Indian market ended in the red on September 27, tracking weakness in other Asian markets.

The 30-share Sensex closed the day with a loss of 167 points, or 0.43 percent, at 38,822.57, with 20 stocks in the red, while the Nifty50 finished 59 points, or 0.51 percent, lower at 11,512.40. Among the 50 stocks in the index, 39 suffered losses.

"Mixed global cues in the wake of rising political uncertainty in the US and lingering uncertainty surrounding the US-China trade war hurt sentiments," said global financial firm Standard Chartered in a note.

However, both Sensex and Nifty gained over 2 percent for the week after Finance Minister Nirmala Sithamraman slashed the corporate tax rate on September 20.

Experts are of the view that the market may see some consolidation due to sharp gains during the previous week.

"Given the gigantic rally, the market is expected to cool down till the beginning of the result season," said Jimeet Modi, Founder & CEO of SAMCO Securities & StockNote.

"The Government has started hustling after taking a huge hit on its yearly revenue of Rs 1,45,000 lakh crore. The hunt for getting back the money from other sources has heightened and the divestment programs have been revived. This will bring vibrancy in capital markets and at the same time, suck away liquidity from the bourses which is a negative for the stock market," he added.

The Nifty50 has begun the consolidation phase after a massive rally. All short-term indicators have moved to overbought levels which cap the upside for the time being.

"Short interests have reduced with the month-end expiry and therefore significant upside is not expected in the near-term. A 50 percent retracement is expected before any fresh upmove. Traders can go long around 11,000-11,100 levels," Modi of SAMCO Securities said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 11,476.93, followed by 11,441.47. If the index starts moving up, key resistance levels to watch out for are 11,570.73 and 11,629.07.

Nifty Bank

Nifty Bank closed with a loss of 0.42 percent at 29,876.65. The important pivot level, which will act as crucial support for the index, is placed at 29,687.77, followed by 29,498.84. On the upside, key resistance levels are placed at 30,089.17 and 30,301.63.

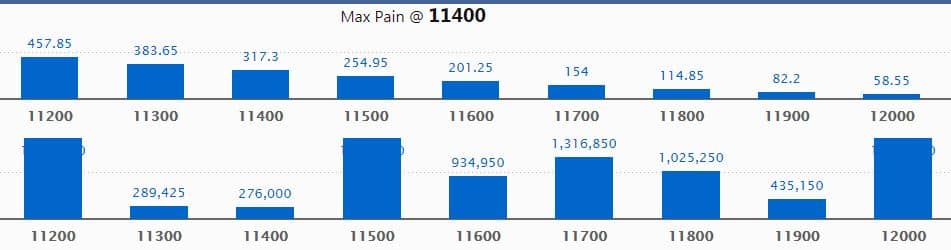

Call options data

Maximum call open interest (OI) of 17.26 lakh contracts was seen at the 11,500 strike price. It will act as a crucial resistance level in the October series.

This is followed by 11,200 strike price, which now holds 17.25 lakh contracts in open interest, and 12,000, which has accumulated 17.19 lakh contracts in open interest.

Significant call writing was seen at the 11,700 strike price, which added 3.13 lakh contracts, followed by 12,000 strike price that added 2.93 lakh contracts and 11,600 strike which added 1.55 lakh contracts.

Minor call unwinding was witnessed at 11,400 strike price, which shed 6,675 contracts, followed by 11,200 which shed 2,475 contracts.

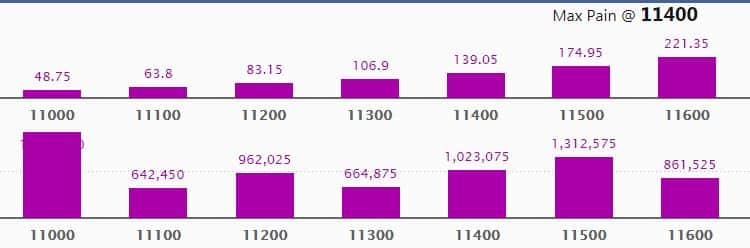

Put options data

Maximum put open interest of 18.24 lakh contracts was seen at 11,000 strike price, which will act as crucial support in October series.

This is followed by 11,500 strike price, which holds 13.13 lakh contracts in open interest, and 11,400 strike price, which has accumulated 10.23 lakh contracts in open interest.

Put writing was seen at the 11,500 strike price, which added 1.48 lakh contracts, followed by 11,000 strike, which added 1.37 lakh contracts.

Significant put unwinding was seen at 11,300 strike price, which shed 1.22 lakh contracts, followed by 11,400 strike which shed 27,825 contracts.

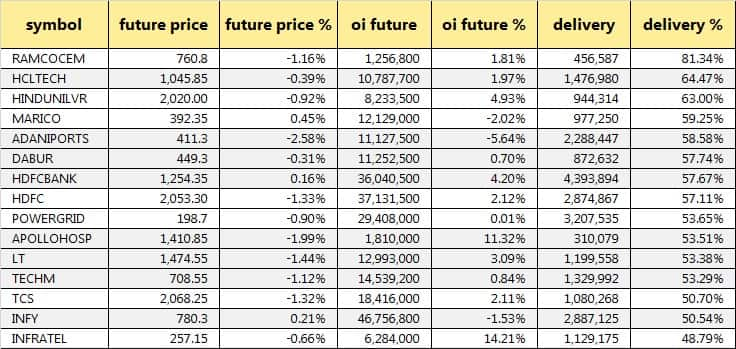

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

23 stocks saw long buildup

Overall, 23 stocks witnessed long buildup on September 27. Based on open interest (OI) future percentage, here are the top 15 stocks in which long buildup was seen.

30 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage, here are the top 15 stocks in which long unwinding was seen.

83 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 15 stocks in which short build-up was seen.

15 stocks witnessed short-covering

15 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering.

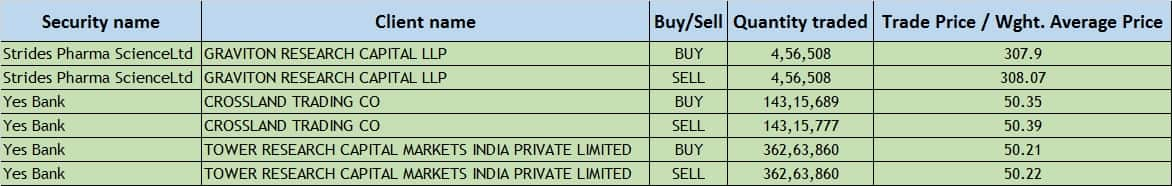

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings:

Authum Investment & Infrastructure: The board will meet on September 30 for general purpose.

Bombay Potteries & Tiles: The board will meet on September 30 for general purpose.

Cella Space: The board will meet on September 30 for general purpose.

Cian Healthcare: The board will meet on September 30 for general purpose.

Fraser and Company: The board will meet on September 30 for general purpose.

Gilada Finance & Investments: The board will meet on September 30 to consider issuance of preferential shares.

IL&FS Investment Managers: The board will meet on September 30 to consider the unaudited financial results for the quarter ended June 30, 2019.

Stocks in news:

Punjab & Sind Bank: The lender received Rs 787 crore from the government in connection with the capital infusion.

Syndicate Bank to adapt repo rate as external benchmark rate to link new floating rate loans.

Future Consumer: Unit acquired 50 percent stake in Genoa Rice Mills from the JV partner.

Voltas: Board approved the proposal for the merger by absorption of Universal Comfort Products Limited, wholly-owned subsidiary of the company, with Voltas.

KP Energy: Company aligned with CLP India Private Limited for developing a 250.8MW wind site at Dwarka for SECI Tranche-VIII bid.

63 Moons Technologies: NTT Data acquired 55.35% stake in Atom Technologies from 63 Moons.

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 213.6 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 458.68 crore in the Indian equity market on September 27, as per provisional data available on the NSE.

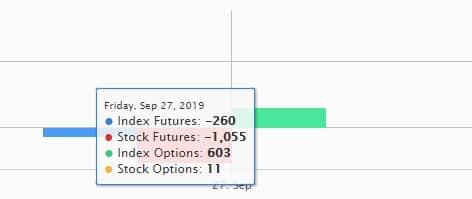

Fund flow

No stock under ban period on NSE

There is no stock under F&O ban for September 30. Securities in ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!