Tracking weak global cues and coronavirus-induced jitters, benchmark indices logged in losses in the last trading session on April 13.

Sensex settled 470 points, or 1.51 percent, down at 30,690.02, while Nifty ended 118 points, or 1.30 percent, down at 8,993.85. BSE Midcap and Smallcap indices closed 0.93 percent and 0.46 percent lower, respectively.

Prime Minister Narendra Modi on April 14 announced an extension in lockdown till May 3. Experts feel the extended lockdown will undoubtedly have an adverse impact on the economy and earnings.

Hence, they expect some selling pressure to remain but overall the market will not have any major reaction during the extended lockdown period and will remain rangebound till the virus spread gets controlled.

We have collated 15 data points to help you spot profitable trades:

Note: The OI and volume data of stocks given in this story are the aggregates of the three-months data and not of the current month only.

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 8,900.15, followed by 8,806.45. If the index starts moving up, key resistance levels to watch out for are 9,099.8 and 9,205.75.

Nifty Bank

Nifty Bank closed 2.14 percent down at 19,488.00. The important pivot level, which will act as crucial support for the index, is placed at 19,225.63, followed by 18,963.27. On the upside, key resistance levels are placed at 19,818.73 and 20,149.47.

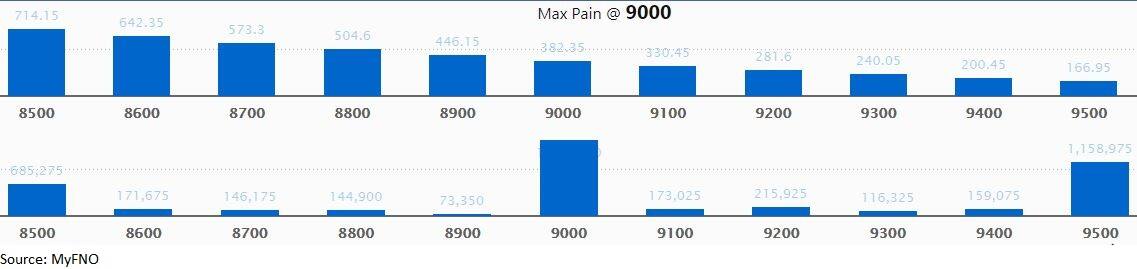

Call options data

Maximum call open interest (OI) of 16.2 lakh contracts was seen at the 9,000 strike price. It will act as a crucial resistance level in the April series.

This is followed by 9,500 strike price, which holds 11.59 lakh contracts in open interest, and 8,500, which has accumulated 6.85 lakh contracts in open interest.

Significant call writing was seen at the 9,000 strike price, which added 1.63 lakh contracts, followed by 9,200 strike price that added 33,225 contracts.

Call unwinding was witnessed at 8,500 strike price, which shed 1.46 lakh contracts, followed by 9,500 strike price, which shed 60,150 contracts.

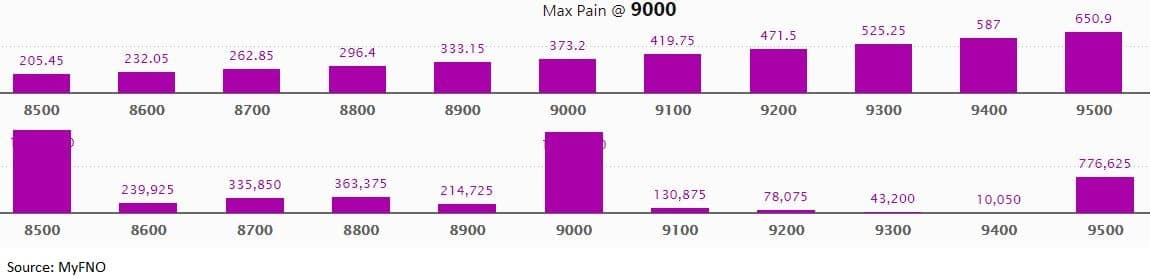

Put options data

Maximum put open interest of 17.63 lakh contracts was seen at 8,500 strike price, which will act as crucial support in the April series.

This is followed by 9,000 strike price, which holds 17.24 lakh contracts in open interest, and 9,500 strike price, which has accumulated 7.77 lakh contracts in open interest.

Put writing was seen at the 9,000 strike price, which added 71,850 contracts, followed by 8,900 strike, which added 70,575 contracts.

Put unwinding was seen at 8,600 strike price, which shed 21,375 contracts, followed by 8,500 strike price which shed 7,950 contracts.

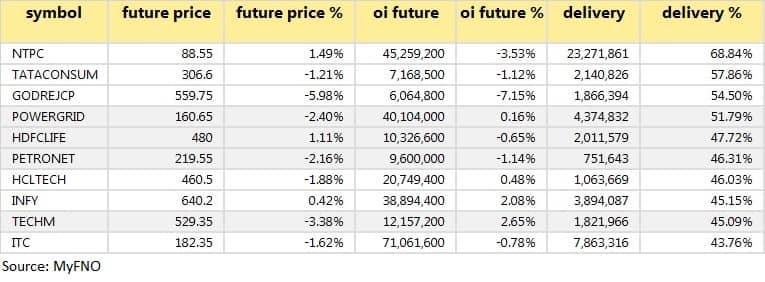

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

42 stocks saw long build-up

Based on open interest (OI) future percentage, here are the top 10 stocks in which long build-up was seen.

36 stocks saw long unwinding

Based on open interest (OI) future percentage, here are the top 10 stocks in which long unwinding was seen.

51 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

17 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

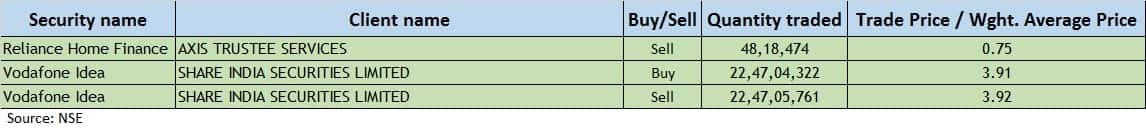

Bulk deals

(For more bulk deals, click here)

Board meetings

Datasoft Application Software (India): The board will meet on April 15 to consider the scheme of reduction of equity share capital.

Franklin Industries: The board will meet on April 15 to consider and approve the demerger of the jewellery unit with aphrodite industries.

Punjab and Sind Bank: The board will meet on April 15 to consider and approve the preferential issue of shares.

Stocks in the news

Wipro: The IT player will release its March quarter numbers on April 15.

Asahi Songwon Colors: Company resumed operations and production at manufacturing plants.

Vardhman Textiles: Company started partial operations in its spinning units in Punjab, HP and MP.

Dalmia Bharat Sugar: Company started manufacturing hand sanitizers at its distillery units in Uttar Pradesh and Maharashtra.

Galaxy Surfactants: Small intermediate feed tank blast at Tarapur M-3 Plant has led to 2 fatalities and 3 injuries.

Nectar Lifesciences: Company started limited operations of its API plants in Derabassi, Punjab.

Rossell India: ICRA reaffirmed its long term credit rating at BBB+/Stable for the company's line of credit facilities.

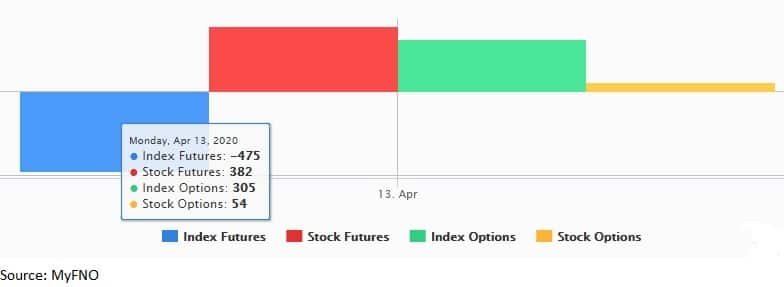

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 1,243.74 crore, while domestic institutional investors (DIIs), too, sold shares of worth Rs 1,096.89 crore in the Indian equity market on April 13, provisional data available on the NSE showed.

Stock under F&O ban on NSE

No security is under the F&O ban for April 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!