The market remained volatile in the week gone by with Nifty rebounding sharply after taking support near its long-term 200-DMA which is placed at 10,850 levels on the daily chart.

For the past week, benchmark indices - Sensex and Nifty - rallied over 1 percent each. The S&P BSE Smallcap index rallied nearly 5 percent while the S&P BSE Midcap index closed with gains of over 3 percent.

Experts pointed out that Nifty continued to make a higher top and a higher bottom formation on the daily chart, which indicates that the recent low of 10,880 will act as crucial support whereas the immediate resistance of a previous swing is placed at 11,341.

"Looking at weekly closing in the Nifty index, the overall setup looks positive and a decisive move beyond 11,350 levels will provide further momentum towards 11,400-11,500 levels in the coming weeks," said Nilesh Ramesh Jain, derivatives and technical analyst at Anand Rathi.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

In the previous trading session on August 7, Nifty closed 14 points, or 0.12 percent, higher at 11,214.05. According to pivot charts, the key support level for the Nifty is placed at 11,160.03, followed by 11,106.07. If the index moves up, the key resistance levels to watch out for are 11,249.93 and 11,285.87.

Nifty Bank

The Nifty Bank index closed 0.51 percent higher at 21,754. The important pivot level, which will act as crucial support for the index, is placed at 21,541.13, followed by 21,328.27. On the upside, key resistance levels are placed at 21,877.03 and 22,000.06.

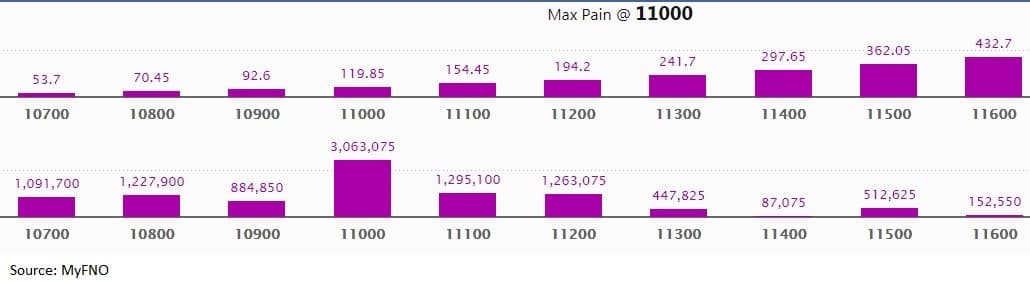

Call option data

Maximum call OI of nearly 22.04 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 11,300, which holds 10.97 lakh contracts, and 11,200 strikes, which has accumulated 10.86 lakh contracts.

Call writing was seen at 11,500, which added 98,775 contracts, followed by 11,600 strikes, which added 62,400 contracts.

Call unwinding was seen at 11,000, which shed 80,550 contracts, followed by 10,800 strikes, which shed 7,950 contracts.

Put option data

Maximum put OI of 30.63 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 11,100, which holds 12.95 lakh contracts, and 11,200 strikes, which has accumulated 12.63 lakh contracts.

Put writing was seen at 10,800, which added 96,675 contracts, followed by 10,900 strikes, which added 93,825 contracts.

Put unwinding was witnessed at 11,500, which shed 37,575 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

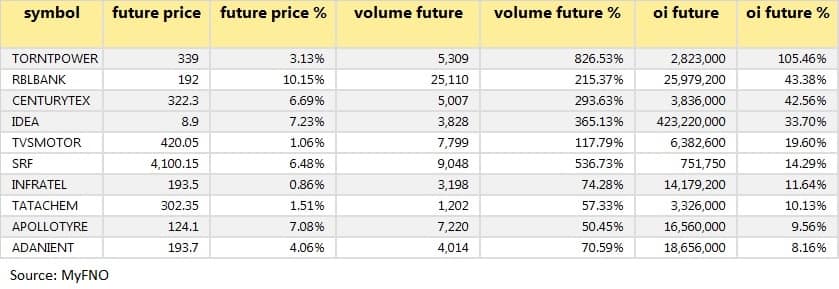

54 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

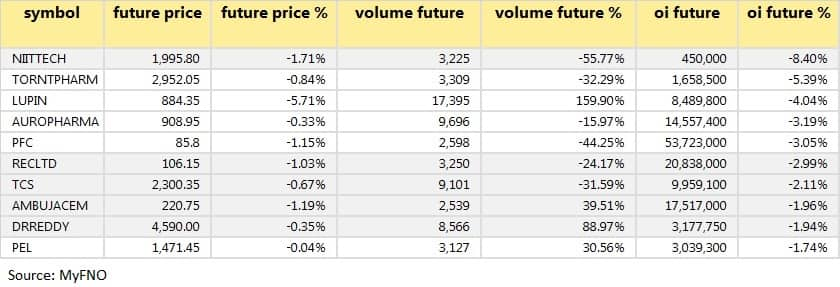

19 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

31 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

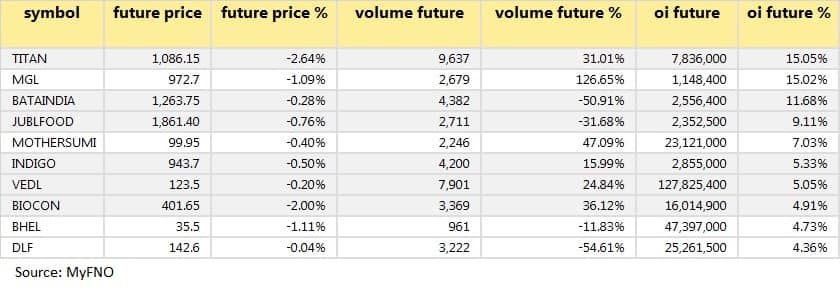

36 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Results on August 10

Bank of Baroda, Power Grid Corporation, Titan Company, Astrazeneca Pharma, Ujjivan Financial Services, CARE Ratings, Equitas Holdings, Force Motors, etc.

Stocks in the news

REC Q1: Profit at Rs 1,845.3 crore versus Rs 1,509 crore, revenue at Rs 8,446.7 crore versus Rs 6,815.3 crore YoY.

Punjab & Sind Bank Q1: Loss at Rs 117 crore versus loss Rs 30.3 crore, NII at Rs 537.22 crore versus Rs 567.6 crore YoY.

Amber Enterprises India Q1: Loss at Rs 23.9 crore versus profit Rs 64.3 crore, revenue at Rs 259.5 crore versus Rs 1,236 crore YoY. Board approved fundraising of up to Rs 500 crore.

Nucleus Software Exports Q1: Profit at Rs 36.33 crore versus Rs 16.57 crore, revenue at Rs 128.35 crore versus Rs 124.05 crore YoY.

JSW Steel: Promoter Danta Enterprises released 3 lakh pledged shares.

Phoenix Mills Q1: Loss at Rs 52 crore versus profit Rs 153.7 crore, revenue at Rs 134.7 crore versus Rs 615 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 397.32 crore while domestic institutional investors (DIIs) sold shares worth Rs 438.62 crore in the Indian equity market on August 7, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Four stocks - Canara Bank, Century Textiles, Vodafone Idea and Vedanta - are under the F&O ban for August 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!