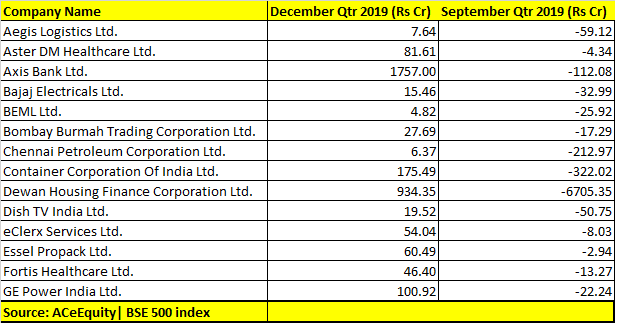

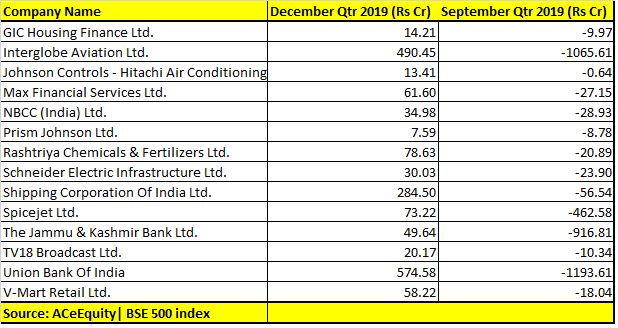

While the December quarter results were uninspiring for the D-Street, nearly 30 stocks in the BSE 500 index showed signs of a turnaround as they turned black on a quarter-on-quarter basis.

In December quarter, Nifty 50 companies reported a 3 percent fall in revenues, while net profit fell 5 percent on a year-on-year basis (excluding banks, financials, and Tata Motors), IndiaNivesh said in a report.

Metals were a drag on profits while banks, financials, and refiners pulled the profits up.

Turning profitable is an environment where demand is falling, it is indeed a positive sign but experts feel investors should not base their judgment on one-quarter performance and should ideally study the reason why it turned profitable – is it because of some adjustment or corporate tax cut, etc.

Stocks in the BSE 500 index that showed signs of a turnaround include Axis Bank, Bajaj Electricals, BEML, Dish TV, Fortis Healthcare, GE Power, InterGlobe Aviation and MAX Financial Services.

“On fundamental grounds stocks must not be judged on just one-quarter performance one must examine stock at broader horizon such as sectorial view, consistency in sales and profit, valuation,” Ritesh Asher - chief strategy officer at KIFS Trade Capital told Moneycontrol.

What should investors do?

Stocks which have turned profitable can be considered to be shortlisted stocks but not all stocks which have turned black can be good buys, suggest experts.

“Shares have fared well on PAT basis in December quarter and thus we can see these stocks to have green shoots and will fare well in the foreseeable time to come,” Gaurav Garg, Head of Research at CapitalVia Global Research Limited- Investment Advisor told Moneycontrol.

“Any dip in these quality stocks may be a good investment opportunity. Stocks like Axis bank, BEML are long term buys and should be added to the portfolio in any correction,” he said.

Ajit Mishra, VP Research, Religare Broking is of the view that Axis bank is one of the largest private banks in India with a strong deposit franchise and constant focus on new customer acquisition.

“Also, Aster DM is an emerging healthcare provider in India, which is consistently delivering good numbers and has also announced a buyback recently. Container Corp could also do well in the long-term with expansion in rail infrastructure (double-rack model) and entry into new segments such as coastal shipping, distribution and other value-added services,” he said.

Small & Midcaps shine:

Small and midcaps reported better Q3 earnings as many companies gave strong bottom line number due to the slashed corporate tax rate, suggest experts.

Most of the companies in the BSE 500 index which have shown signs of a turnaround are from the broader market space.

There are more than 40 companies in the smallcap index which turned profitable in December quarter on QoQ basis that include names like Aegis Logistics, Aster DM, Bombay Burmah, DHFL, Essel Propack, Novartis India, Opto Circuits, etc. among others.

“Smallcap Index has a high potential for growth and thus can give a good opportunity of Value Investing-Aster DM Healthcare Ltd., Bombay Burmah Trading Corporation Ltd., Essel Propack Ltd., Johnson Controls - Hitachi Air Conditioning India Ltd., PNB Gilts Ltd., RattanIndia Power Ltd,” said Garg of CapitalVia Global Research Limited- Investment Advisor.

“All these companies’ quarterly results have exponentially grown in December and thus more bullish expectations are piling up which will help these stocks propel forward,” he said.

Small-cap stocks that have started performing have a better future outlook and the ability to outperform the benchmark index. Currently, the smallcap stock has given 40 percent rally from the lows but if we look at the bigger picture there is still some space left for further growth, suggest experts.

“In the small-cap space we bet on V-Mart as the stock has managed to outperform irrespective of broader trends and still have some space left, also the stock have a relatively strong balance sheet that will allow the company to invest further in growth,” Asher of KIFS Trade Capital.

“Fortis Healthcare is also good bet as the stock has shown consistent operational performance in terms of occupancy and ARPOB at hospitals with rising EBITA margins as well as diagnostics led by cost rationalization and operating leverage,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!