The market has witnessed a pleasant move through the week ended December 30, after the havoc from the previous week. The firm recovery from the lows of 17,800 showcased the resilience of the bulls and made a merry Santa rally to close the year on a cheerful note. The benchmark index Nifty50 snapped three consecutive weeks of sell-off and concluded the week with gains of over 1.60 percent at 18,105.

After the recent price-wise correction in the market, the chart structure construes optimism, and it is highly anticipated to continue the cheerful run in the new calendar year. The broad-based buying in the last week has levitated market sentiments and can be seen as a sign of progression as we outclass our major global peers.

As far as levels are concerned, 18,000 is expected to cushion any short-term blip, with the sacrosanct support placed around 17,800 for the time being. While on the higher end, a decisive move above 18,400-18,450 would affirm the continuation of the uptrend in the market.

Going forward, we remain sanguine with the current momentum and would advocate the traders to utilize the dips to add long positions in the index in the comparable period.

Simultaneously, one should stay abreast with global and domestic developments regularly and continue with a buy on decline strategy for the time being.

Also, we expect strong moves in the broader market, so one needs to have a stock-centric approach for better trading opportunities.

Here are two buy calls for next 2-3 weeks:

Titan Company: Buy | LTP: Rs 2,597.50 | Stop-Loss: Rs 2,475 | Target: Rs 2,720-2,760 | Return: 6 percent

Titan has seen a strong spurt from its 200-EMA (exponential moving average), backed by notable volumes on the daily chart, signifying positive development on the counter.

On a technical aspect, the stock has witnessed a positive crossover on the 14-day RSI (relative strength index) from the oversold region, adding to the bullish quotient.

Hence, we recommend to buy Titan Company for a target of Rs 2,720-2,760.

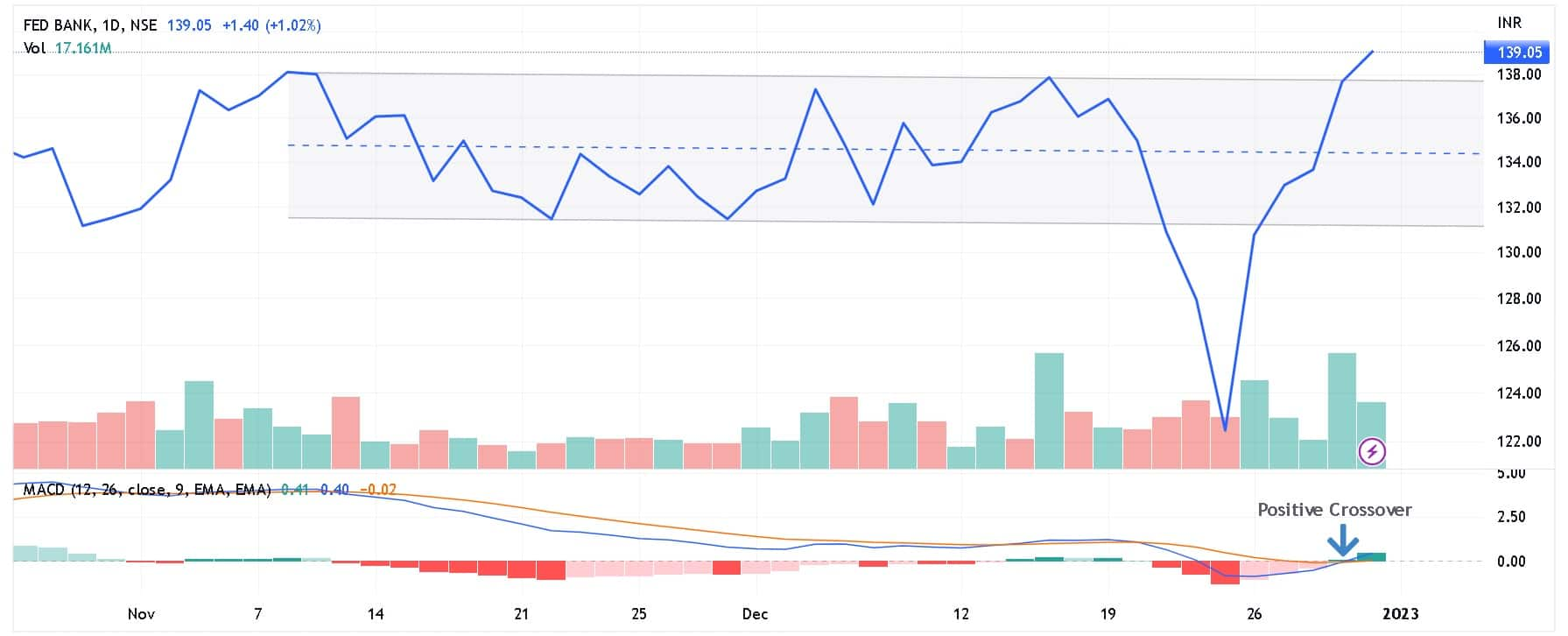

Federal Bank: Buy | LTP: Rs 139 | Stop-Loss: Rs 132 | Target: Rs 148-150 | Return: 8 percent

Federal Bank is in a secular up trend and is hovering in a cycle of higher highs – higher lows, indicating inherent strength in the counter. The stock is placed well above all its major moving averages on the daily time frame, which adds up to the ongoing momentum.

The primary indicators align with the trend suggesting a continuation in the movement in a comparable period. Hence, we recommend to buy Federal Bank for a target of Rs 148-150.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!