At first glance, State Bank of India’s (SBI) offer of automatic deferment of loan EMIs for the borrower looks attractive. Borrowers do not have to apply to avail the offer. The bank, India’s largest, will do the honours.

Immediately after Reserve Bank of India (RBI) governor Shaktikanta Das announced that customers could defer payment of EMIs on term loans, SBI chairman Rajnish Kumar said his bank would implement the automatic deferral of three loan EMIs. "Instalments will get automatically deferred by three months for term loans and customers don't have to apply to banks for it," Kumar said. Those who don’t want this offer can approach the bank, according to him.

SBI’s action immediately put other banks in a spot. They started getting a flurry of customer calls asking why they had not followed suit, according to private sector bankers Moneycontrol spoke to. “Typically, SBI immediately follows what the government wants. But, being the market leader, SBI’s actions have a bearing on other banks. Already, there are continuous enquiries from the customers seeking a similar offer,” said a senior official at a private bank, requesting anonymity.

Yet, other lenders, mainly private banks, did not react to SBI announcement immediately. They began a wait-and-watch approach for four days. It was on March 31 that most of SBI’s competitors —both in the public and the private sector—followed with moratorium announcements. But, there was a difference. Most banks are giving an option for customers to apply for the three-EMI moratorium, or to ‘opt in’ (apply) for the scheme rather than ‘opt out’.

In other words, while SBI is offering an automatic deferral option to customers, private banks are seeking an initial consent from the customer if he/she wants the deferral.

Which approach is good?

There is a clear downside to the EMI moratorium scheme. The RBI, in its circular, clearly states that the interest amount will get accrued on the loan outstanding even during the moratorium period.

This means the borrower will have to pay up the additional interest amount once the moratorium ends. According to bankers, this will reflect in the loan repayment schedule later. “It is not going to be three EMIs as against the three EMIs deferred. The customer may have to pay five or six EMIs additional depending upon the loan size and year of repayment cycle,” said the banker quoted earlier.

Also Read: Why borrowers should continue with payment of EMIs

“Seeking the consensus of the customer before applying the moratorium on his loan account is important. This is because in future if the interest burden escalates significantly, he shouldn’t blame the bank,” said Jaikishan Parmar, an analyst at Angel Broking.

This is where private banks offering an option to the customer to choose the moratorium plan makes sense. ICICI Bank, on its website says. “In case you choose to opt for a moratorium, then the applicable interest on the amount outstanding will continue to be charged during the period of moratorium. The payment schedule would be extended to recover the postponed instalments which will include the outstanding principal and interest.”

Similarly, according to IDFC First Bank’s website, customers have to apply for the moratorium. “To apply for the moratorium, kindly write to us from your registered email address at help@idfcfirstbank.com with your mobile number and loan account number and we will activate the moratorium for the unpaid EMI of March 2020 if any, and for EMI of April and May 2020,” the bank said.

Besides, IDFC First’s communication clearly specifies that interest will continue to accrue on the EMIs for which moratorium is provided at the same rate as contracted for the respective loan, and such interest will be collected as per applicable interest rate from the customer. “An updated loan repayment schedule will reach you by email, which can also be accessed on mobile app and website by end of the respective month,” IDFC First said.

These communications clearly tell the borrower about the risks of EMI deferral.

Not just private banks. Even in the case of state-run Canara Bank, the bank has asked the borrowers through a message to opt in for the scheme “if you don’t want installment to be deducted till May, 2020.”

When should a borrower opt for the moratorium? As Moneycontrol has explained in earlier articles, the EMI deferral is not a benefit to any category of borrower since it is not a waiver or a payment holiday. It is only a relief for the distressed borrower who has lost income during the COVID-19 lockdown and does not have the money to pay up their EMIs.

SBI’s approach of applying the moratorium without seeking customer’s consent may lead to unexpected burden for the customer when the additional interest payment finally reflects in their loan schedule post the moratorium period. This will be particularly true about customers who are not informed or aware about the interest payment part of the moratorium offer. Logically, this may lead to future disputes.

A better strategy for banks would be to seek the customer’s consensus before deferring loan payments and let him/her choose. There is a hidden risk for the borrower in SBI’s automatic moratorium offer.

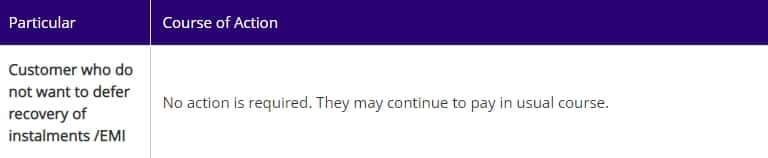

Editorial note: SBI has updated its policy. As per the new policy, customers who do not want to defer the recovery of instalments or EMIs may continue to pay in usual course. They are not required to do anything. This article is based on SBI's previous announcement.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!