Newsletters Newsletters |

ETtech Bytes on 25 Jan. 2021: Top 5 Tech News Today, in 10 Minutes

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Newsletters

We'll soon meet in your inbox.

Good evening, ETtech reader.

Tata Consultancy Services (TCS) has overtaken Accenture as the world’s most-valued IT services firm. India plans to permanently ban the 59 Chinese apps it blocked in June 2020. Among those is TikTok.

In the Delhi High Court today, the government said that WhatsApp, with its new and contentious privacy policy, is treating Indians differently than Europeans. PE-VC hirings in India didn’t slow down during the Covid-19 crisis.

Here’s a look at the must-read, top tech news this evening.

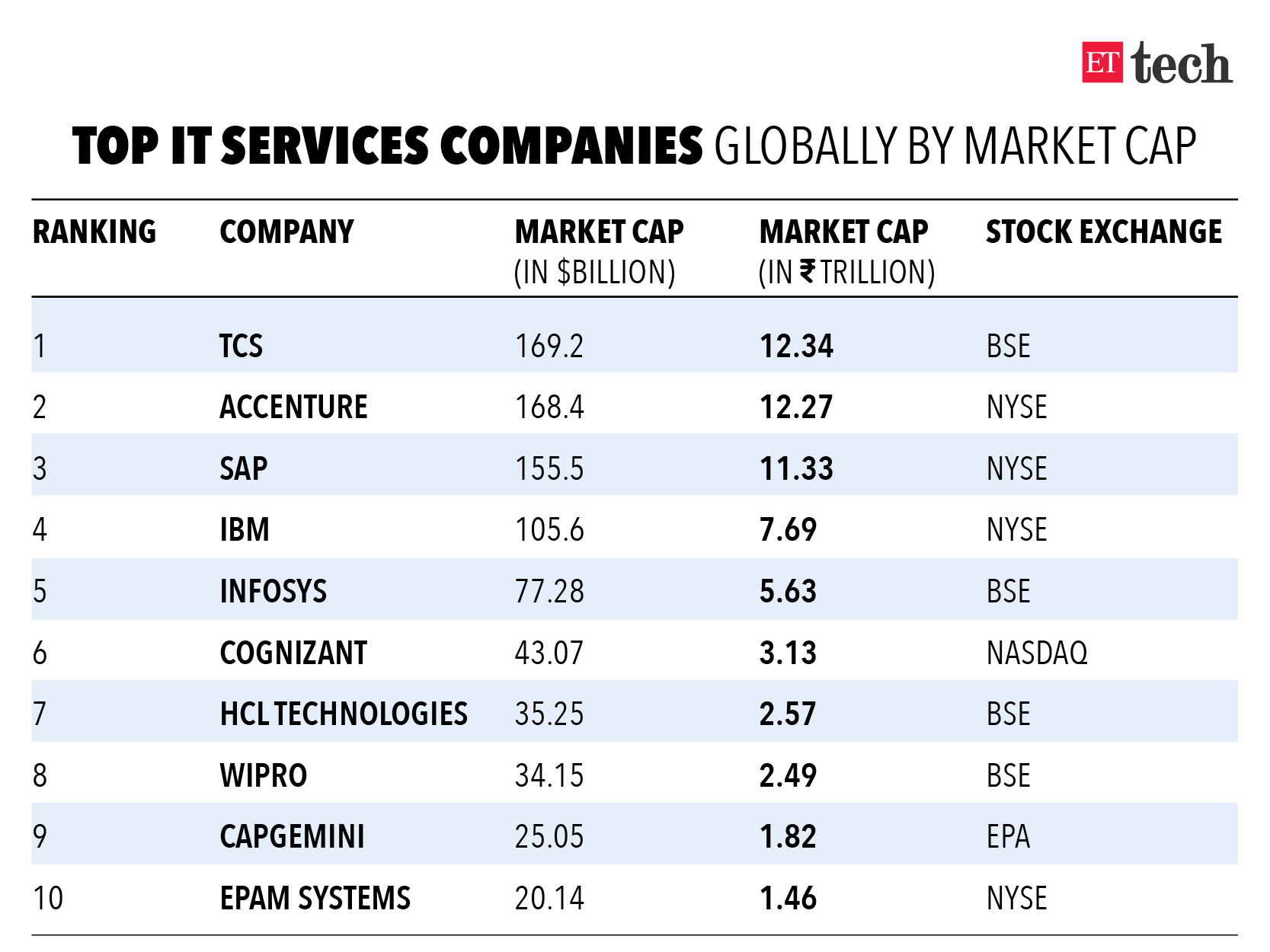

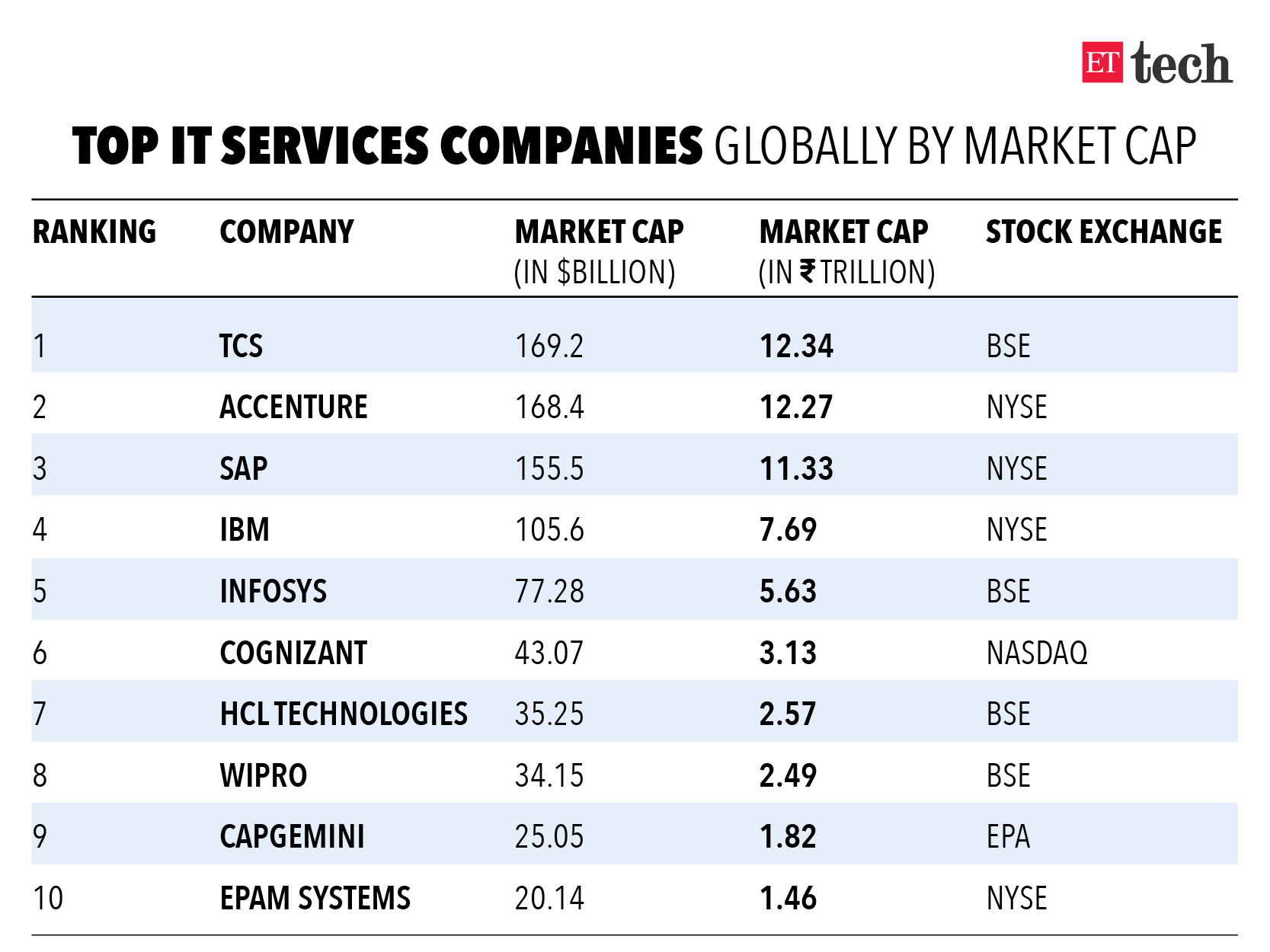

1. TCS overtakes Accenture as most-valued IT firm globally

Tata Consultancy Services Ltd. (TCS) on Monday eclipsed Accenture Plc to become the world’s largest IT company by market cap. In the process, it also became India’s most valuable company, overtaking Reliance Industries Ltd. (RIL) after 11 months.

The New York Stock Exchange, where Accenture is listed, is yet to open for trade on Monday.

In numbers: TCS’ share price fell 0.40% Rs 3,290 apiece — on the BSE today, imparting the country’s largest software services exporter a market cap of $169.2 billion, or Rs 12.34 lakh crore. Accenture is currently valued at $168.4 billion, or Rs 12.27 lakh crore, on the NYSE. RIL’s market cap is currently at $168.5 billion, or Rs 12.29 lakh crore.

2. India to permanently ban 59 Chinese apps, including TikTok

India has issued new notices to 59 Chinese apps, including TikTok, seeking to permanently ban them in the country.

Backstory: India had in June last year outlawed 59 Chinese apps — including TikTok, Shareit and UC Browser — citing security concerns amid the border standoff with China along the Line of Actual Control in Ladakh. In September, the central government banned an additional 118 Chinese-owned apps, including the popular game PUBG, on concerns over “stealing” user data and for engaging in activities prejudicial to the country’s “sovereignty and integrity”.

Why it matters: Chinese apps had an estimated 300 million unique users in India before these bans, which essentially meant that two-thirds of about 450 million smartphone users in India used at least one Chinese app.

Meanwhile, a rival of TikTok’s parent Bytedance Inc. in China is aiming to raise up to $5.5 billion in the largest initial public offering in Hong Kong for more than a year, Reuters reported. The IPO will value Kuaishou Technology, backed by Tencent Holdings, between $55.6 billion and $60 billion pre-greenshoe, the report said.

3. ‘WhatsApp treating Indian users differently from Europeans’

WhatsApp is treating Indian users differently from Europeans over opting out of its new privacy policy, the government told the Delhi High Court on Monday.

Why it matters: This comes days after the Ministry of Electronics and Information Technology (MeitY) asked instant messaging app WhatsApp to immediately “withdraw” its proposed privacy policy changes. The government has also questioned the timing of the company’s “momentous change” to (its privacy policy) even as the Parliament prepares to finalise the country’s Personal Data Protection Bill.

WhatsApp had deferred the implementation of its new privacy policy to 15 May from 8 February after backlash from users who switched to rival messaging apps such as Signal.

Meanwhile, Atmanirbhar Digital India Foundation, a newly formed industry association of homegrown startups, has alleged that WhatsApp’s recent privacy policy update is a looming threat to the payments and financial data of users and has sought greater oversight from the authorities.

4. PE-VC hiring in a pandemic year

Hiring by global and domestic private equity and venture capital firms in India rose to the highest in five years in 2020, according to data by staffing firm Native (previously VitoAltor).

What’s happening: Native has successfully closed more than 50 searches across PE, VC and portfolio hiring over the last one year. It is currently running over 15 CXO searches across various marquee fund portfolios.

Why it matters: 2020 was supposed to be a washout year with the Indian economy coming to a standstill amid a raging pandemic and the resultant lockdowns. About 51% of the PE-VC churn happened within global funds with almost 31% hires in growth funds. The data showed a 45% increase in hiring activity at the mid-level.

And it’s not just PE funds that are ramping up hiring. Startups too are looking to increase their headcounts. Companies that graduated to being unicorns in 2020 are on the prowl to ramp up hiring across product, tech, engineering, sales, operations, and data sciences teams in 2021.

5. ETtech Done Deals

■ Clubhouse, one of Silicon Valley's buzziest social media products, has raised fresh funds in a Series B funding round led by Andreessen Horowitz, a US venture capital firm, at a reported valuation of $1 billion. If true, that’s a ten-fold jump since its last funding round in May.

The audio-only platform, which is still in invite-only mode, plans to use the funds for a global rollout later this year. The company, which currently has only an iOS app, will soon begin work on an Android app, as well as adding more accessibility and localisation features.

■ Mpower Financing, an education-loan provider to international students, has raised $25 million from US-based investment management firm Tilden Park Capital Management. The company plans to use the funds to invest in technology and automate its digital loan platform further, as well as for marketing and expanding its team in Bengaluru and Washington, DC.

■ Revfin, an advanced digital consumer lending platform, today announced that it has received funding from Shell Foundation in partnership with electric vehicle operator, SmartE. The funds will be utilised for extending new loans for electric 3-wheelers operating on SmartE’s platform.

Tata Consultancy Services (TCS) has overtaken Accenture as the world’s most-valued IT services firm. India plans to permanently ban the 59 Chinese apps it blocked in June 2020. Among those is TikTok.

In the Delhi High Court today, the government said that WhatsApp, with its new and contentious privacy policy, is treating Indians differently than Europeans. PE-VC hirings in India didn’t slow down during the Covid-19 crisis.

Here’s a look at the must-read, top tech news this evening.

1. TCS overtakes Accenture as most-valued IT firm globally

Tata Consultancy Services Ltd. (TCS) on Monday eclipsed Accenture Plc to become the world’s largest IT company by market cap. In the process, it also became India’s most valuable company, overtaking Reliance Industries Ltd. (RIL) after 11 months.

The New York Stock Exchange, where Accenture is listed, is yet to open for trade on Monday.

In numbers: TCS’ share price fell 0.40% Rs 3,290 apiece — on the BSE today, imparting the country’s largest software services exporter a market cap of $169.2 billion, or Rs 12.34 lakh crore. Accenture is currently valued at $168.4 billion, or Rs 12.27 lakh crore, on the NYSE. RIL’s market cap is currently at $168.5 billion, or Rs 12.29 lakh crore.

2. India to permanently ban 59 Chinese apps, including TikTok

India has issued new notices to 59 Chinese apps, including TikTok, seeking to permanently ban them in the country.

Backstory: India had in June last year outlawed 59 Chinese apps — including TikTok, Shareit and UC Browser — citing security concerns amid the border standoff with China along the Line of Actual Control in Ladakh. In September, the central government banned an additional 118 Chinese-owned apps, including the popular game PUBG, on concerns over “stealing” user data and for engaging in activities prejudicial to the country’s “sovereignty and integrity”.

Why it matters: Chinese apps had an estimated 300 million unique users in India before these bans, which essentially meant that two-thirds of about 450 million smartphone users in India used at least one Chinese app.

Meanwhile, a rival of TikTok’s parent Bytedance Inc. in China is aiming to raise up to $5.5 billion in the largest initial public offering in Hong Kong for more than a year, Reuters reported. The IPO will value Kuaishou Technology, backed by Tencent Holdings, between $55.6 billion and $60 billion pre-greenshoe, the report said.

3. ‘WhatsApp treating Indian users differently from Europeans’

WhatsApp is treating Indian users differently from Europeans over opting out of its new privacy policy, the government told the Delhi High Court on Monday.

Why it matters: This comes days after the Ministry of Electronics and Information Technology (MeitY) asked instant messaging app WhatsApp to immediately “withdraw” its proposed privacy policy changes. The government has also questioned the timing of the company’s “momentous change” to (its privacy policy) even as the Parliament prepares to finalise the country’s Personal Data Protection Bill.

WhatsApp had deferred the implementation of its new privacy policy to 15 May from 8 February after backlash from users who switched to rival messaging apps such as Signal.

Meanwhile, Atmanirbhar Digital India Foundation, a newly formed industry association of homegrown startups, has alleged that WhatsApp’s recent privacy policy update is a looming threat to the payments and financial data of users and has sought greater oversight from the authorities.

4. PE-VC hiring in a pandemic year

Hiring by global and domestic private equity and venture capital firms in India rose to the highest in five years in 2020, according to data by staffing firm Native (previously VitoAltor).

What’s happening: Native has successfully closed more than 50 searches across PE, VC and portfolio hiring over the last one year. It is currently running over 15 CXO searches across various marquee fund portfolios.

Why it matters: 2020 was supposed to be a washout year with the Indian economy coming to a standstill amid a raging pandemic and the resultant lockdowns. About 51% of the PE-VC churn happened within global funds with almost 31% hires in growth funds. The data showed a 45% increase in hiring activity at the mid-level.

And it’s not just PE funds that are ramping up hiring. Startups too are looking to increase their headcounts. Companies that graduated to being unicorns in 2020 are on the prowl to ramp up hiring across product, tech, engineering, sales, operations, and data sciences teams in 2021.

5. ETtech Done Deals

■ Clubhouse, one of Silicon Valley's buzziest social media products, has raised fresh funds in a Series B funding round led by Andreessen Horowitz, a US venture capital firm, at a reported valuation of $1 billion. If true, that’s a ten-fold jump since its last funding round in May.

The audio-only platform, which is still in invite-only mode, plans to use the funds for a global rollout later this year. The company, which currently has only an iOS app, will soon begin work on an Android app, as well as adding more accessibility and localisation features.

■ Mpower Financing, an education-loan provider to international students, has raised $25 million from US-based investment management firm Tilden Park Capital Management. The company plans to use the funds to invest in technology and automate its digital loan platform further, as well as for marketing and expanding its team in Bengaluru and Washington, DC.

■ Revfin, an advanced digital consumer lending platform, today announced that it has received funding from Shell Foundation in partnership with electric vehicle operator, SmartE. The funds will be utilised for extending new loans for electric 3-wheelers operating on SmartE’s platform.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Newsletters

We'll soon meet in your inbox.