Sensex, in a little more than last two years, gained a whopping 10,000 points despite a number of headwinds viz. NPA crisis, liquidity crunch, an economic slowdown, trade wars, etc.

Sensex closed above 30,000 for the first time on April 26, 2017 and it ended above 40,000 for the first time on June 3, 2019—taking barely 25 months for achieving the milestone.

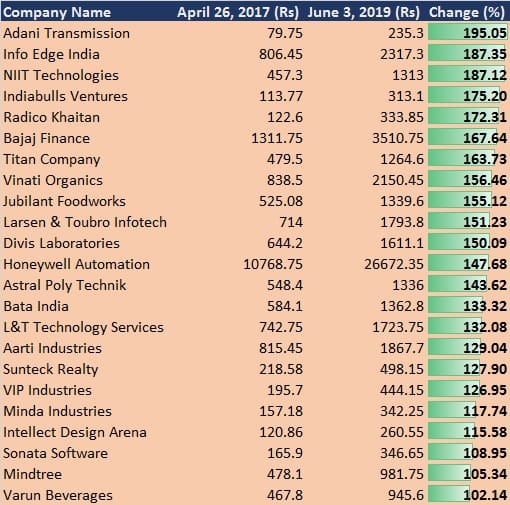

In the period, 23 stocks among BSE500 companies more than doubled their investors' wealth. They include Adani Transmission, Info Edge, Jubilant Foodworks, Divi's Labs, Bata India, L&T Technology, Mindtree, Varun Beverages, Bajaj Finance and Titan Company.

Among the Sensex stocks, only Bajaj Finance could give more than 100 percent return during the time index travelled from 30,000 to 40,000. It surged 167 percent in the given period.

Table: 23 BSE500 stocks that gave more than 100 percent returns in the last 25 months.

Most experts see the rally to continue in coming years as they expect NDA government to carry on implementing reforms announced in its first term at the centre.

"We believe a broad-based rally in the stock market is likely for the next 2-3 years. Most of the measures undertaken by the NDA government in the past five years was for building the foundations for long-term growth through the cleansing exercise, implementation of key policies like GST and others. Now, a host of other measures announced in their election manifesto is likely to boost the equity market," Stewart & Mackertich said.

According to the brokerage, fast economic policy decisions and reforms, implementation of projects and the transmission of earlier reforms are likely to boost employment, productivity and growth in the country.

Axis Capital also said the key to the virtuous cycle is strong public investment push over the next two years without any speed breakers like demonetisation, which can propel Nifty to 15,000.

Last month, Morgan Stanley had said it has set June 2020 target for Sensex at 45,000, which assumes resolution to the ongoing strain in the financial sector via liquidity infusion and continuing fiscal discipline.

The global brokerage house also expects inflation framework (low food prices and positive real rates), fiscal consolidation, infrastructure spending, FDI focus and strong foreign policies to continue. However, the risk for equities are mostly global including crude oil, US Fed and trade tension, it said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!