terms of verticals, L&T -- especially its IT service arm L&T Infotech (LTI) -- has a lot to gain as Mindtree has a strong presence in technology, media and services (close to 40 percent) where the rate of growth of digital adoption is very high. The other verticals where Mindtree has a strong footprint are retail and CPG (consumer packaged goods) and travel and hospitality – industries that are at the forefront of digital adoption. In fact, the share of digital in total business for Mindtree is much higher at 49.3 percent compared to 38 percent for LTI.

Incidentally, Mindtree’s revenue per employee (thanks to the higher value added in digital) is also a tad higher than LTI.

However, LTI has been reporting a much better operating margin of close to 18.4 percent EBIT than 12.8 percent for Mindtree. While for LTI, this has come with a record high utilisation rate of 81 percent (compared to 77 percent for Mindtree), we feel the synergistic benefits coupled with sharper management focus could lead to improvement in Mindtree’s margin performance.

Are all the near-term headwinds in the price?

There are undoubtedly near-term headwinds like a management change and a cultural overhaul, with a new promoter coming in. However, we do not expect a large scale exodus of employees under a new stable management. Prolonged uncertainty over ownership would have resulted in that. Nevertheless, investors should be prepared for near to medium term loss of business momentum.

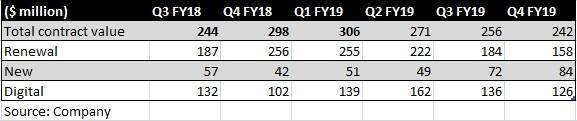

There is also a genuine risk of deals not fructifying as the founders were the face of the company to the clients. So, there may be a couple of quarters of deceleration until clients get the requisite comfort with the new management.

While the management (the founders) of Mindtree had been sounding positive on the deal pipeline and win rates, the same was not getting reflected in the deal wins, which looked a tad soft in recent times. So, a couple of weak quarters along with transition pangs impacting numbers cannot be ruled out.

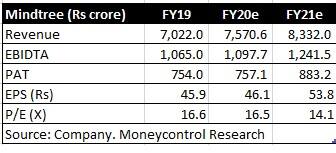

We expect the stress case earnings of the company to grow at 8 percent CAGR (compounded annual growth rate) as against 15 percent under our ‘blue sky’ assumptions.

At the current price, Mindtree trades at 14.1X FY21e earnings, at a discount to the valuation of L&T Infotech. While the subdued earnings and management transition may keep the stock price softer for a little longer, given the possibility of eventual merger with LTI and the fundamental strength that Mindtree possesses (as highlighted above) coupled with the strength of L&T as a promoter, investors should start accumulating the stock gradually.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!