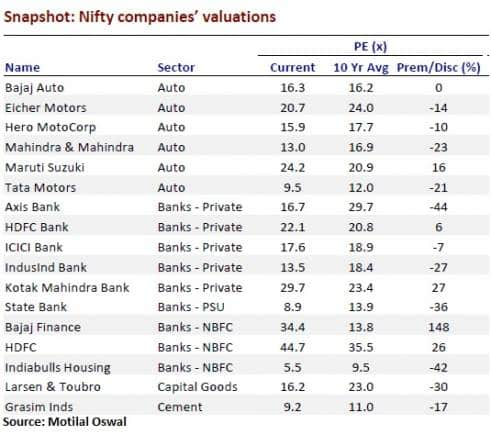

Despite being a fair distance away from record-high levels, Nifty's slow but steady rise toward 12,000 is good news for the Indian markets especially as more than 50 percent of the stocks in the index are available at attractive valuations.

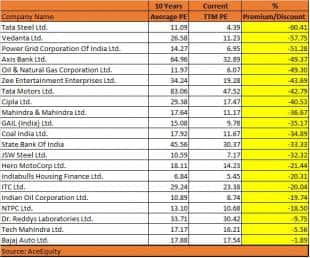

About 23 companies, or nearly 50%, of the Nifty50 universe is trading at a discount to their 10-year P/E multiple, data from Motilal Oswal and AceEquity showed. These include Tata Steel, ONGC, Coal India, NTPC, JSW Steel, IOC, Gail India, Axis Bank, Power Grid, among others.

Even though the valuations appear mouthwatering, the questions remains– should you buy around these levels or one should stay put or avoid getting into these stocks altogether?

Investors must note that even though these stock appear attractive based on numbers, the fundamentals may present a different story. Most experts we spoke to opined that investors should tread cautiously when it comes to these stocks.

A Price-to-Earnings ratio or PE value the company is a ratio of current market price to its earnings per share. It also referred to as multiple. This measure of valuing the company is used by investors to filter out stocks for investment.

The golden rule of investment is to pour money in stocks that are trading at attractive levels compared to their intrinsic value, thus allowing investors to create wealth over a period of time.

“We would advise not to go by only the price decline from average price as average can shift further below. Key is to look at what are the business ecosystem that can drift the positives turn profitable for the company and how it reflects on share price,” Pritam Deuskar, Fund Manager, Bonanza Portfolio Ltd told Moneycontrol.

“Today, it looks like as if the pharma sector has bottomed out but when it will start working nobody knows. The kind of infra spending, smart cities, airports, and construction budget till 2030 will come out, for sure some of these companies will benefit,” he said.

Well, markets are built on hope and everything gets priced well in advance. Fundamentally speaking, individual stock fundamentals and business developments matter more than just the price of the stock. Should investors bottom fish in some of these names?

“One has to carry out stock-specific analysis while bottom fishing stocks which are trading at a discount to their historical averages,” Dinesh Rohira, CEO & Founder 5nance.com told Moneycontrol.

“Many of these stocks are cyclical, like Tata Steel, JSW Steel, ONGC and Coal India. These stocks are driven by their commodity-related specifics. Sustainable growth plays an important role while ascertaining a stock’s fundamentals. Sun Pharma and Zee have been in the news for corporate governance reasons, one of them might be out of the woods,” he said.

How relevant are long term averages?

Long term moving averages define the price action of a security. It is a good tool to use while analyzing market movements as valuations are key while analyzing indexes, suggest experts.

The golden rule is that if the index is trading at a significant premium above the moving average then it might be a good time to sell, and vice-versa. But, it should be used with other parameters such as price to book value, as well as moving averages.

“Buying stocks that are trading at deep discounts to long term moving average works better when this happens in cyclical industries. Moving averages like 200 DMA & 30 DMA acts as a general indicator of long term and short term trends,” Romesh Tiwari, Head of Research, CapitalAim told Moneycontrol.

“It must be used with other parameters like PE ratio and Price to book value to make long term buying and selling decisions in quality stocks,” he said.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!