Sensex and Nifty settled with gains for the second consecutive day on May 28 amid reports of reopening of more economies and a bigger than expected stimulus plan for the European Union.

Sensex closed 595 points, or 1.88 percent, higher at 32,200.59 while Nifty settled 175 points, or 1.88 percent, up at 9,490.10.

"Nifty has managed to surpass its immediate and crucial hurdle at 9,450 so it may be heading towards 9,650-9,750 levels. We feel banking and financials will continue to play a critical role. Amid all, market participants are likely to keep a watch on GDP data scheduled on May 29 while on the global front any news on US-China tussle will be on investors’ radar. Further, the on-going earning season would keep stock-specific volatility high," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,380.65, followed by 9,271.2. If the index moves up, key resistance levels to watch out for are 9,555.4 and 9,620.7.

Nifty Bank

The Nifty Bank closed 2.45 percent lower at 19,169.80. The important pivot level, which will act as crucial support for the index, is placed at 18,840.6, followed by 18,511.4. On the upside, key resistance levels are placed at 19,477.3 and 19,784.8.

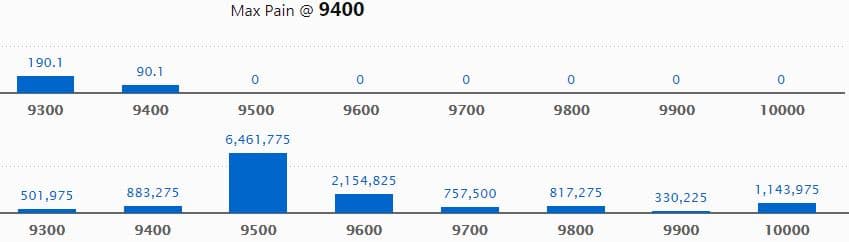

Call option data

Maximum call OI of 64.62 lakh contracts was seen at 9,500 strike, which will act as crucial resistance in the June series.

This is followed by 9,600, which holds 21.55 lakh contracts, and 10,000 strikes, which has accumulated 11.44 lakh contracts.

Significant call writing was seen at the 9,500, which added 36.71 lakh contracts, followed by 9,600 strikes that added 9.62 lakh contracts.

Call unwinding was witnessed at 9,300, which shed 14.63 lakh contracts, followed by 9,400 strike, which shed 7.29 lakh contracts.

Source: MyFNO

Source: MyFNO

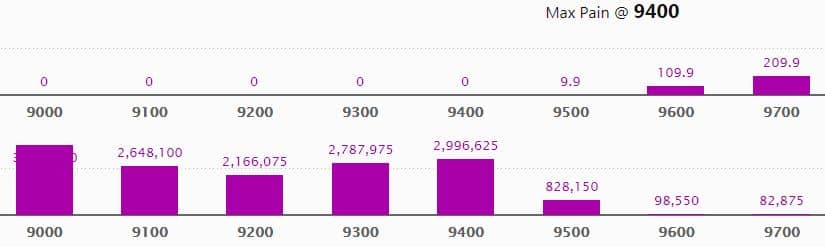

Put option data

Maximum put OI of 37.54 lakh contracts was seen at 9,000 strike, which will act as crucial support in the June series.

This is followed by 9,400, which holds nearly 30 lakh contracts, and 9,300 strikes, which has accumulated 27.88 lakh contracts.

Significant Put writing was seen at 9,400, which added 26.58 lakh contracts, followed by 9,300 strikes, which added 12.18 lakh contracts.

Put unwinding was seen at 9,000, which shed 6.27 lakh contracts, followed by 10,000 strikes that shed 42,075 contracts.

Source: MyFNO

Source: MyFNO

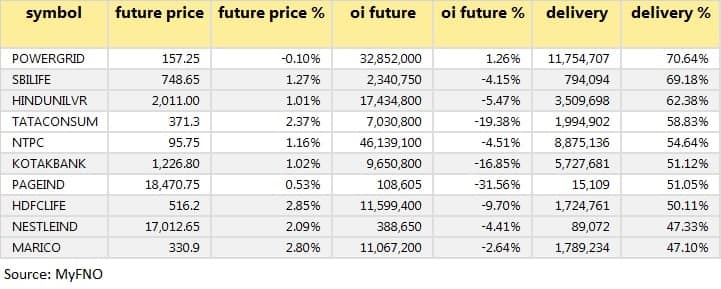

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

104 stocks saw long build-up

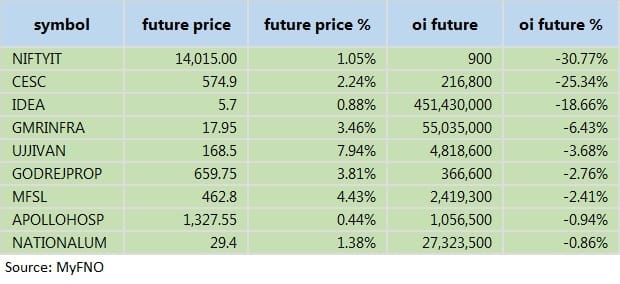

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

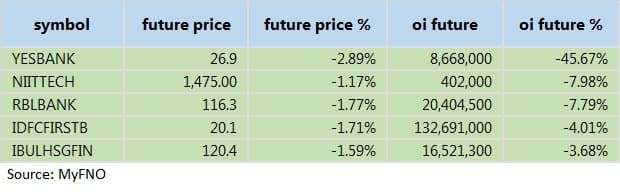

5 stocks saw long unwinding

29 stocks saw short build-upA decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

9 stocks saw short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

Rollovers

Results on May 29

Voltas, Dilip Buildcon, Equitas Holdings, Jubilant Life Sciences, KEC International, Metropolis Healthcare, RCF, Symphony, 3M India, Andhra Paper, Citadel Realty, Everest Industries, Jagran Prakashan, Lemon Tree Hotels, Majesco, NCC, Procter & Gamble Healthcare, Ponni Sugars (Erode), Shree Rama Newsprint, Sagar Cements, Shipping Corporation of India, Shaily Engineering, Sundaram-Clayton, Sundaram Finance, Trigyn Technologies, V-Mart Retail

Stocks in the news

NIIT Technologies: Company's Rs 337.46 crore buyback issue will open on May 29.

Reliance Industries: May 29 will be the final trading day for RIL Rights Entitlement. (Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.)

Yes Bank: The bank will not be available for trading in Futures & Options segment from May 29.

KPIT Technologies: CLS Investments LLC bought 19,99,998 shares at Rs 46.91 per share.

Aksh Optifibre: Board approved the appointment of Sudhir Kumar Jain as Chief Financial Officer.

Cadila Healthcare: Formulations manufacturing unit at Baddi received an Establishment Inspection Report (EIR) from USFDA.

Automobile Corporation of Goa Q4: Loss at Rs 0.35 cr versus profit at Rs 3.65 cr, revenue at Rs 75.4 crore versus Rs 107.4 cr YoY.

CEAT Q4: Profit at Rs 51.88 cr versus Rs 64.25 cr, revenue at Rs 1,573.4 cr versus Rs 1,760.5 cr YoY.

Union Bank of India: Prafulla Kumar Samal nominated as Chief Financial Officer.

Bulk deals

(For more bulk deals, click here)

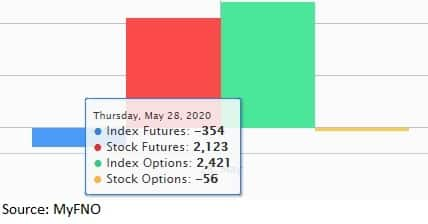

Fund Flow Picture

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth net Rs 2,354.14 crore, while Domestic Institutional Investors (DIIs), too, bought net Rs 144.83 crore worth of shares in the Indian equity market on May 28, as per provisional data available on the NSE.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!