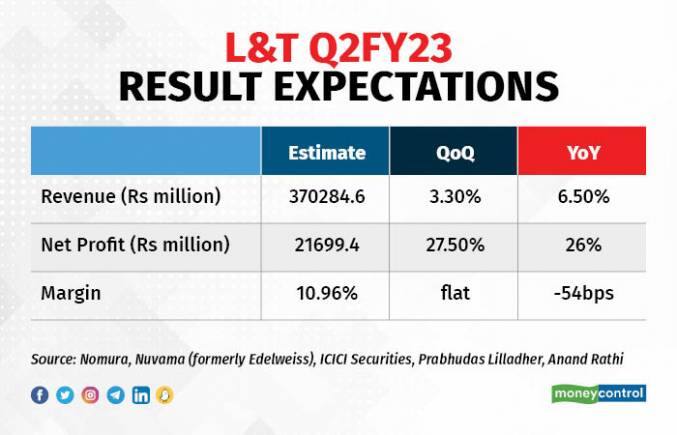

According to an average estimate of five brokerage firms polled by Moneycontrol, Larsen & Toubro (L&T) is expected to post a consolidated net profit of Rs 21,699.4 million in Q2 of FY23, up 26 percent, while sales could rise 6.5 percent to Rs 3,70,284.6 million.

Prabhudas Lilladher has estimated a sales growth of 17.1 percent year-on-year (YoY) to be driven by growth in IT, Infrastructure, Heavy Engineering and Hydrocarbon segments.

Besides, a strong tender pipeline from domestic and export market is likely to ramp up order inflows, it said.

During the second quarter of the current fiscal, engineering procurement and construction (EPC) order inflows announced by L&T are in the range of approximately Rs 7,500-17,500 crore across railway, hydrocarbon, power T&D, water treatment, heavy engineering, building & factory segments, indicating decent order inflows for the quarter, amid challenging environment, said ICICI Securities.

Also Read | Maruti Suzuki Q2 net rises four-fold as supply worries ease, stock upbeat

The brokerage firm expects a decent pick-up in execution on a YoY basis.

Meanwhile, analysts believe that lower commodity prices, coupled with price hikes and operational efficiencies could help cushion the blow to the operating margin on a QoQ basis.

“The full effect of softer commodity prices should reflect in the second half,” said Anand Rathi Share and Stock Brokers.

Meanwhile, some brokerage firms like Anand Rathi expect the conglomerate to report flat margin on a QoQ basis.

As per the poll, L&T’s operating margin may remain unchanged sequentially and decline by 54 basis points on a YoY basis.

Also Read | Investors unimpressed by Tata Chemicals strong Q2 show, dump shares

“We expect significant growth traction YoY due to a large order book and also from a weak COVID-19 impacted base of 1HFY22,” said Nomura.

Analysts expect the company to be focused on working capital and cash flow management amid better execution and also focus on collection of receivables.

Pointing out the challenges, analysts said revival in marketing and travelling would have led to some cost rises. Besides, supply-chain concerns continue from international headwinds.

The company is slated to announce its September quarter earnings on October 31.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!