The Indian market started the week on a positive note, with Sensex and Nifty hitting fresh record highs, amid supportive global cues.

Reports of progress in the COVID-19 vaccine and healthy inflows by FII helped markets continue the upward trend.

Sensex closed 347 points, or 0.77 percent, higher at 45,426.97 and Nifty ended 97 points, or 0.73 percent, higher at 13,355.75 on December 7.

"We are seeing buying interest emerging on every dip, thanks to rotational participants across the sectors. Nifty could face a hurdle around 13,450. The stock-specific trading approach is yielding decent returns so far and we suggest continuing with the same. Also, keep a close watch on global markets and upcoming domestic macro data for cues," said Ajit Mishra, VP - Research, Religare Broking.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 13,276.3, followed by 13,196.8. If the index moves up, the key resistance levels to watch out for are 13,401 and 13,446.2.

Nifty Bank

The Bank Nifty climbed 159 points or 0.53 percent to close at 30,211.55 on December 7. The important pivot level, which will act as crucial support for the index, is placed at 29,990.07, followed by 29,768.53. On the upside, key resistance levels are placed at 30,393.67 and 30,575.73.

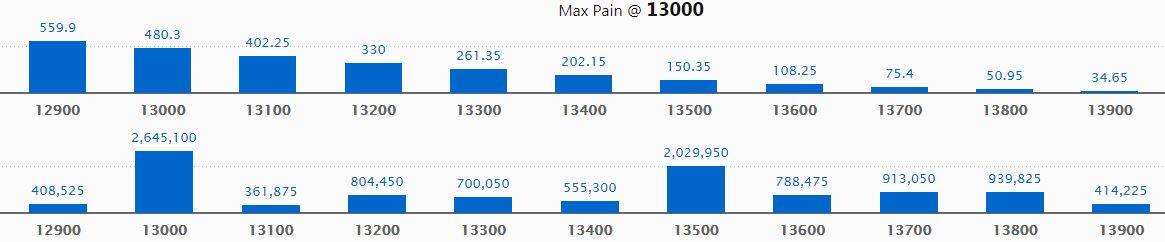

Call option data

Maximum Call open interest of 26.45 lakh contracts was seen at 13,000 strike, which will act as a crucial level in the December series.

This is followed by 13,500 strike, which holds 20.3 lakh contracts, and 13,800 strike, which has accumulated 9.4 lakh contracts.

Call writing was seen at 13,500 strike, which added 1.45 lakh contracts, followed by 13,700 strike which added 1.25 lakh contracts.

Call unwinding was seen at 13,200 strike, which shed 90,450 contracts, followed by 13,000 strike which shed 66,225 contracts.

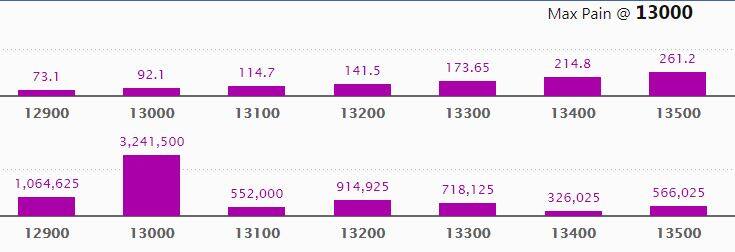

Put option data

Maximum Put open interest of 32.42 lakh contracts was seen at 13,000 strike, which will act as crucial support in the December series.

This is followed by 12,900 strike, which holds 10.65 lakh contracts, and 13,200 strike, which has accumulated 9.15 lakh contracts.

Put writing was seen at 13,300 strike, which added 4.44 lakh contracts, followed by 12,900 strike, which added 1.58 lakh contracts and 13,000 strike which added 1.55 lakh contracts.

There was a minor Put unwinding at 13,100 strike which shed 21,600 contracts.

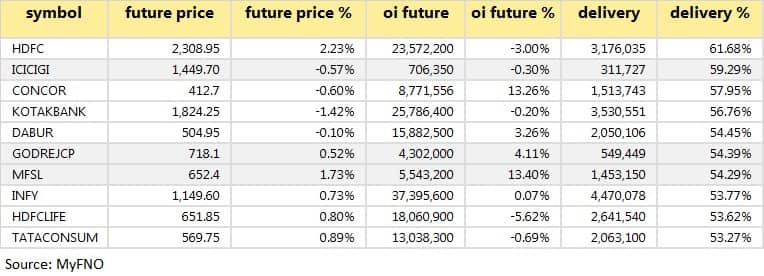

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

54 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which long build-up was seen.

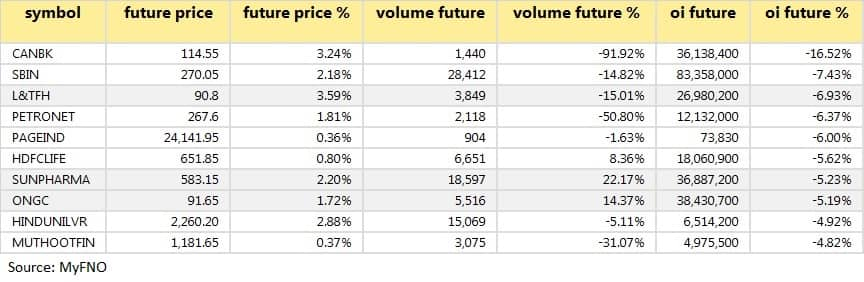

14 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

25 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Bennett Coleman & Co sold 2,78,000 shares of Ind Terrain Fashions at an average price of Rs 34.35 in a bulk deal on NSE.

Abakkus Emerging Opportunities Fund-1 bought 5,74,842 shares of Technocraft Industries at an average price of Rs 311 in a bulk deal on NSE.

DSP Emerging Stars Fund sold 6,81,455 shares of Technocraft Industries an average price of Rs 311.03 in a bulk deal on NSE.

M/S Malabar India Fund sold 10,71,621 shares of Uniply Industries at an average price of Rs 3.30 in a bulk deal on NSE.

LTS Investment Fund bought 46,00,000 shares of Vikas Multicorp at an average price of Rs 7.60 in a bulk deal on NSE. Vikas Garg sold 40,00,000 shares of the company at the same average price.

(For more bulk deals, click here)

Analysts Meets/Board Meetings

Ballarpur Industries: The board will meet on December 8 to consider and approve quarterly results.

Brahmaputra Infrastructure: The board will meet on December 8 for general purposes.

Poly Medicure: The board will meet on December 8 for general purposes.

Stocks in the news

Eimco Elecon - CRISIL reaffirmed the long-term rating at CRISIL A with outlook revised from 'Stable' to 'Negative'.

Goa Carbon - November 2020 production up 58.8 percent at 14,309.200 MT versus 9,006.000 MT in October 2020.

Cupid - The company received a purchase order from Uttar Pradesh Medical Supplies Corporation Limited for the supply of "Covid - 19 Antigen Based Rapid Test Kits" worth Rs 8.27 crore.

Titan to direct Swiss arm Favre Leuba to scale down operations, to cease further investments.

TCPL Packaging - The company subscribed an additional 39,90,000 fully paid-up equity shares of wholly-owned subsidiary TCPL Innofilms.

Bannari Amman Spinning Mills - shareholders approve sub-division of the face value of equity shares.

Ashiana Housing - The company repaid Rs 2.53 crore against partial redemption of NCDs.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 3,792.06 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,767.09 crore in the Indian equity market on December 7, as per provisional data available on the NSE.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!